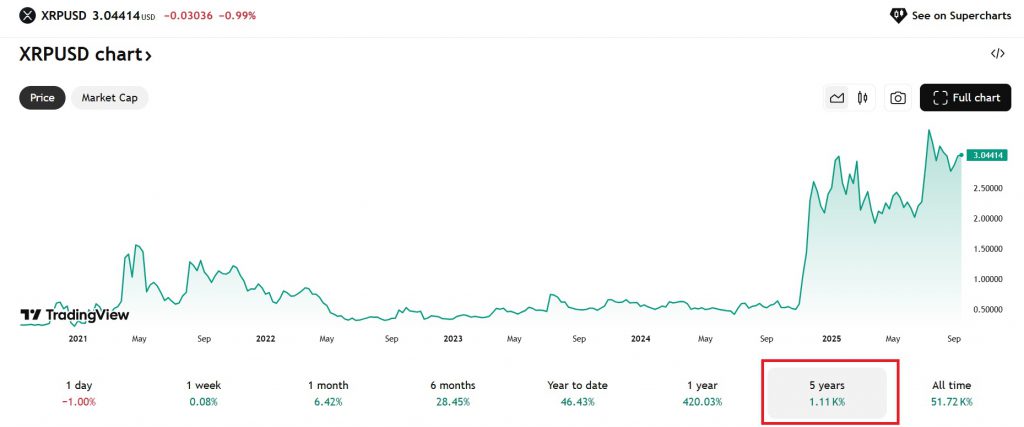

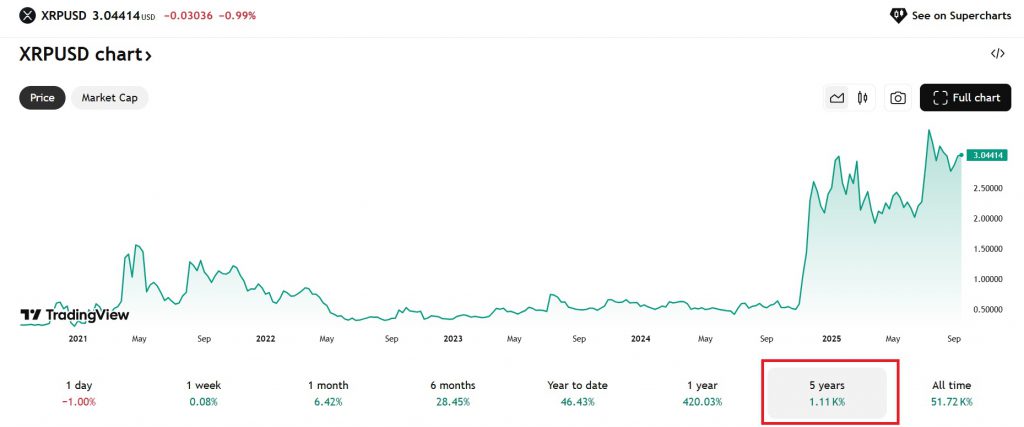

If you invested $1,000 in XRP and $1,000 in the S&P 500 index five years ago, Ripple’s native token would have generated 12 times more profits than the US stock market.

Yes, XRP was trading at $0.24 in September 2020 and was available for a quarter of a dollar. On the other hand, the S&P 500 index was at the $3,310 mark during the same timeframe.

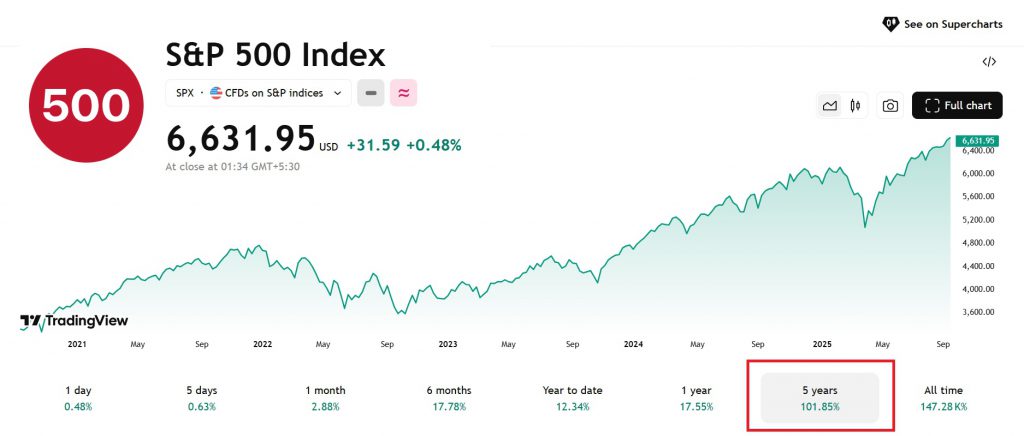

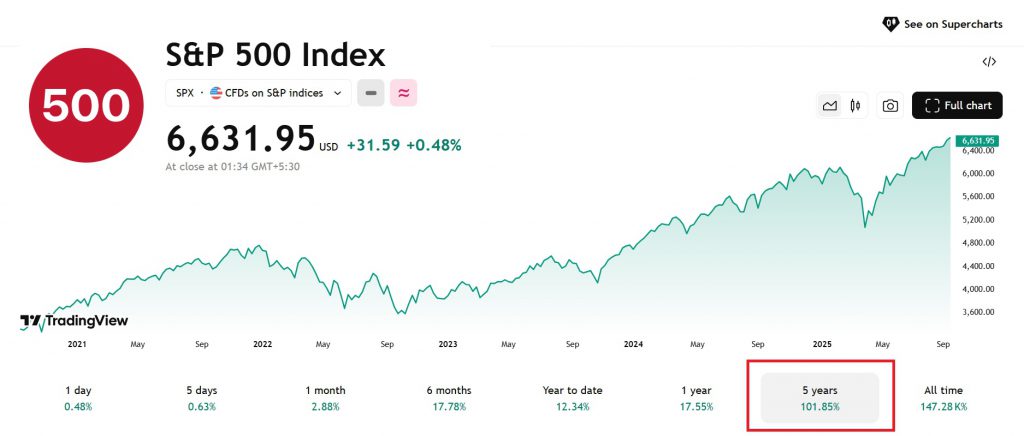

Fast-forward to September 2025, XRP is at $3.04 while the S&P 500 index is at $6,630. Both financial assets have delivered striking returns, swelling investors’ portfolios in five years.

Also Read: 2000 XRP Enough to Reach $100K by 2026, Analysts Predict

Ripple’s XRP Beats the S&P 500 Index by 1,170% in 5 Years

To keep it in context, XRP has generated 1,170% profits from September 2021 to 2025. On the other hand, the S&P 500 index has generated returns of 101% during the same timeframe. Therefore, Ripple’s native token has given 12 times more returns than the US stock market index.

An investment of $1,000 in XRP in 2020 would have turned into $12,700 in September 2025. However, the same $1,000 investment in the S&P 500 index would have turned into $2,010 in the same timeframe. Ripple’s native token is the clear winner here as the returns are much larger and humongous.

Also Read: Will XRP Follow Binance Coin To A New High In September?

Moreover, that does not mean that the S&P 500 index is performing below average. The US stock market and the cryptocurrency market work in different parameters. The cryptocurrency market is mostly not connected to the performance-based parameters of companies like the stock market. The two move on separate tracks, and the investor’s interest acts differently.

For example, cryptocurrency investors blindly invest money while stock market traders think twice. Therefore, XRP’s influx of funds comes from all corners, while the S&P 500 investments come after deep analysis from traders and institutions. This gives the cryptocurrency market an added advantage when compared to the stock market.