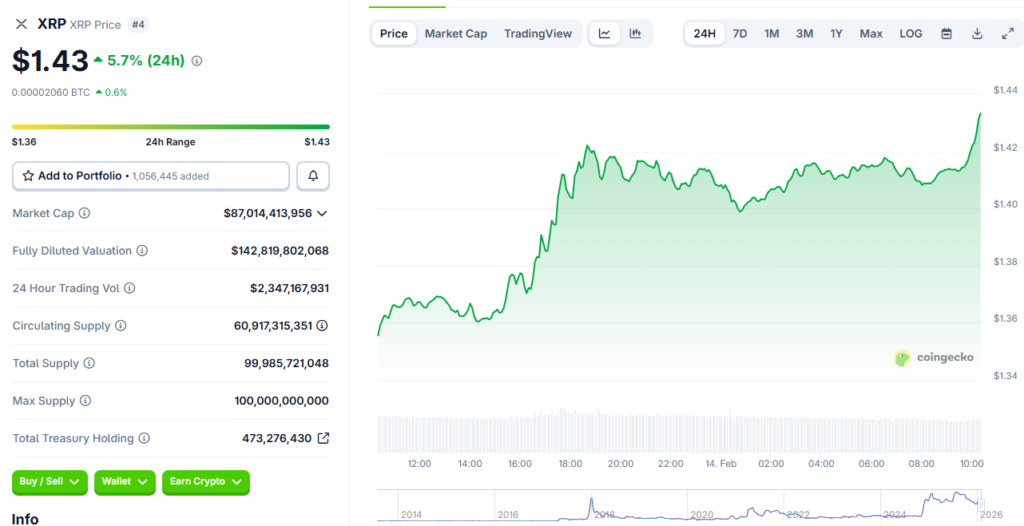

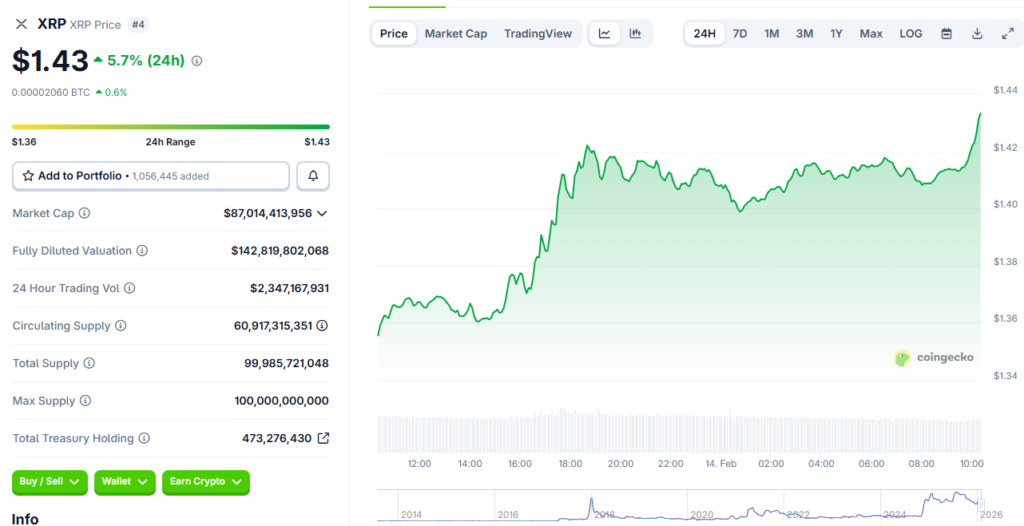

XRP panic selling has intensified dramatically as holders face mounting losses right now, and the situation continues to worsen. Market dynamics have catalyzed widespread capitulation, with the token trading at $1.43, down from $3.50 in mid-2025. This wave of XRP panic selling has triggered various major psychological barriers across the investor community, and it’s been creating uncertainty.

With XRP price prediction targets ranging from $3 to $8 among analysts, yet current market conditions demonstrating 60% declines, investors are left wondering when to sell XRP amid the chaos right now. The strategic decision of whether to sell or hold XRP has emerged as a critical consideration, with on-chain data confirming significant holder distress across multiple essential metrics.

Also Read: XRP Owners: “I Don’t Have Anymore Patience,” Here’s How to Decide

Holders Face Losses and SOPR Drops Below 1 Amid Market Pressure

On-Chain Metrics Flash Warning Signals

On-chain analytics firm Glassnode revealed critical signals behind the current XRP panic selling wave, and the data has been raising concerns. Through several key profitability metrics, the analytics platform documented a dramatic shift in market structure at the time of writing. Since August 2025, long-term holders who had accumulated before November 2024 increased their spending by 580% from $38 million per day to $260 million per day, and this distribution into weakness has added significant pressure. Various major selling patterns have accelerated across numerous significant holder cohorts, intensifying the broader market downturn. In a February 9 post, Glassnode stated:

XRP lost its aggregate holder cost basis, triggering panic selling. SOPR (7D EMA) fell from 1.16 (Jul ’25) to 0.96 (now). Holders are realizing significant losses. On-chain profitability flipped negative. This setup closely resembles the Sep 2021–May 2022 phase, where SOPR plunged to a <1 range for prolonged consolidation before stabilization.

When SOPR drops below 1, it means that coins are being sold at a loss on average, and this metric has been central to understanding when to sell XRP for many investors right now. Across several key market indicators, data confirms that over 41% of XRP supply sits underwater at the time of writing, creating pressure that influences whether to sell or buy XRP for many holders.

The psychological impact has been significant, with investors realizing between $500 million and $1.2 billion in losses per week each time XRP retests the $2 zone, and this has intensified capitulation pressures. Through various major liquidation events, the share of XRP supply in profit had plummeted to 58.5% by mid-November, representing the lowest level since November 2024 when the asset was worth $0.53, making the decision to sell or buy XRP even more challenging right now.

CEO Promises Meet Community Skepticism

Ripple CEO Brad Garlinghouse attempted to address concerns about the XRP panic selling and reassure the community right now, though reactions have been mixed. Strategic communications from company leadership focused on Ripple’s commitment to the XRP ecosystem, and they emphasized long-term vision. The company recently launched an institutional DeFi roadmap seeking to make the XRP token available for on-chain credit and global payments, encompassing multiple strategic initiatives across various major sectors. Garlinghouse stated:

“XRP family has and always will be top of mind for Ripple.”

However, pro-XRP lawyer Fred Rispoli challenged this approach and called for more than just words, emphasizing action over rhetoric. Through several key statements, the legal expert articulated that the XRP community demands tangible results rather than verbal assurances, especially amid the ongoing XRP panic selling right now. Rispoli stated:

“SHOW ME YOUR LOVE THROUGH ACTIONS BRAD NOT WORDS.”

What This Means for Your XRP Position

The disconnect between executive assurances and XRP price prediction realities leaves investors questioning whether to sell or hold XRP through this consolidation period, and the uncertainty continues. Historical market patterns from 2021-2022 have demonstrated prolonged sideways movement before recovery, establishing precedent for current conditions. This makes decisions around when to sell XRP and whether to sell or buy XRP dependent on individual risk tolerance and time horizons, and it’s been a difficult choice for many. For those caught in the current XRP panic selling, the data indicates that fundamentals are stronger now than in 2022, when regulatory clarity didn’t exist and the SEC lawsuit was still ongoing at the time.

Also Read: XRP Price: Ripple May Rally after Feb 10, Here’s What’s Changing

Across numerous significant valuation metrics, the current $1.48 realized price represents the average cost basis, with many analysts interpreting SOPR readings below 1 as capitulation signals where weak hands exit at a loss. XRP price prediction models vary widely, with some forecasting $5 to $15 by year-end if the market stabilizes, though uncertainty remains right now. Still, the XRP panic selling remains urgent as the market processes these losses and decides on next steps, leaving many to reconsider whether to sell or hold XRP positions through various major transition points