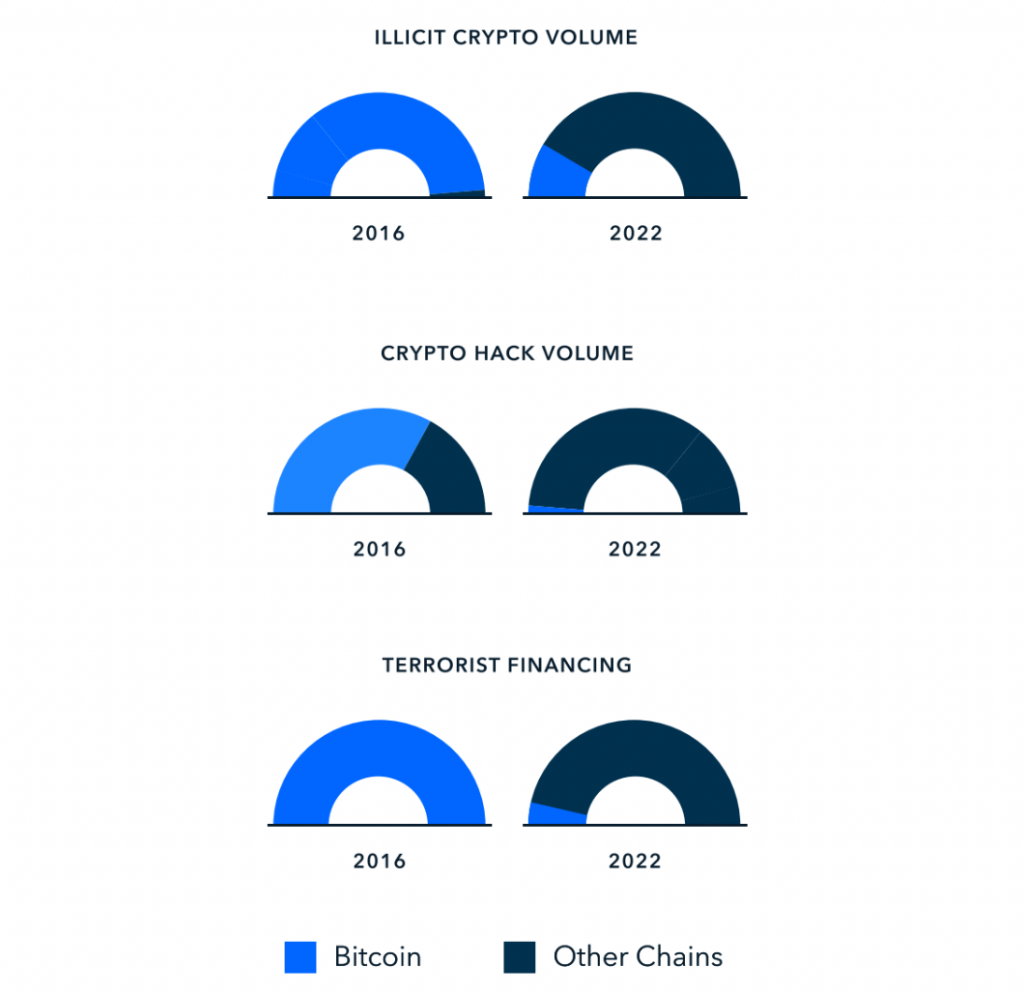

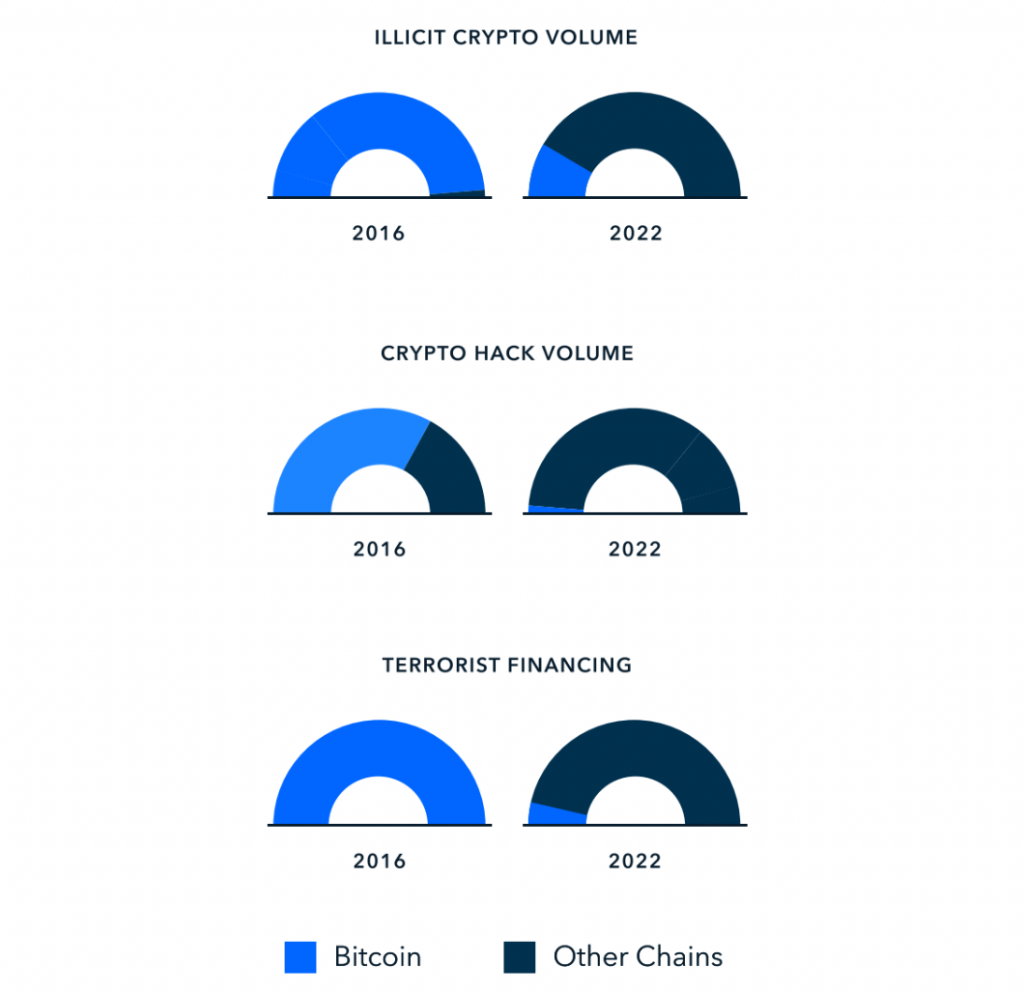

According to a new report by TRM Labs, Bitcoin (BTC) is losing favor among cybercriminals. The report claimed that illicit players are choosing to stick to fiat or move to other cryptocurrencies. TRM Labs revealed that BTC volumes in illicit activities have fallen over the past seven years.

In 2016, Bitcoin accounted for two-thirds of all cryptocurrency hacks, but by 2022, that percentage had dropped to just under 3%. According to the survey, Ethereum (68%) and BNB Smart Chain (19%) picked up the slack.

Instead, according to TRM Labs, a new multichain era has caused a “qualitative leap” away from Bitcoin as the main method of transferring illicit proceeds. The company also said that criminal money movements continue to be cash and other kinds of fiat-related finance. The firm pointed to “hawala” remaining as one of the primary methods of laundering. Hawala is the process of transferring money without physically moving it.

TRM Labs added that while there has been an increase in illicit cryptocurrency activity, “crypto did not invent these criminal forms.” Additionally, the company stated that in 2022, attacks on cross-chain bridges resulted in the theft of almost $2 billion in cryptocurrency.

Why are cyber criminals moving away from Bitcoin?

It is possible that the Bitcoin (BTC) network has gotten more and more secure over the years. Which could be the reason for less number of BTC being stolen. Furthermore, the use of crypto mixers such as Tornado Cash has become problematic of late. It is also possible that as the value of BTC has increased over the years, criminal use for the same has declined as they prefer something which has lesser value than BTC.

The most current data on cryptocurrency’s illicit funding may be good news for Bitcoin. BTC has recently appeared to be back on the table for institutional adoption.

TRM Labs estimated that in 2022, the cryptocurrency saw at least $7.8 billion invested in Ponzi and pyramid schemes. Moreover, it saw up to $1.5 billion spent on darknet drug markets and $3.7 billion stolen through DeFi breaches and exploits.