With the event underway, 15 countries are reportedly seeking to join the BRICS New Development Bank as the 2023 annual summit begins. The bank is set to be a focal point of the event, as the discussion over local currency lending is likely to be prioritized by the alliance.

The Shanghai-based BRICS lender is set to focus on lessening its dependence on the US dollar. Moreover, the bank’s president, Dilma Rousseff, noted the desire for the institution to be “made by developing countries for themselves.” While she also noted the host of countries seeking to join the bank.

Also Read: BRICS Bank to Increase Funding in Local Currency

BRICS Bank Sees 15 Countries Interested in Joining

The BRICS Summit is officially underway, and the entire world is observing its happenings. As the bloc sets out to discuss vital topics like local currency use and expansion, its development bank is also set to be a focus. Now, there are reportedly a host of countries that hope to become a part of the institution.

Indeed, there are reportedly 15 countries that are seeking to join the BRICS New Development Bank. Moreover, Rousseff said that the bank is currently considering the applications, according to the Financial Times. However, the bank is likely to approve the admission of only four or five nations.

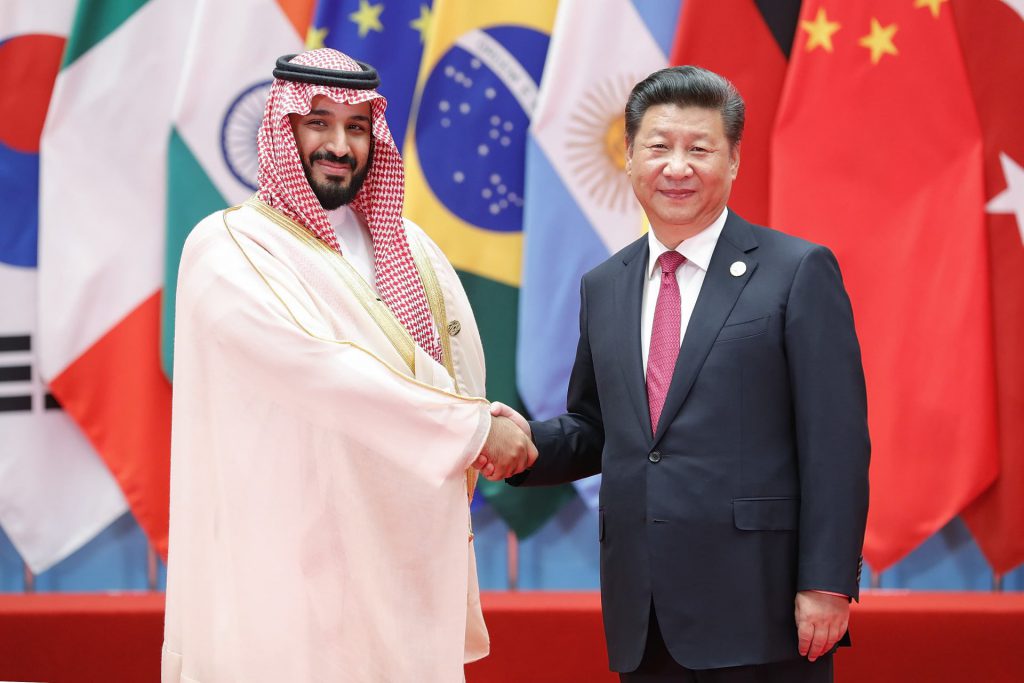

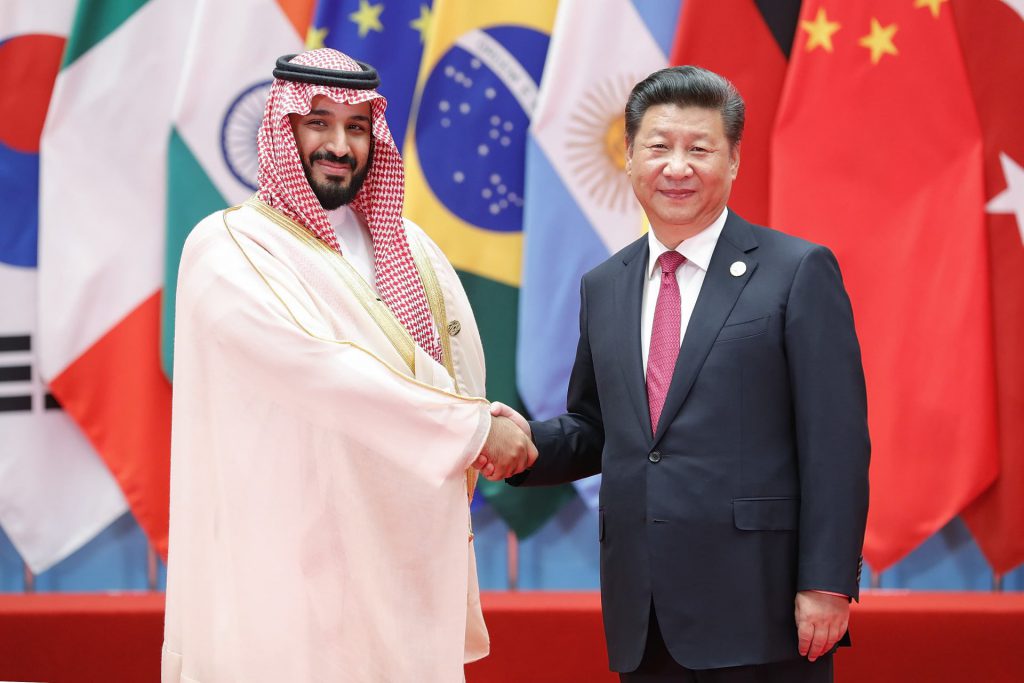

Also Read: Saudi Arabia Likely to Join BRICS Bank at August Summit

The applications represent a chance for the bank to embrace its hope to “diversify its geographic representation,” according to the report. Additionally, BRICS hopefuls like Saudi Arabia are already planning to join the development bank.

“We expect to lend between $8Nm-$10bn this year,” Rousseff told the publication. “Our aim is to reach about 30 percent of everything we lend… in local currency.” Both Rousseff and the BRICS alliance are hopeful that the financial entity can continue embracing US dollar alternatives. Subsequently, the expansion of the bank’s membership could facilitate that hope.