Ripple’s XRP token has fallen victim to the ongoing market bearishness. The popular crypto had quite a bullish year in 2025, but the momentum slowed down since October. XRP hit a new all-time high of $3.65 in July 2025, but has since faced a 48% price dip. Moreover, given the current market scenario, XRP could be in for a rough Q1 2026. Let’s discuss if Q2 will bear better results.

Rough Q1 2026 Expected For XRP: Q2 Could Change Fate

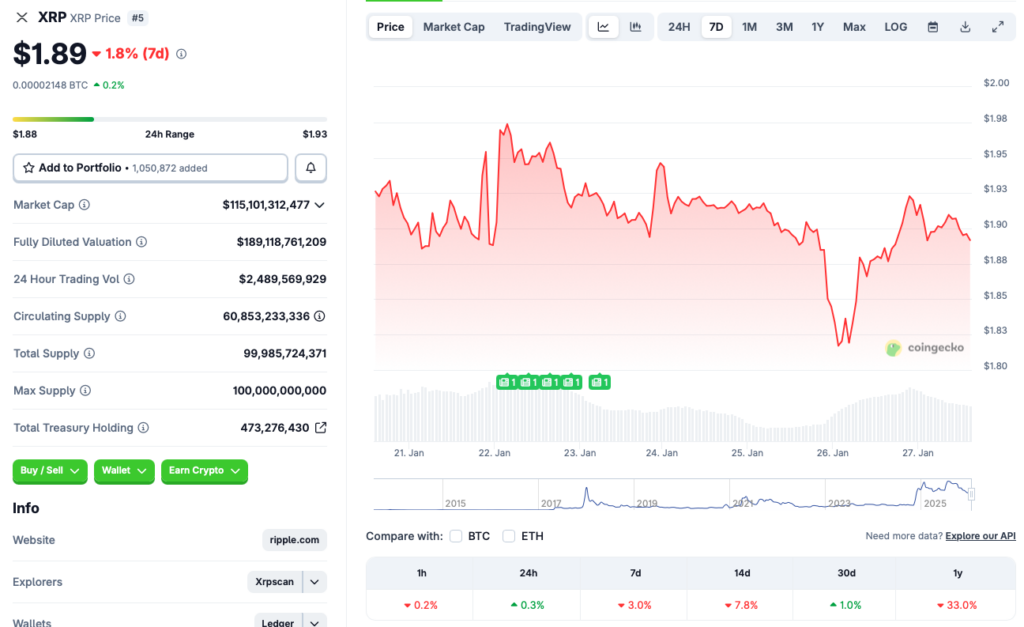

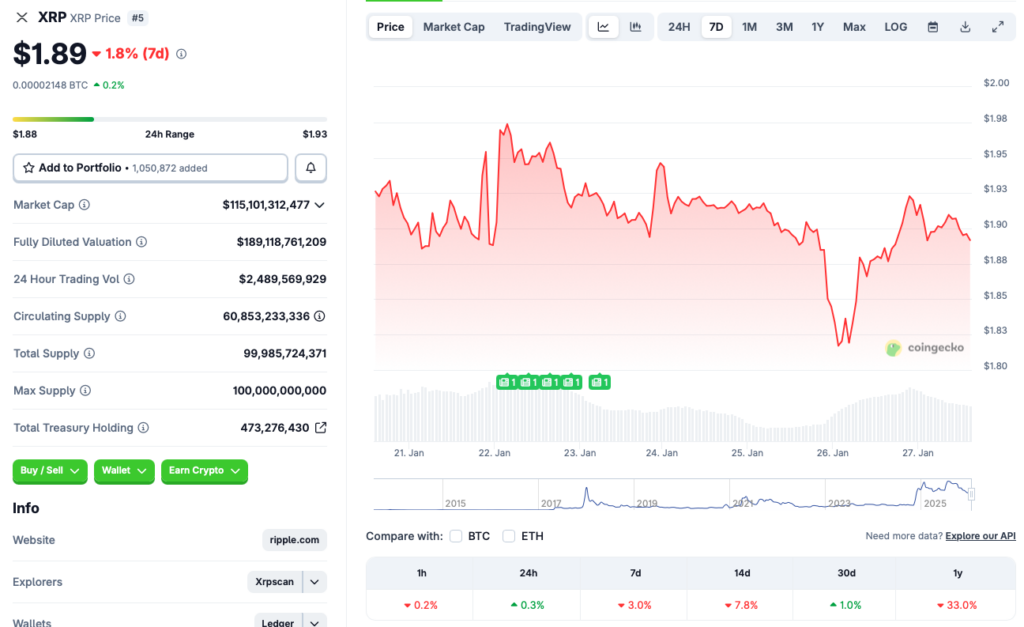

According to CoinGecko data, XRP’s price has fallen 3% in the last week, 7.8% in the 14-day charts, and 33% since January 2025. However, the asset has registered gains of 0.3% in the last 24 hours and 1% over the previous month. XRP seems to be holding steady at around $1.90, and could climb to $2 in the coming weeks.

According to CoinCodex analysts, XRP will oscillate between $2 and $1.90 over the coming weeks, before hitting $2.26 in April. Moreover, with macroeconomic worries taking center stage, Q1 seems to be quite bearish for the popular crypto. The rise of gold and silver prices is another factor that could signal investors moving away from the crypto market.

Q2, however, could bring some relief to XRP. New trade deals and the possibility of a more stable global economy could lead to a spike in investor sentiment. Additionally, XRP could see a rise in ETF inflows, which could lead to a price rally. However, nothing is set in stone. The market continues to follow a risk-off approach, and the pattern could remain for a good while.

Also Read: ARK Invest Files ETF, XRP Becomes Core Asset With 19.88% Weight

XRP will likely follow Bitcoin’s (BTC) trajectory, and may not move until the original crypto shows some price action. Many anticipate new peaks for BTC, and such a development could lead to XRP reclaiming the $3 mark.