XRP has had quite a bullish year in 2025, despite the ongoing lackluster market. XRP saw the launch of 5 spot ETFs, which have collectively accumulated more than $1 billion so far. ETF inflows have played a significant role in the current market cycle. However, despite the large inflows, XRP’s price continues to struggle. Let’s discuss if the asset can recover its momentum in the coming weeks.

Why Is XRP Struggling Despite Large ETF Inflows?

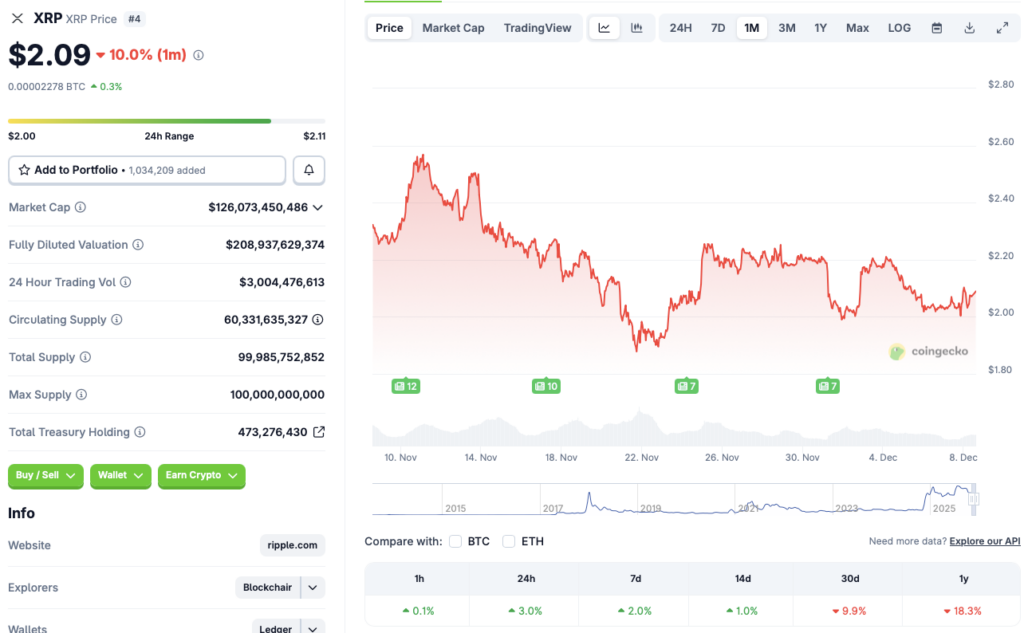

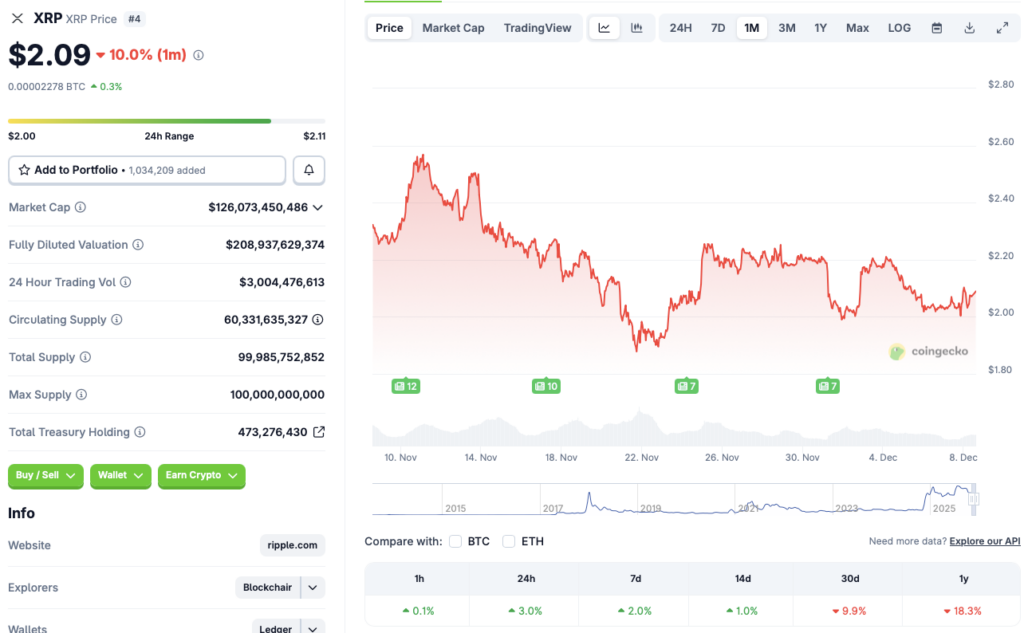

XRP started the year with a bang. The asset breached the $3 mark in January of this year for the first time in nearly seven years. The rally was likely due to the SEC vs. Ripple lawsuit coming to an end. XRP’s celebrations did not stop with the lawsuit settlement. The launch of 5 spot ETFs led to a substantial rise in investor sentiment. However, the asset’s price has taken a hit over the last two months. According to CoinGecko data, XRP is down 9.9% over the last month and 18.3% since December 2024. However, XRP is green in the other time frames, rallying 3% in the last 24 hours, 2% in the last week, and 1% in the 14-day charts. The asset’s price seems to be consolidating around the $2.10 mark.

Also Read: ‘Short’ Positions in XRP Go Aggressive: A Major Price Drop Next?

The current market scenario could be due to macroeconomic uncertainties. The Federal Reserve announced an interest rate cut in October, but the chances of a third rate cut in 2025 significantly fell due to rising inflation and slow economic growth. XRP and other crypto assets faced massive liquidations after the development. However, the chances of another interest rate cut in 2025 have substantially increased over the last few weeks. Another rate cut could trigger a market-wide rally for the crypto sector. The uncertainties in the market could be keeping XRP’s price at bay for the moment.