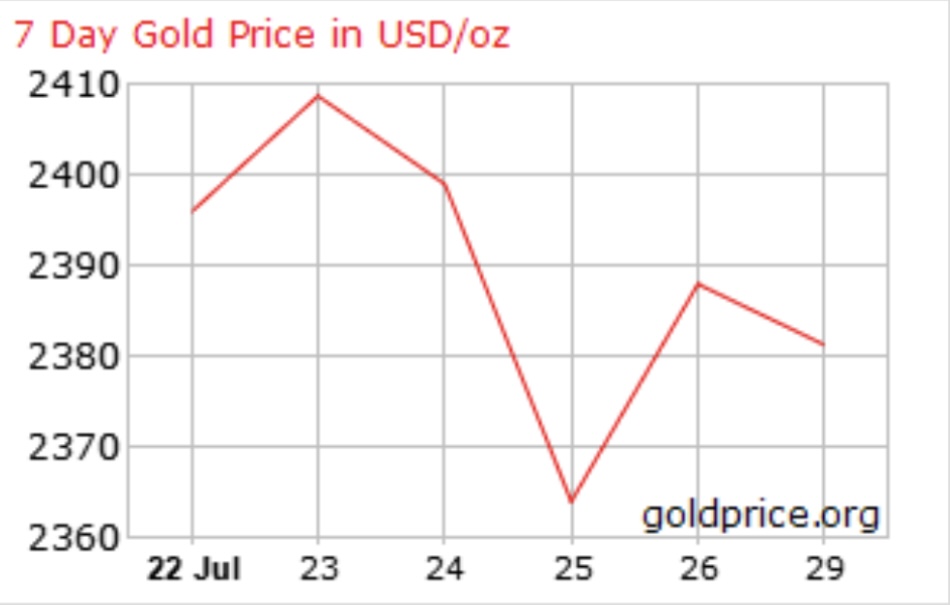

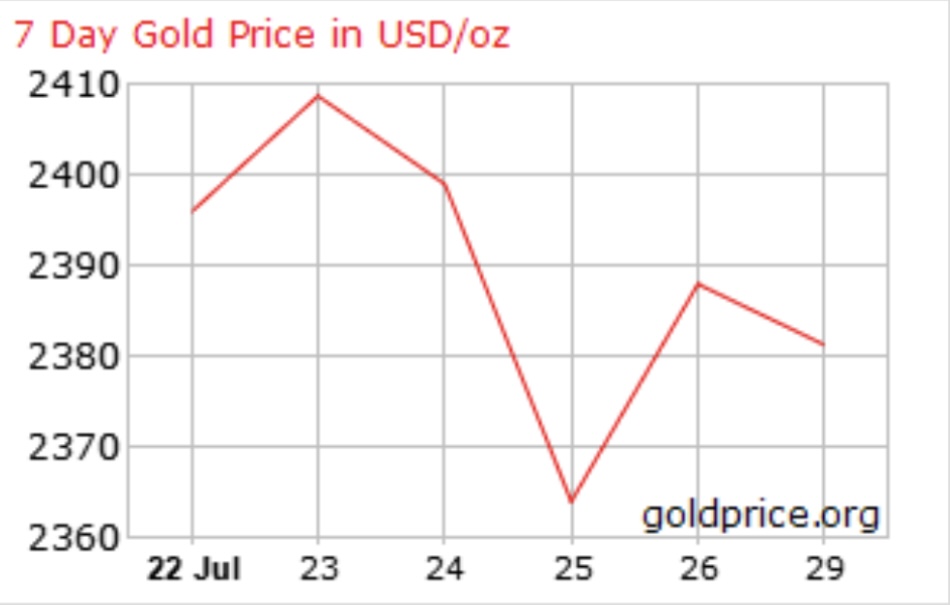

Gold has been often dubbed a haven asset. Gold is expected to act as a hedge against inflation and other economic shifts. But in a new turn of events, investors were seen growing wary of the declining prices of gold. The yellow metal dipped below a prominent support level of $2,400. Currently, the price of gold sits at $2,387 with a 0.25% daily rise. The asset had a pretty good year as it witnessed a 21.24% surge over the past 12 months.

This dip was linked to various factors. This covers global events and economic situations in addition to those in the United States. Events can impact investor mood globally and might include shifts in interest rates, geopolitical unrest, or financial catastrophes. These occurrences may affect the global demand for gold as a safe-haven asset, which may affect the price of the metal.

Also Read: Gold Price: How High Can XAU Rise In August 2024

Main Causes Behind Gold’s Plummet

A big sell-off in the equities markets has indeed been driven by tech stocks. It’s crucial to remember that this is not just about the equities falling in value. Since traders do not take systematic risk into account, gold prices did not rise this week in response to the tech selloff. They quantify this for themselves by looking at the volatility index [VIX index]. The index has amply demonstrated that there are now no signals of panic and that the sell-off that is occurring is simply profit-taking.

Profit-taking is considered a factor contributing to the fall of the shiny metal. Since the beginning of the year, gold prices have had an incredible rise. As a result, it was almost inevitable that values would decline as traders started to take profits. Despite the decline in the precious metal’s prices, the sell-off hasn’t been very severe.

Also Read: BRICS: Gold-Backed Currency is Beginning of the End for US Dollar