Alongside the growth of the NFT space, inter-related crimes have also been rising. A recent report from Elliptic revealed that more than $8 million of illicit funds had been laundered via NFT-based platforms since 2017.

Per the report, another $328.6 million originates from obfuscation services like crypto

mixers, which may reflect proceeds from illicit activity. Crypto mixers have been the talk of the crypto town ever since sanctions were imposed on Tornado Cash.

The mixer, as such, was involved in a few recent hacks in the DeFi world. Per the US treasury department, Tornado has “repeatedly failed” to impose controls to stop its platform from being used to launder funds by malicious cyber actors. According to Elliptic,

“Tornado Cash, a US-sanctioned mixer, was the source of $137.6 million of cryptoassets processed by NFT marketplaces and the laundering tool of choice for 52% of NFT scam proceeds before being sanctioned by OFAC in August 2022.”

Getting into the nitty gritty

From July ’21 to July ’22, over $100 million worth of NFTs were publicly reported as stolen via scams. Retrospectively, perpetrators fetched around $300,000 per scam on average. Being in a bear market has not kept exploiters away. Elliptic revealed,

“July 2022 saw over 4,600 NFTs stolen – the highest month on record – indicating that scams have not abated despite the crypto bear market.”

Value-wise, however, May tops the list. A confirmed value of $24 million worth of NFTs was stolen during the month. The actual numbers, however, are likely to be higher, as thefts are not always publicly reported.

Bored Ape Yacht Club NFTs were the most valuable series stolen. Notably, 167 pieces worth more than $43.6 million and more than $8 million worth of funds were laundered via the NFT platform.

The BAYC boat has not been sailing very smoothly of late. Its floor price had dropped to 66 Ethereum at the beginning of this week, and it was targeted by scammers associated with a phishing site.

Read More – NFTs: Bored Ape Yacht Club floor drops to 66 ETH

NFT trading arena widens

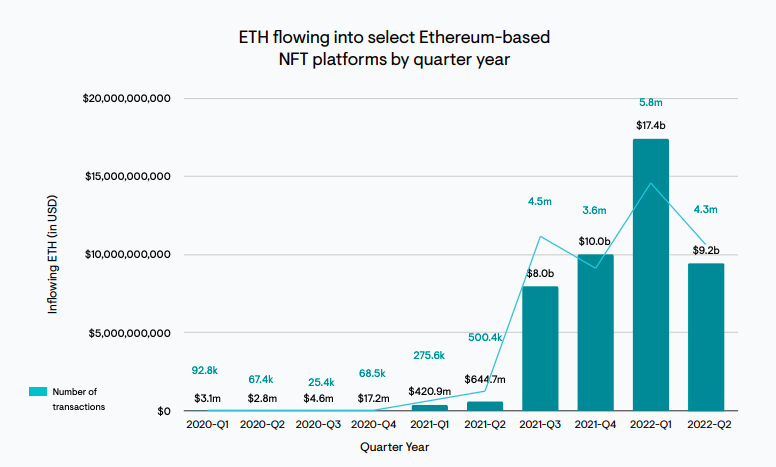

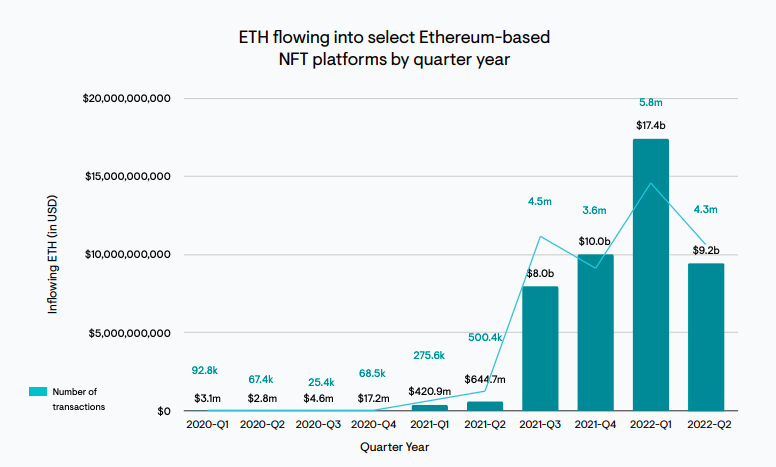

Despite the rise in NFT-related crimes, a blind eye cannot be turned towards the budding interest of participants. NFT trading increased from summer 2021, with daily average sales of over $50 million and over $17.7 billion in NFTs sold that year. The same accounts for an increase of over 200% from 2020.

Despite high fees and congestion, NFT trading remains primarily on the Ethereum blockchain. Elaborating on the same, Elliptic highlighted,

“Meanwhile, alternative blockchains such as Solana and Polygon remain behind, despite aggressive marketing campaigns and creator funds to entice people from Ethereum.”

Further, as illustrated below, the funds flowing into Ethereum-based NFT platforms have increased. Q1 2022 noted the highest ETH inflow, amounting to $17.4 billion. Unlike stolen funds, the ETH inflows bore the brunt of crypto winter, and as illustrated below, a dip to $9.2 billion was noted in Q2.