Stock split stocks are driving market growth, with the S&P 500 gaining 24% in 2024. AI made headlines, but stock splits from big Wall Street companies brought major returns. Investors looking at the best stocks to buy in 2025 need to know about stock split investment strategy as they deal with market volatility stocks.

Also Read: European Banks to Offer Crypto Services in the EU

How To Navigate Market Volatility With Stock Splits In 2025

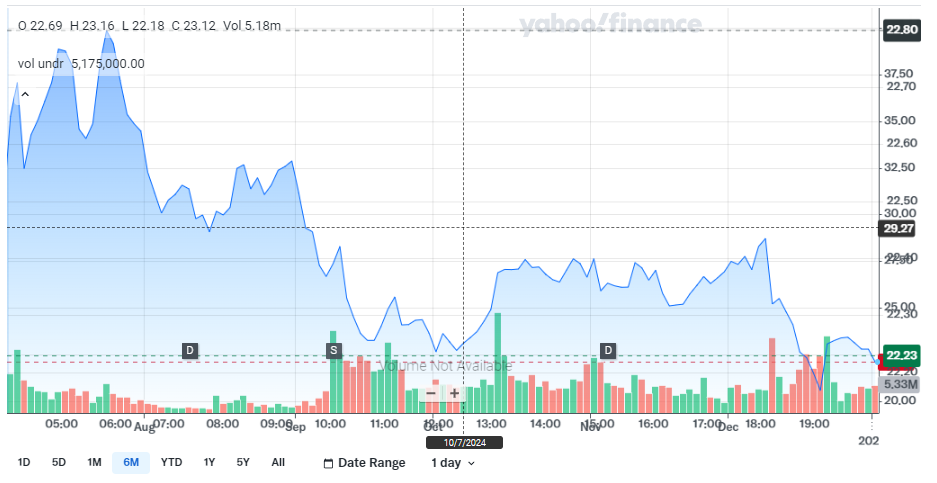

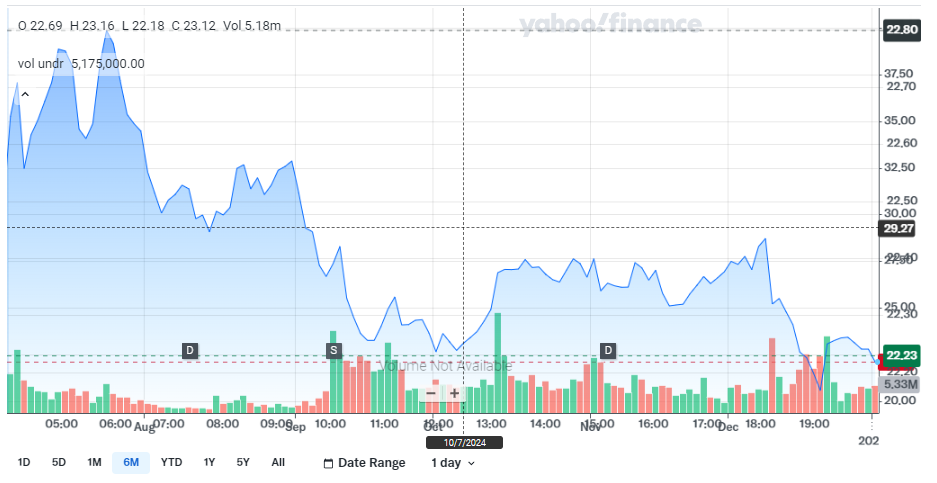

Sirius XM (SIRI): A Unique Reverse Split Play

Among stock split stocks, Sirius XM Holdings shows promise. The stock trades between $20.00 and $22.80. “Having this distinction affords the company strong subscription pricing power more often than not,” market analysts note. Their 1-for-10 reverse split in 2024 drew in big investors, with 5.17 million shares traded.

They get 77% of their money from subscriptions, making them stable when markets shake. “Through the first nine months of 2024, Sirius XM had generated only around 20% of its net sales from advertising,” company reports indicate. Their stock is cheap at 7.5 times earnings, and dividends near 5% make them a strong stock split investment strategy pick.

Also Read: GTA 6 Comes Out This Year: Here’s Everything We Know

Sony Group (SONY): Gaming Giant’s Strategic Split

Sony Group’s shares grew after splitting 5-for-1. The price sits at $21.09, with 3.34 million shares traded daily. Games still sell well despite console timing. “Sony Group is still finding new ways to capitalize on its existing PlayStation 5 console,” management reports, noting Japan’s 19% price bump.

The company does more than games, helping its place among stock split stocks. “The company’s Imaging and Sensing Solutions segment delivered year-over-year sales growth of 32% in the fiscal second quarter, with operating income effectively doubling to $92.4 million,” financial statements reveal. They plan $1.6 billion in buybacks plus bigger dividends.

MicroStrategy (MSTR): A Split Stock to Avoid

MicroStrategy’s stock jumps between $100 and $450, showing risky market volatility in stock behavior. They trade 19.8 million shares while facing problems despite their 10-for-1 split. “MicroStrategy’s Bitcoin assets are worth $41.1 billion. Yet as of the closing bell on Dec. 30, MicroStrategy had a market cap of $74.2 billion,” which shows too high a premium.

Their approach to stock split stocks raises red flags. “MicroStrategy’s AI-inspired enterprise analytics software segment isn’t generating enough operating cash flow to service the interest payments on its outstanding debt,” analysts warn. Bitcoin bets and weak operations make this a bad choice for 2025.

Also Read: Gold Price Prediction 2025