Ripple’s native token XRP is facing its resistance at the $0.40 level after jumping from $0.33 to $0.39 this week. The token briefly touched $0.40 on Sunday before retracing in price on the same day in the indices. However, XRP is trading sideways since Tuesday and is consolidating at the $0.38 level.

The token retested its resistance levels on Wednesday reaching $0.39. The latest data shows that whales are taking an entry position into XRP after moving millions of tokens to private wallet addresses. You can read here to know more details about the whale purchases in January 2023 into XRP.

Also Read: XRP Tested $0.40: What’s Next?

XRP: Bulls Aim For $1, Can it Happen?

The cryptocurrency markets turned bullish last week after the CPI report showed inflation falling to 6.5% from 7.1%. Bitcoin climbed above $21,000 and Ethereum touched $1,595 levels while leading altcoins pumped double-digits.

While the long-term target is above $1, the SEC Vs Ripple lawsuit is derailing the desired target. The lawsuit took centerstage again this week after Amicus Curiae attorney John Deaton drew attention on Tuesday by talking about the influence of the Amicus brief. He said that the SEC is aggressively bidding to classify XRP as a security.

“The SEC literally claims XRP itself was, is, and always will be a security. The scope of the SEC’s Howey argument has become so stretched that it is truly indefinable, in space or in time,” he said.

Also Read: When Will XRP Reach Its All-Time High of $3.40?

In conclusion, the lawsuit developments and updates are stunting XRP’s growth in the markets. Once the case is settled in the courts, Ripple’s native token might eventually climb above the $1 mark. Until then, the token could remain in a consolidated state.

Also Read: 3 Cryptos to Watch Out for After CPI Data Rally

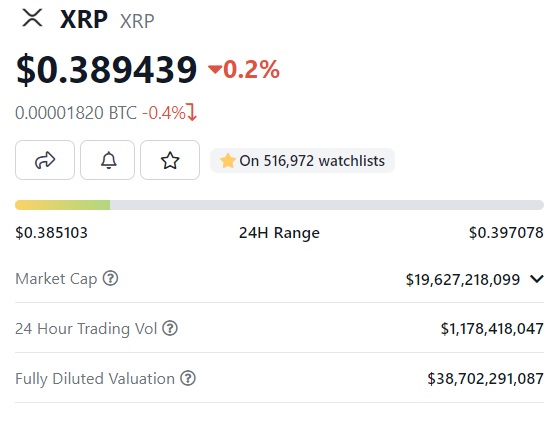

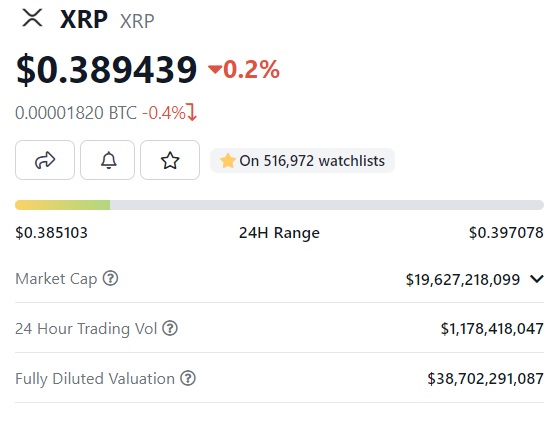

At press time, XRP was trading at $0.38 and is up 0.2% in the 24 hours day trade. It is down 88.6% from its all-time high of $3.40, which it reached in January 2018.