Three Arrows Capital (3AC), the Singapore-based hedge fund manager, has found itself in quite a fix. Unconfirmed rumors are circulating on the internet that the firm is facing liquidations amounting to hundreds of millions of dollars.

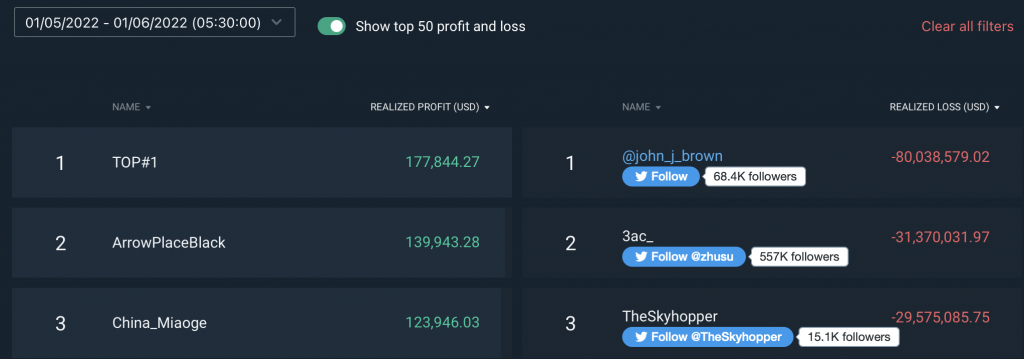

According to the data available on Bitfinex’s leaderboards, Three Arrows Capital lost a total of $31,370,031.97 in May. However, the hedge fund’s June accounts were not recorded.

The address designated as 3AC has a debt of $183 million in stablecoins USDC and USDT in addition to 211,999.12aWETH ($235 million) in collateral on AAVE V2.

Being a hedge fund manager is to deal with losses all the time. The losses accounted for in one exchange could just be a part of their hedging strategy.

Nonetheless, Three Arrow Capital’s capital-backed NFT funds also relocated the complete collection to the SuperRare marketplace, with its goals remaining unknown. Sadly, it won’t make any difference for the funds due to the poor demand on the NFT market and the decline in the value of Ethereum.

3AC suffered large losses as a result of its heavy investment in Terraform Labs’ sister tokens, LUNC (formerly LUNA) and TerraUSD (UST). According to FatManTerra, a whistleblower from the Terra community, Three Arrows Capital purchased 10.9 million locked LUNC for $559.6 million, which is currently worth $670.45.

Additionally, 3AC co-founders, Zhu Su and Kyle Davies, were off the grid for three days, leaving investors in a state of confusion. Zhu has since resurfaced and has assured investors that all is being done to control the situation. Some investors who have accounts in Three Arrows Capital have come forward accusing the fund of taking out capital from their pockets.

Three Arrows Capital was infamous for promoting the “supercycle” concept and advocating the Ethereum alternatives Solana, Avalanche, and Terra before their parabolic price increases during the year 2021.