A few hours back, 1,000,000,000 USDT tokens were minted at the Tether Treasury on the Ethereum blockchain. To foster the mint, 0.0132594 ETH worth $25.72 USD was paid as a transaction fee.

Tether CTO Paolo Ardoino clarified that the mint was an “inventory replenish.” Elaborating on the same, he tweeted,

“1B USDT inventory replenish on Ethereum Network. Note this is an authorized but not issued transaction, meaning that this amount will be used as inventory for next period issuance requests and chain swaps.”

Here it is worth recalling that Tether registered $700 million in profit during the December quarter last year. Tether’s reserves were boosted by the aforementioned profit. As Watcher Guru reported, its consolidated total assets stood at around $67.04 billion at that time, while its consolidated total liabilities were at least $66.08 billion. In all, it had an excess reserve of at least $960 million.

Ardoino said last month that the company estimates the excess reserves to increase by another $700 million in Q1. That would take Tether’s excess reserves to $1.66 billion. It also means that the figure will surpass the $1 billion mark for the first time in such a scenario.

Also Read: USDT Issuer Tether Estimates to Make $700 Million Profit in Q1

Tether’s growth

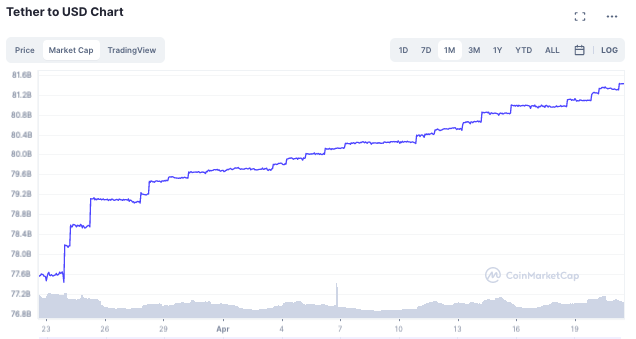

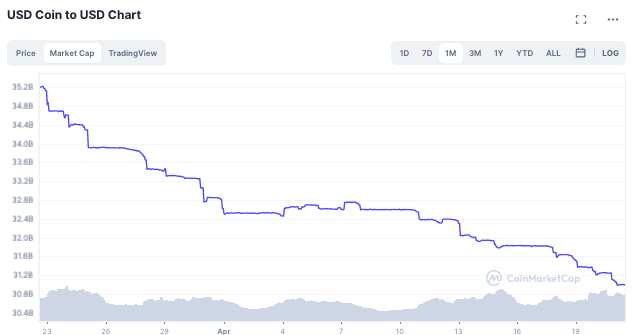

At this stage, Tether and its competitor USD Coin’s market cap are headed in the opposite direction. Over the past month, USDT has risen from $77.5 billion to $81.4 billion [chart above]. On the other hand, USDC has dropped from $35.2 billion to 31 billion [chart below].

Parallelly, it is also worth noting that the number of USDT addresses ever created surpassed the 30 million mark recently. As shown below, the curve has only been on an uptrend, bringing to light the consistent growth and rise in the number of users.

Despite the macro-instability, Tether has been able to fare well in the face of adversity. Ardoino recently underlined that Tether is making money as banks are failing and asserted that it is the safest option among all the choices for users to divert funds towards.

Parallelly, it should be noted that Tether’s dominance has been on the rise. Since 2017, the market share of USDT’s trade volume for BTC trading pairs has gone from 3% to 92%. In fact, as analyzed by Watcher Guru, it attained an all-time high recently.

Also Read: After Silvergate, Stablecoins Use for Crypto Trading Likely to Improve