Bitcoin has hardly received a concrete olive branch for the past few weeks, and most of the data and speculations indicate another round of sell-offs. While multiple arguments suggest that the bottom is in or near, reports continue to flood bearish sentiments across the board.

An investment vehicle was also formed by ProShares’ which allows investors to short Bitcoin to gain profits during its downtime. BITI, the short bitcoin ETF, was released only a week back, and now it is already the 2nd largest U.S bitcoin-related ETF.

BITI causing Bitcoin’s price further stress?

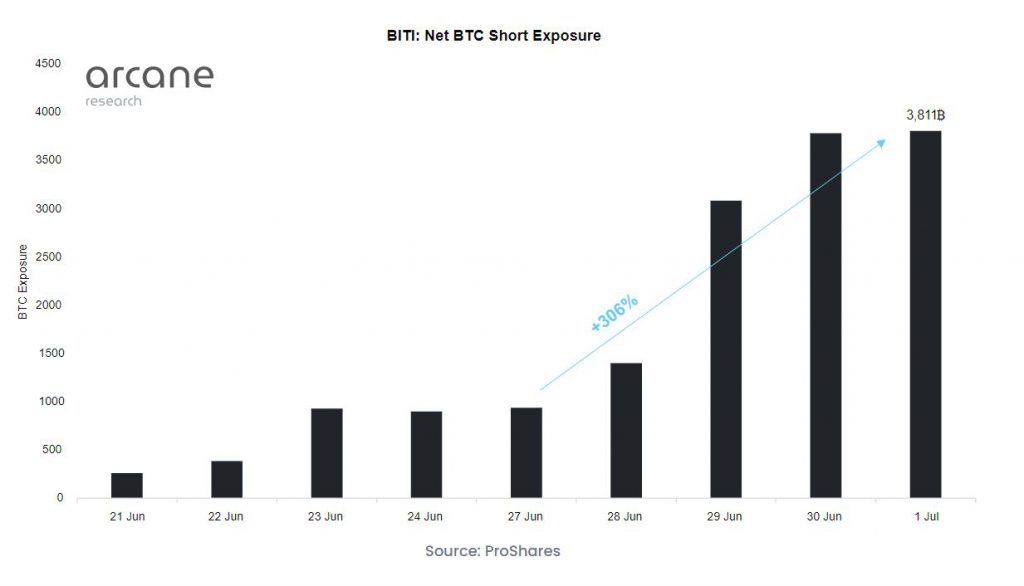

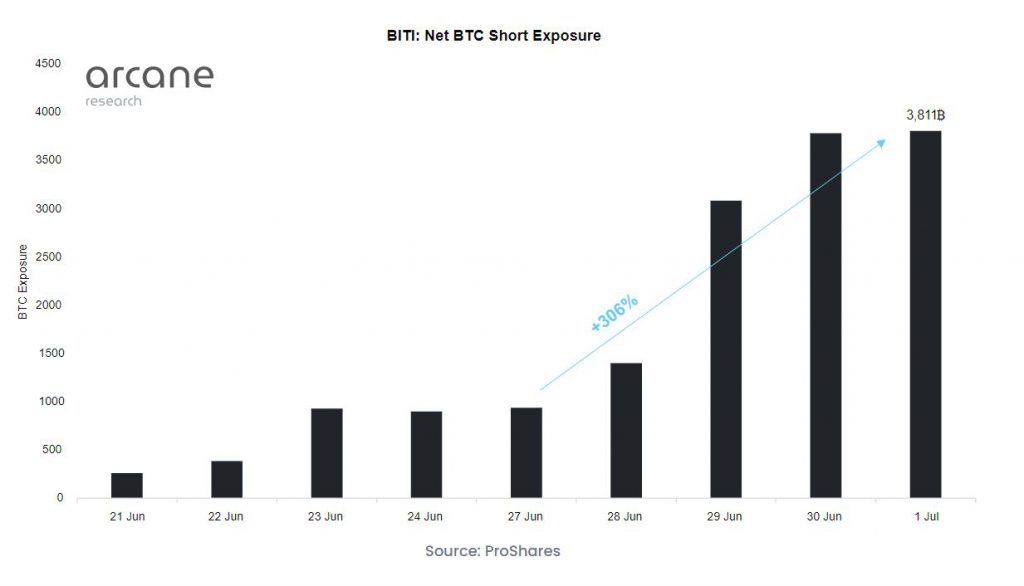

According to Arcane Research, BITI’s net exposure has increased 300% over the last week. At press time, more than 3800 BTC is hedged on the investment vehicle, where BTC’s depreciation would reap profits for the investors. One of the primary reasons for such an increase in net exposure is the inflows witnessed on 29th and 30th June. 1684 BTC and 700 BTC were injected into BITI quickly, potentially increasing sell pressure on Bitcoin.

Now, this may look highly bearish, but it is important to note that BITI comprises only 12% of the size of Proshares’ BITO. Most U.S ETF investors are still essentially long exposed to Bitcoin.

Does it leave BTC out of bear’s sight?

Most analysts do not think Bitcoin is going to recover anytime soon. As observed by Peter Brandt, BTC’s price is forming a pennant with historical bearish sentiment over the past few months.

Additionally, the increased inflows in short BTC ETF came weeks after more than $400 million was withdrawn from Bitcoin and other crypto products. Amidst these movements, the rising concern for inflation and recession continues to pile up. Jerome Powell, U.S Federal Reserve Chairman, stated that the central bank would continue to increase interest rates to tame inflation, which indirectly will push the U.S economy into a period of recession.

However, the Fear and Greed Index for Bitcoin reached a two-month high on the charts, which indicates that the current price remains a buying opportunity. The only issue remains that these indicators are not precisely quantifiable, and numbers continue to incline towards another sell-off. It could be a tough week for Bitcoin, and pressure will continue to mount for the digital asset, currently consolidating near $20,000.