Although 2021 has been phenomenal for the cryptocurrency market on a whole, investors have had to deal with several market cycles. The second half of the year helped in rebuilding the market after major outflows took place between mid-May to late-July. Now as the year comes to a conclusion, market momentum seems to have tapered off once again. Major cryptocurrencies have had a woeful month of December, with the top 10 coins by market cap registering monthly losses ranging between 13%-30%. Similarly, XRP’s movement has been quite lackluster. However, a recent breakout has renewed hopes of an XRP price recovery. A bullish RSI and higher lows along the On Balance Volume underpin XRP’s near-term price action and call for an optimistic outcome. At the time of writing, XRP traded at $0.864, up by 4.4% over the last 24 hours.

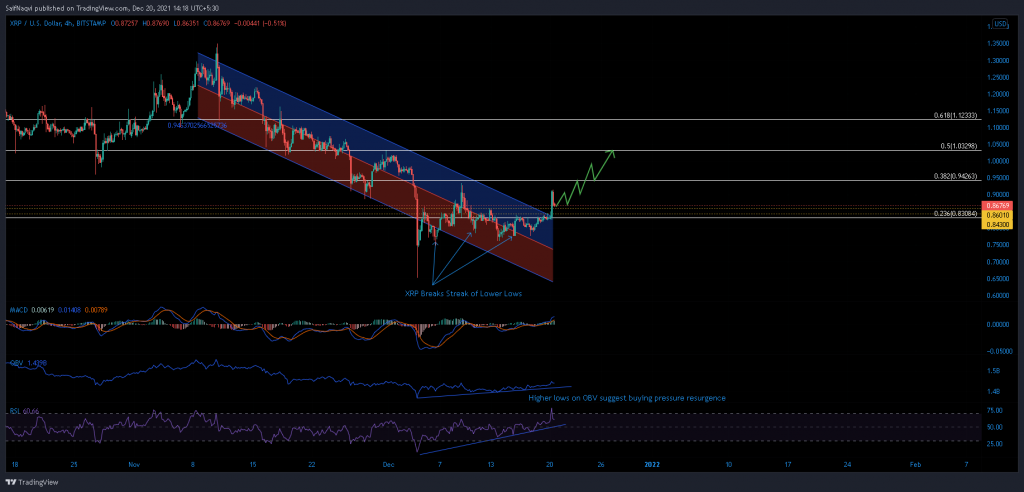

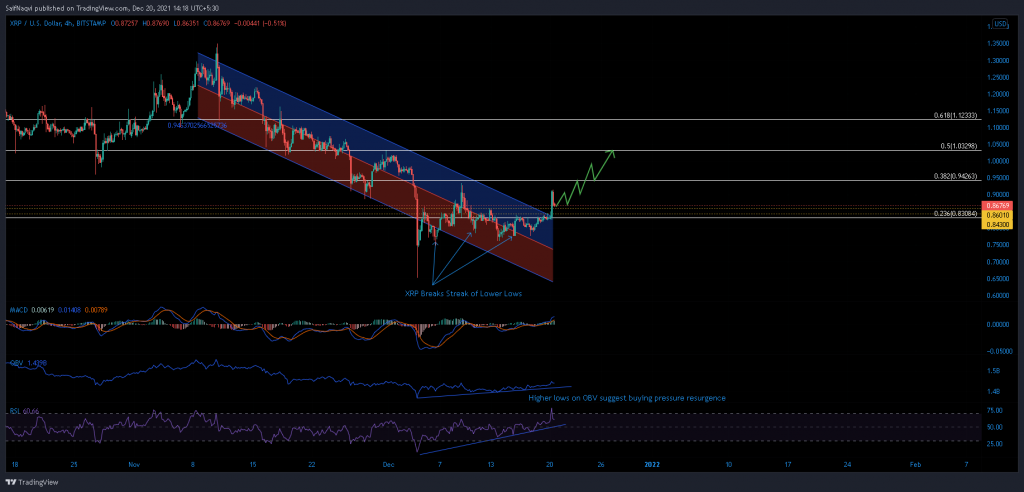

XRP 4-hour Chart

Since surging to a near 1-month high at $1.34 on 10 November, XRP has kept within a down-channel. Bulls finally kickstarted a recovery following a breakout over the last 24 hours.

XRP has laid the groundwork regaining the $1-mark following a breakout above the upper band of the channel (blue). The goal would be to take on the notorious 50% Fibonacci level once the 38.2% Fibonacci level is toppled. The aforementioned region currently poses as resistance and has been a contentious ground for buyers and sellers since mid-August.

On the flip side, focus would shift to near-term support levels of $0.86 and $0.843 should XRP fail to reposition above the 38.2% Fibonacci level. These regions can allow some buying pressure to seep back into the market. However, traders must be cautious of a close below the 23.6% Fibonacci level. If XRP drops back within the confines of its down-channel, traders can anticipate a new low around $0.742.

Indicators

XRP’s indicators favor a bullish near-term price action. The Awesome Oscillator traded above the half-line following a steady pickup over last week. Higher lows along the On Balance Volume was a positive sign. The RSI also eased from overbought levels and presented no threats of a major sell-off.

Conclusion

XRP’s immediate goal would be to regain ground above the 38.2% Fibonacci level. A breakout above the 50% Fibonacci level would then become achievable over the coming week. Meanwhile, the abovementioned indicators would allow some more speculation. Traders can opt to long XRP at support levels of $0.86 or $0.843. On the flip side, a close below $0.830 should sound some alarm bells in the market.