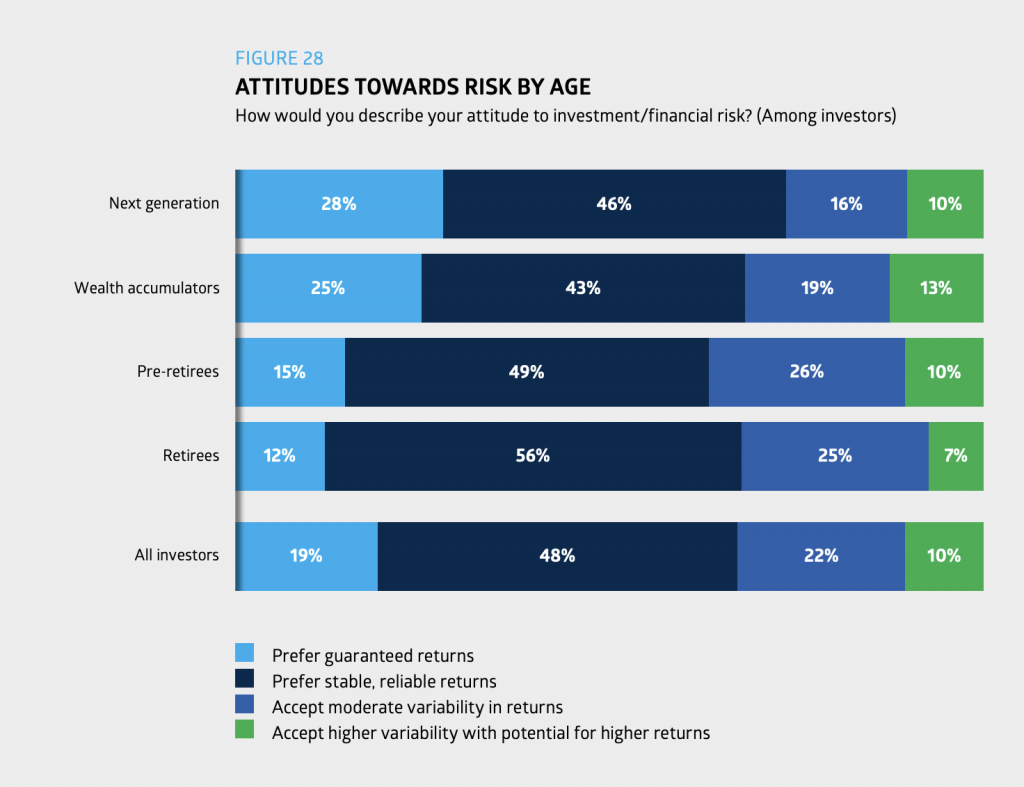

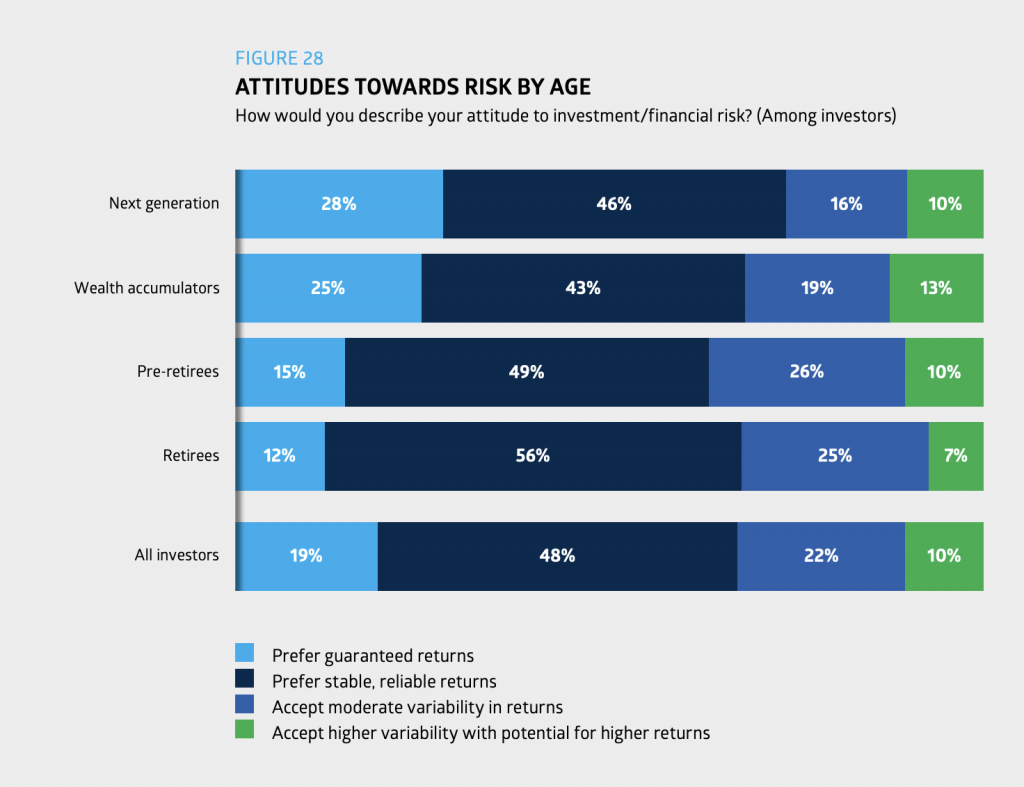

According to an Australian Securities Exchange (ASX) study, 31% of young investors (aged 18-24) have substantial crypto allocations. Despite 46% of young investors saying that they are more “risk averse” than older investors, a third of them have more than just dipped their toes in digital assets.

The industry is more attractive to the tech-savvy younger generation. Therefore, it is not surprising to see such a large number of young investors in the sector. According to research, the reason behind young people investing in cryptocurrencies is a desire to do things differently. The report noted that many of the new investors since 2020 are more connected to social media. Furthermore, they are more tech-friendly than previous generations.

As per the report, the average cryptocurrency holding for young investors is around $2700, which represents about 6% of their portfolio. Meanwhile, for other age groups, cryptocurrencies make up about 3%, i.e. nearly half. However, although young investors hold the most crypto relative to their portfolios, ages 25-49 (wealth accumulators) hold the most overall. This age group represented 69% of investments in digital assets. Lastly, ages above 50 represented 19% of the cryptocurrency ownership.

The report also found that 29% of the people polled are interested in putting money in crypto, but have not done so yet. They are considering buying into the asset class within the next 12 months.

Do Australia’s crypto laws need an urgent update?

The head of a new crypto-think group believed that the Australian government must move more quickly to create regulations for crypto. Otherwise, it runs the risk of falling behind growing economies. The remark was made by Loretta Joseph, chair of the Australian Digital Financial Standards Advisory Council (ADFSAC).

Joseph said that emerging economies like Bermuda, Mauritius, and Nigeria are moving at a much faster pace than Australia. Bermuda has shown support for a regulated cryptocurrency business, while Mauritius and Nigeria have recently been interested in regulating or formulating policies for their respective local industries.

Australia’s Treasury held discussions earlier this year for its “token mapping” project to assist categorize various crypto assets. Moreover, a document offering advice on a potential licensing framework is expected sometime this year. A private bill to hasten crypto regulation is also in the works.

Australia, along with the U.S. are two major economies that still do not have a proper rulebook on regulating the emerging new asset class. The lack of clear guidelines has led to several lawsuits and confusion in the last few months.