Payments company Ripple and its native token XRP have consistently been in the news of late, thanks to the back-to-back pre-Christmas developments taking place w.r.t. its ongoing lawsuit against the US Securities and Exchange Commission. On Thursday, for instance, the regulatory agency requested the court to seal certain documents related to motions for the summary judgment.

Leaving aside the lawsuit development, a noteworthy milestone was achieved within the Ripple ecosystem recently. Data from XRP Ledger Service revealed that the number of account holders on the platform surpassed the 4.5 million mark. At press time, the exact figure stood at 4,506,950.

Basically, the XRP Ledger [XRPL] is a decentralized, public blockchain that fosters payment transfers. The rise in the number of account HODLers points toward the entry of new participants into the ecosystem.

XRP Trends On Social Platforms

The sentiment associated with the XRP token has been refined of late. With successive developments taking place almost on a daily basis, the chitter-chatter on social media platforms has registered an uptick. On Thursday, #XRP was trending on Twitter.

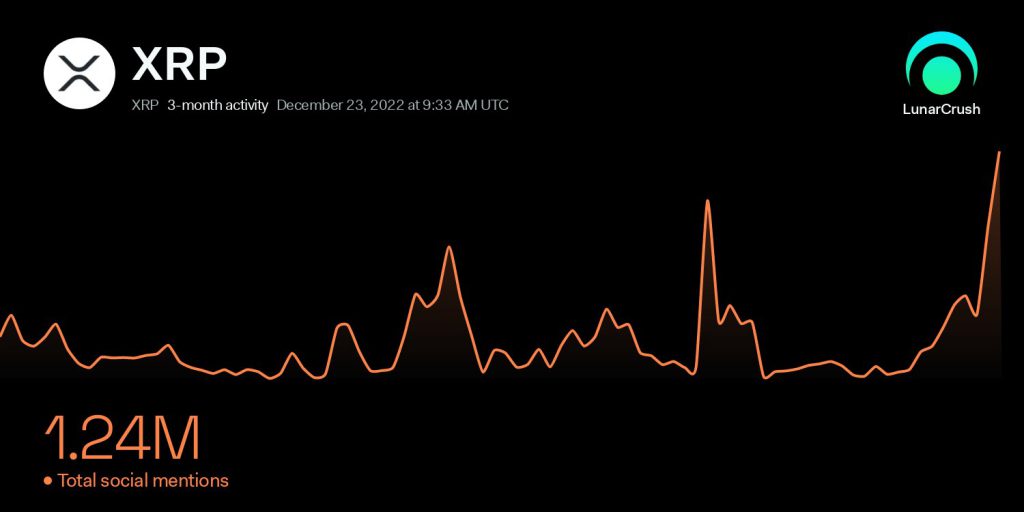

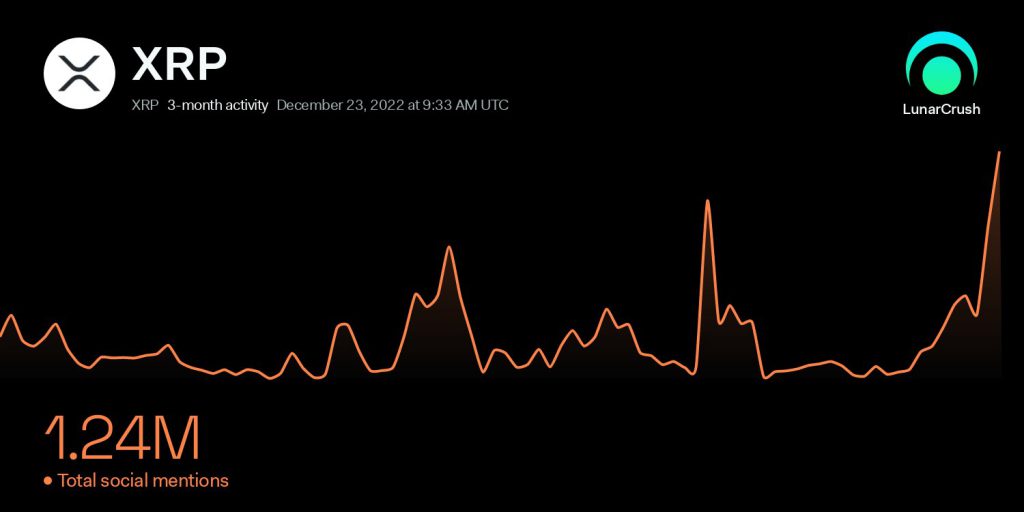

The rise in social mentions implied that XRP is being keenly watched by market participants. In fact, data from LunarCrush confirmed the same. In its latest tweet, the social intelligence platform revealed,

“We are noticing soaring XRP social activity today. XRP social mentions measured daily hit 57.46K, the highest point in the last 90 days.”

Source: LunarCrush

Additionally, the number of XRP active addresses noted a rise from 44k to 47.9k, indicating that more market participants have started engaging in XRP-related transactions of late, making it another positive takeaway.

Meanwhile, on a daily, the price was already seen reacting to the same. Gradually trying to drag itself out of the bearish woods, the seventh largest crypto asset noted a 1% uptick on the daily and was trading at $0.35 at press time.

So, if the current conditions persist or improve, then a 10% rally to wards its 50 EMA at $0.3870 can be expected over the next few days. If that level is checked, then its path towards the $0.4 and $0.43 will eventually open up.

If the buying momentum fails to balloon up, then a drop down towards $0.34 and $0.31 can be anticipated.