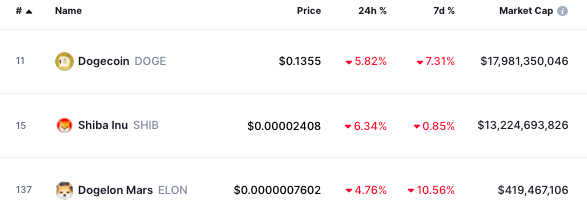

After holding back and having a rather monotonous weekend, the crypto market ended up tumbling during the early hours of Monday. With Bitcoin dipping below $40k yet again, most alts from the market had notable haircuts. Coins from the meme genre too felt the bite.

Top coins like Dogecoin and Dogelon Mars had lost under 6% of their respective values over the past day, while Shiba Inu managed to surpass the said threshold. After depreciating by 6.34% in the said timeframe, SHIB was seen exchanging hands at $0.00002408 at press time.

Degree of bearishness in the Shiba Inu market intensifies

Owing to the dip, SHIB liquidations massively spiked up over the past few hours. Per data from Coinglass, long contract traders felt the pinch the hardest, with assets worth more than $1.62 million being wiped off since the largest local spike was registered on the chart.

Alongside, the 1000SHIB contracts too witnessed massive liquidations. In the same period, a long 1000SHIB worth almost $700k was liquidated.

As such, 1000SHIB is a USDT-margined futures contract that uses USDT as collateral. The notional value of the 1000SHIBUSDT contract is 1,000 SHIB each, which means the underlying index price of 1000SHIBUSDT is 1000 times that of the SHIB/USDT spot index.

The bearishness amongst the remaining traders within the Shiba Inu arena had intensified too. The funding rate on exchanges like Okex had stooped down to levels that were last observed back in mid-March [-0.03%].

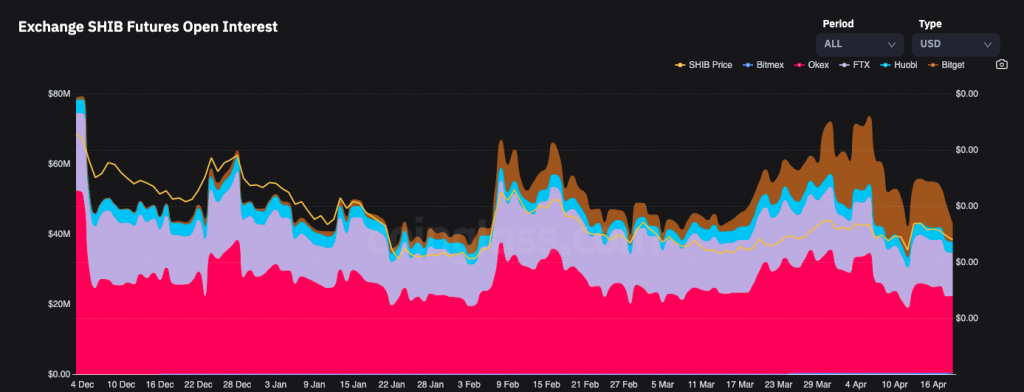

As a result, the Shiba Inu’s Open Interest, which seemed to be on its recovery path, ended up derailing as well. From the local peak of $75.3 million registered on 6 April, SHIB’s futures OI stood merely at $42.57 million at press time.

As long as this trend continues, it is a bearish sign for SHIB. However, once the open interest stabilizes at a low level, and the liquidations gradually subside, the price would be in a position to rally again.