The U.S. SEC has several crypto assets on its radar. In its recent lawsuit against Coinbase, it deemed SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO to be securities. In the other parallel lawsuit filed against Binance, BNB, BUSD, SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and COTI were victims.

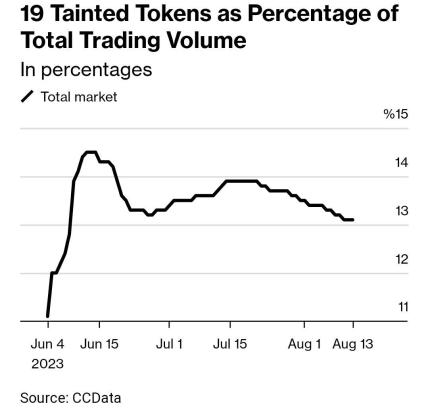

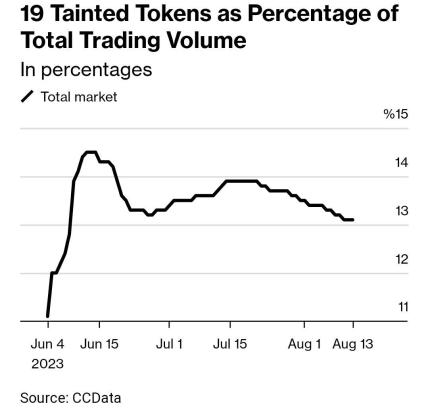

After the securities allegations, these assets lost around $20 billion of their combined market value. However, a recent report brought to light that the aforementioned 19 crypto assets have been noting a rise in trading volume, bringing to light the maturation of the market and investors. According to data from CCData, the tokens’ overall share of trading has increased by about 2%, to around 13%.

Also Read: Bitcoin Miner Earns 5019590600% Profit After Holding 150 BTC for 13 Years

Solana Marches ahead, Cardano Lags Behind

A few assets have recovered faster than others. Solana, which had initially dropped by around 35%, is now up 11%. Cardano, however, has not been able to recover. ADA is down by roughly 20% since early June.

Some tokens were de-listed by Robinhood, Bakkt, Bitstamp, etc. However, these assets continue to have a “strong following overseas,” with non-U.S. exchanges supporting them. CCData’s report revealed that U.S.-based exchanges only account for 10% of the total crypto trading volume. Binance and Coinbase, the largest global and U.S. exchanges, did not delist any of the assets.

This aggregate rise in volume trend suggests that investors are perhaps trying to encash the volatility of these assets and make profits. Bitcoin currently seems to be out of the equation, owing to its consolidation. Apart from the aforementioned targeted assets, investors also seem to be eying other tokens. THOR, for instance, is up nearly 300% over the past week. Alongside, even RUNE has appreciated by over 50%.

Also Read: Coinbase: ‘Fresh’ Whale Wallets Created in 2023 Drive Activity on Base