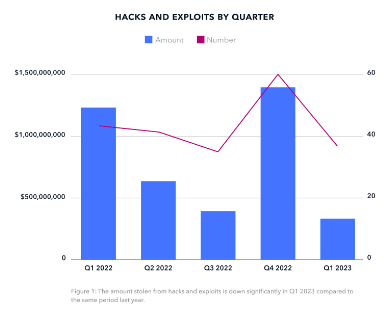

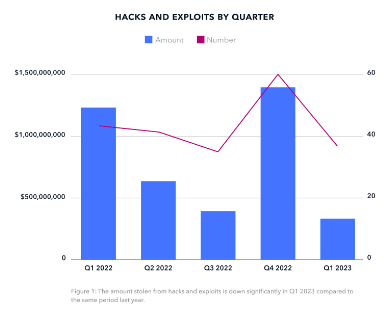

Hacks were a common occurrence during last year’s crypto winter. On one hand, firms from the space kept tumbling. On the other, perpetrators kept exploiting the inadequacies and flaws in the system. As a result, months like October were dubbed “Hacktober.” This year, however, hackers applied brakes during the first quarter. A recent report from TRM Labs underlined,

“Around USD 400 million was stolen across nearly 40 cryptocurrency attacks in the first three months of 2023 – down 70% from the same period in 2022.”

Moreover, the amount stolen via crypto hacks in Q1 2023 was less than in any quarter in 2022. In fact, the drop in value was “significantly greater” than the fall in crypto prices during this period, according to the report. The hack size also ended up shrinking, despite the number of incidents being nearly the same. Elaborating on the numbers, the report highlighted,

“The average hack size also took a hit in Q1 2023 – to USD 10.5 million from nearly USD 30 million in the same quarter of 2022, even as the number of incidents was similar (around 40).”

Also Read: 46% of Audited Crypto Companies Work with KPMG, EY, Deloitte, PwC

Downtrend to continue?

In 2021, DeFi protocols were the primary target of crypto hackers. The trend intensified last year, with DeFi projects continuing to be targeted. Victims accounted for 82.1% of all cryptocurrency stolen by hackers in 2022. The same marked a rise from 73.3% in 2021, making DeFi the hackers’ paradise.

According to TRM Labs, two recent events could have provided a “temporary discouragement” to attackers. First, the arrest of Avraham Eisenberg, who carried out the $116 million price manipulation attack against the DeFi platform Mango Markets in 2022.

Even though Eisenberg returned a portion of the funds based on the understanding that he would not face legal action, the SEC charged him for violating anti-fraud and market manipulation provisions of the securities laws. In fact, he was additionally sued by Mango Markets for $47 million in damages plus interest. Even so, a fair share of hackers continues to return stolen funds. According to the report,

“To date, hacking victims have recovered over half of all stolen funds in Q1 2023.”

The tightening of regulatory screws and sanctions imposed on platforms like Tornado Cash might have also played a role in bringing down the number this quarter. However, this respite might not last long. According to the report, this is likely a “temporary reprieve rather than a long-term trend.” However, all hope is not lost. Elaborating on the same, the report concluded,

“Although we are likely to see crypto hacks rebound, widespread adoption of industry security measures and increased user education, can help prevent the industry from revisiting or exceeding the record-setting USD 3.7 billion stolen in 2022.”