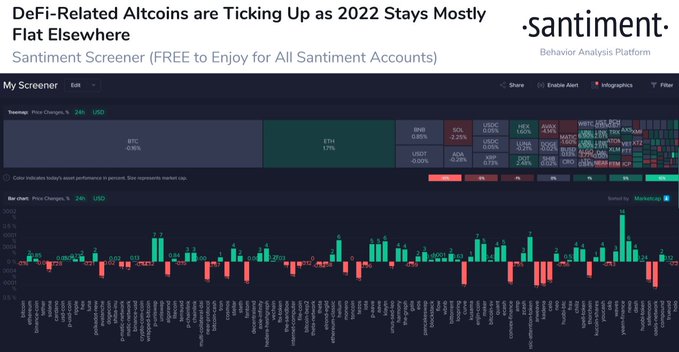

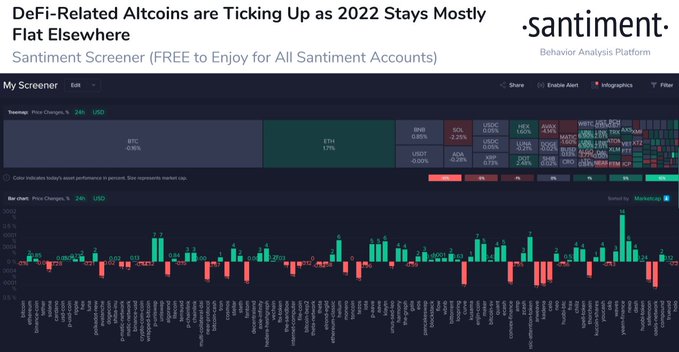

The cryptocurrency asset may be stuck in a consolidation phase, but not the world of decentralized finance. The Defi assets have witnessed periods of immense growth whenever the cryptocurrency space was stuck with correction. Even now, the DeFi assets were showing signs of growth, as per the analytics firm Santiment.

Santiment noted in a tweet on Monday,

“DeFi assets are showing some nice signs of growth to kick-off 2022. $YFI, $UNI, and $AAVE are all ticking up nicely thus far with the first Monday of the year looking #bullish for several #altcoins.”

The special mentions here were Yearn Finance, Uniswap, and Aave. These projects have carved a special place among DeFi users and the alts were also reflecting the positive sentiments attached.

Yearn Finance

Yearn Finance platform provides multiple products to the decentralized finance ecosystem. Over the past few weeks, its YFI token has been moving higher on the price scale and the reasons were the suggested changes to its tokenomics.

The proposal is to “direct a portion of YFI bought back by the Treasury as rewards to YFI token holders who actively participate in Yearn Governance.” It was currently in the voting phase.

The manifesto seems to have been made amid the community as the YFI was being driven from $33,000 levels of 2021 to $41,000, at the time of press.

Uniswap

Uniswap, on the other hand, emerged as the most traded asset among Ethereum whales. This speaks of the project’s popularity and interest growing for UNI, as it also pushed LINK in terms of the trading volume.

As per WhaleStats, Uniswap remained Ethereum whales’ favorite with the largest holdings in their wallets. The largest whale was noted to hold over $100 million worth of UNI tokens.

Being a decentralized exchange, users have to utilize UNI to use the platform. The recent surge in usage caused the asset to start the new year with strong green candles and note 16% growth. At the time of press, UNI was exchanging hands at $18.81.

Aave

Whereas Aave was indicating a slight bearishness as its token braves on resistance at the $277.26 level.

Nevertheless, many more milestones are to come for Aave as founder, Stani Kulechov announced to launch a mobile wallet this year.

This was only the first of many announcements as per the founder as he went on to say “this is the year of L2s for real.”

This has boosted the community sentiment and AAVE was reporting growth of 17.33% since 1st January. At the time of press, the asset was tussling an important resistance while trading at $278.79.

Overall, it will be interesting to analyze these three assets’ trajectories over the next few weeks and whether they can drive more engagement from the DeFi ecosystem.