Donald Trump has claimed victory in the recent US elections. Trump’s crowning as the 47th US president of the United States is significant in many ways. Firstly, his inclination towards the cryptocurrency domain is commendable in many ways, which may help the sector touch new highs under his leadership. Similarly, Trump’s recent win has also added more strength to the US stock market, paving the way for certain stocks to claim new highs soon. Here are the three stocks owned by Trump, which may cruise towards new highs as he assumes the role of the US president.

Also Read: Shiba Inu Gains Momentum: SHIB Set To Outpace Dogecoin In 2025

Three Stocks That Donald Trump Owns, And Now You Should Too For Major Future Gains

1. Apple (AAPL) Stock

Tech behemoth Apple is one of Donald Trump’s major stock market focuses, with the US president owning nearly $500,000 worth of Apple stocks. Apple is a leading tech company that produces a variety of products, including the iPhone, iPad, Macbook, and watches. The firm recently launched a research subsidiary in India called Apple Operations India. Per its recent report, the newly opened research outlet will be executing hardware and design-centric duties while managing failure analysis and procurement of engineering equipment.

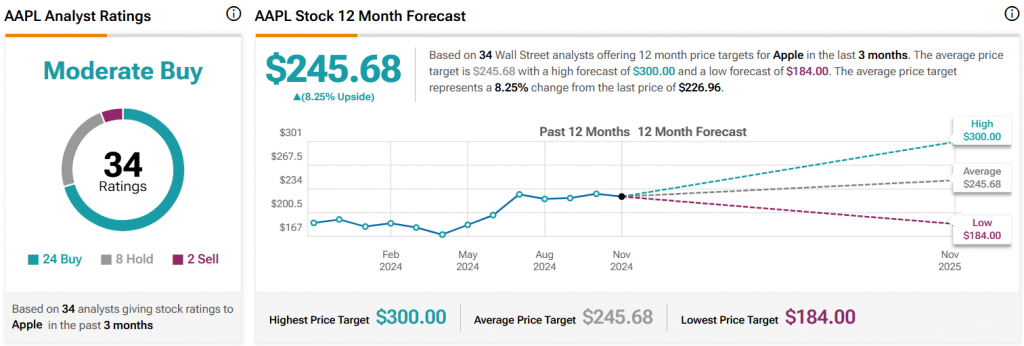

Per TipRanks, Apple is eyeing the $300 stock target, which it may achieve within the next 12 months.

“The average price target for Apple is $245.68. This is based on 34 Wall Street Analysts 12-month price targets issued in the past 3 months. The highest analyst price target is $300.00; the lowest forecast is $184.00. The average price target represents an 8.25% increase from the current price of $226.96.”

2. Microsoft (MSFT)

Microsoft is another leading tech firm that has captivated the attention of US President Donald Trump. Trump reportedly owns $500,000 worth of MSFT stocks. Furthermore, Microsoft is a leading software giant primarily known for launching the Windows Office suite.

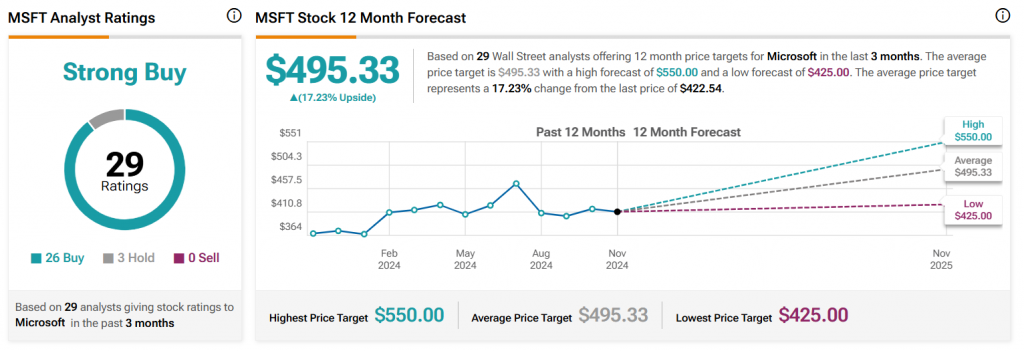

Per TipRanks, MSFT is poised for growth as the firm is targeting a new stock price of $550 in the near future.

“The average price target for Microsoft is $495.33. This is based on 29 Wall Street analysts 12-month price targets issued in the past 3 months. The highest analyst price target is $550.00; the lowest forecast is $425.00. The average price target represents 17.23% increase from the current price of $422.54.”

Also Read: Ripple vs. SEC: Shockwave as CEO Demands SEC Chair’s Immediate Resignation

3. Nvidia (NVDA)

Donald Trump’s latest filing reveals that the current US president holds nearly $500,000 worth of stocks in Nvidia. The firm is renowned for its AI chips, which have recently outpaced Apple to become the leading tech company in the world. Nvidia stocks continue to deliver stellar gains as utilitarian purposes of the firm rise to new highs.

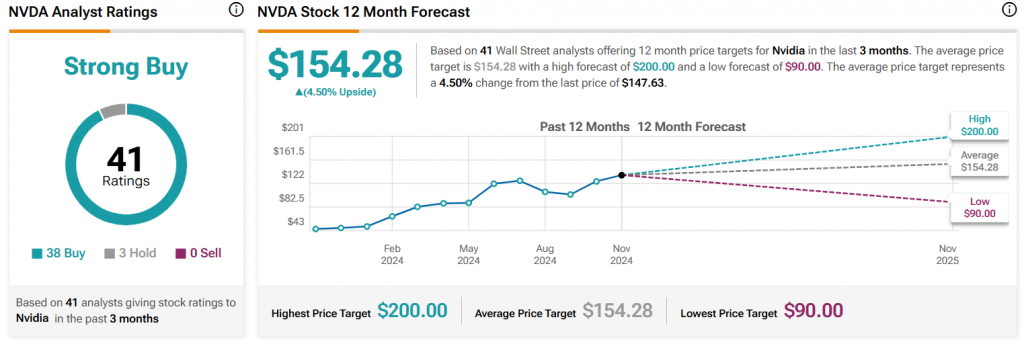

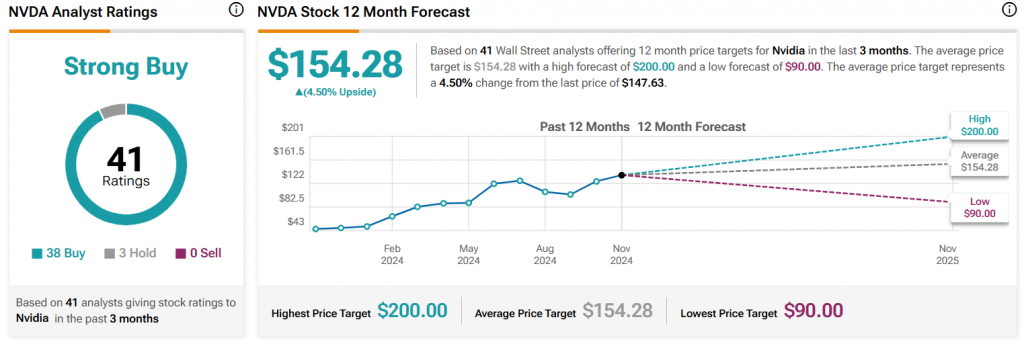

According to TipRanks, Nvidia may claim a high of $200 in the next 12 months.

“Accordingly, the average price target for Nvidia is $154.28. This is based on 41 Wall Street Analysts 12-month price targets issued in the past 3 months. The highest analyst price target is $200.00; the lowest forecast is $90.00. The average price target represents a 4.50% increase from the current price of $147.63.”

Also Read: Cryptocurrency: Top 3 Memecoin That May Hit New All-Time Highs