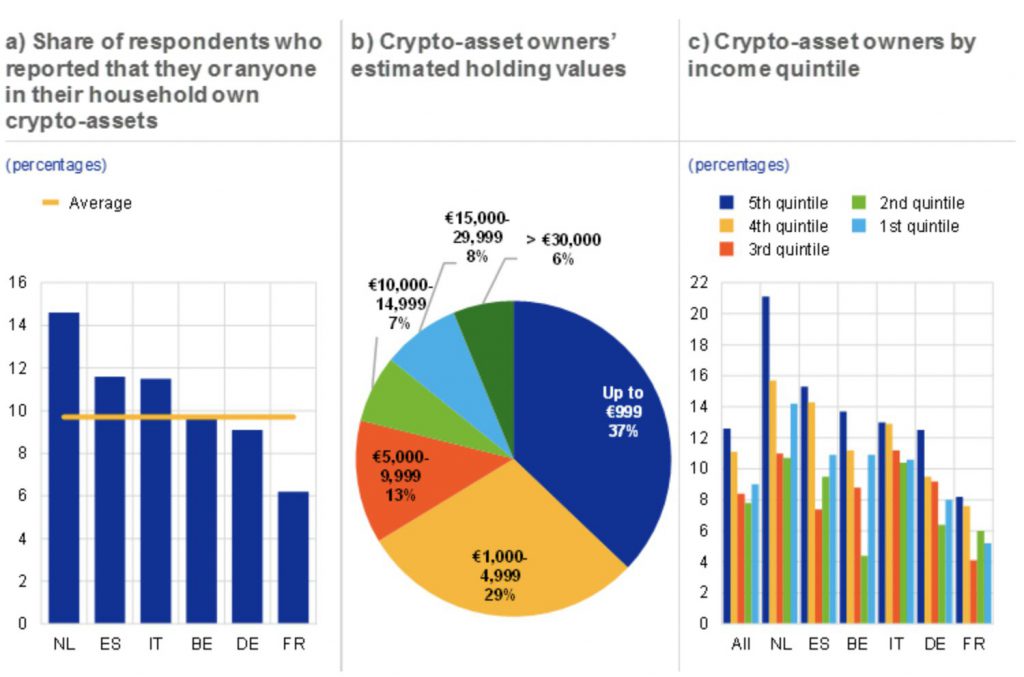

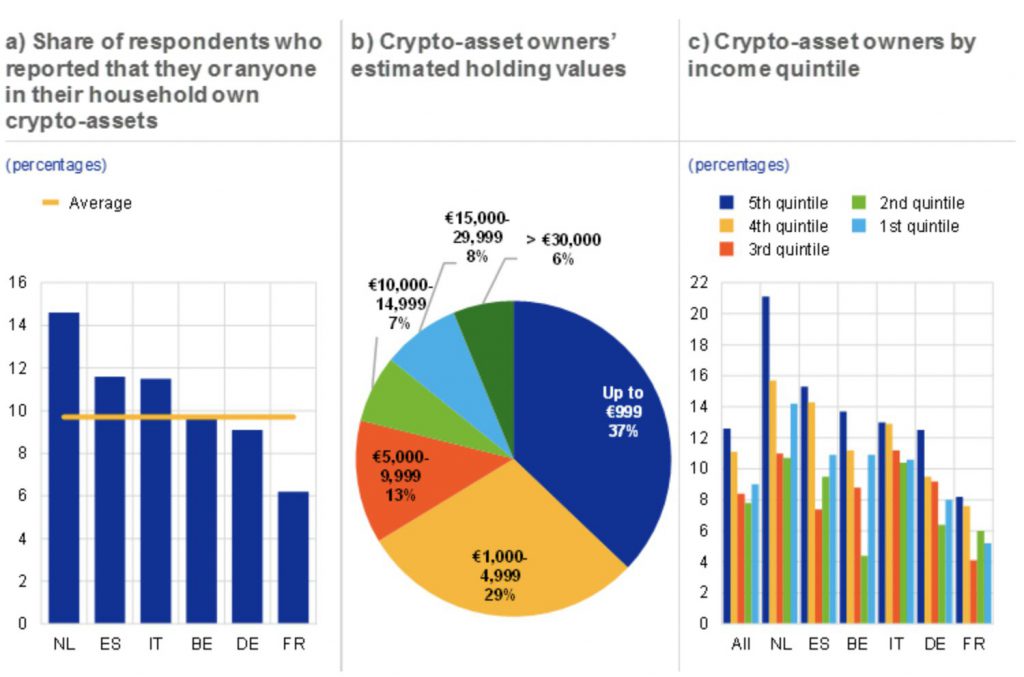

According to a new survey for the financial stability review by the European Central Bank (ECB), one in every ten households, in the six Euro zones selected for the poll, held crypto. The research shows that while the wealthiest are the most likely to possess crypto assets, poorer households are not far behind.

The countries that were considered for the poll were Belgium, France, Germany, Italy, the Netherlands, and Spain. The Netherlands had the highest percentage of crypto owners (14%) among the six Eurozone countries, while France had the least with only 6%.

Findings of the report

The majority of cryptocurrency owners reported having less than €5,000 in digital assets, with a slight preference for lower holdings (below €1,000). On the other hand, around 6% of crypto-asset owners acknowledged that they had more than €30,000 in crypto-assets.

The trend is broadly U-shaped when looking at the respondents’ income quintiles: the greater a household’s income, the more probable it is to have crypto-assets, with lower-income households being more likely to possess cryptocurrencies than middle-income households.

This fact leads to the speculation that middle-income households are more reluctant to put their capital into risky assets.

In the nations questioned, young adult men and those with higher education were more inclined to invest in crypto-assets. Respondents who scored at the top or bottom of the financial literacy scale were much more likely to own crypto-assets. It can be speculated that people with more knowledge, and people with little knowledge, were more open to digital investments, rather than those who had a middle ground awareness regarding the same.

European crypto investors on the rise

Fidelity Digital Assets, a custody and execution services provider, found that 56% of European institutional investors had some degree of exposure to digital assets, up from 45% in 2020, with their intention to invest likewise growing upwards.

Since July 20, 2021, German institutional investment funds have been permitted to invest up to 20% of their assets in cryptocurrency. This is supported even further by the growing availability of crypto-based derivatives and securities on regulated exchanges, such as futures, exchange-traded notes, exchange-traded funds, and OTC-traded trusts, which have grown in popularity in Europe in recent years.

According to European regulatory agencies, which recently renewed their warning, crypto-assets are very risky and speculative. Increased financial institution engagement might accelerate the rise of crypto-assets and put financial stability at risk, as per the ECB’s report. Although EU regulation to reduce the dangers presented by crypto-assets has been proposed, no consensus has yet been reached.