Ripple (XRP) is currently attracting heavy momentum and traction. The token is busy expanding its ecosystem, building new avenues, all while eyeing major price hikes in the near future. The fact that the token is still engaged with the US SEC case has had a mild impact on the token’s progress, hindering the token from blooming at a rapid pace. That being said, despite the token’s versatile collaboration and retail influence, XRP is unable to move past the critical barrier of $2. When can investors expect XRP to scale past its current price spot? Should investors still hold or sell their Ripple tokens? Let’s find out.

Also Read: New Projection Estimates XRP Could Surge 6,000%

Analysts’ Insights on XRP

Per Finder’s analyst Jeremy Britton, XRP’s institutional interest is rapidly peaking, which signals that a brewing XRP uptrend is in the works. Per Britton, investors should continue holding on to Ripple, as it may deliver new price peaks soon.

“XRP seems to be the choice for many institutions. It is arguably no longer a cryptocurrency, and its ethos is almost gone, but its value is in the eye of the banker.” Britton later shared (CFO of BostonTrading.co)

In another case, Sathwik Vishwanath shared how Ripple is amassing global interest but could still face barriers from its peers and competitors.

“XRP’s price depends heavily on regulatory clarity and adoption for cross-border payments. The favorable resolution of its legal battles (e.g., with the SEC) has improved sentiment. Ripple’s partnerships with financial institutions worldwide and its utility in reducing transaction costs enhance its long-term potential. However, competition from other digital assets in the payments space could temper price growth.”

In the middle of this, Joseph Raczynski, a futurist for JT Consulting and Media, is in the “hold” territory, claiming that XRP’s institutional appeal could be a game changer for the token.

“…the US institutes a no tax on local (US-based) cryptocurrencies” because, if that happens, “XRP will be the winner.”

However, one analyst, Josh Fraser, later shared that he does not believe in any long-term value in XRP, flashing a sell signal.

“XRP is often seen as the cryptocurrency used by banks and institutions. However, stablecoins are much more practical for this use case, and I do not see long-term value in holding Ripple.”

The Token Short- and Long-Term Price Targets

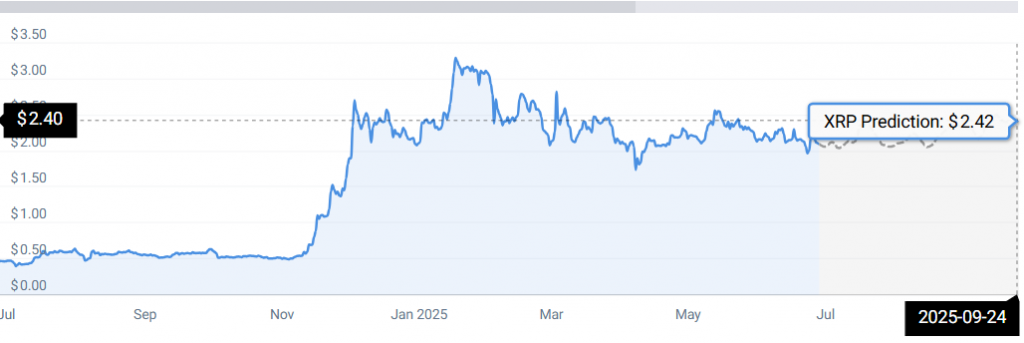

Per CoinCodex, irrespective of the opinions shared by the analysts, the market momentum states that Ripple may first hit $2.43 by September 2025.

“According to our current XRP price prediction, the price of XRP is predicted to rise by 15.22% and reach $2.43 by September 25, 2025. Per our technical indicators, the current sentiment is bearish, while the Fear & Greed Index is showing 65 (greed). XRP recorded 13/30 (43%) green days with 3.02% price volatility over the last 30 days.”

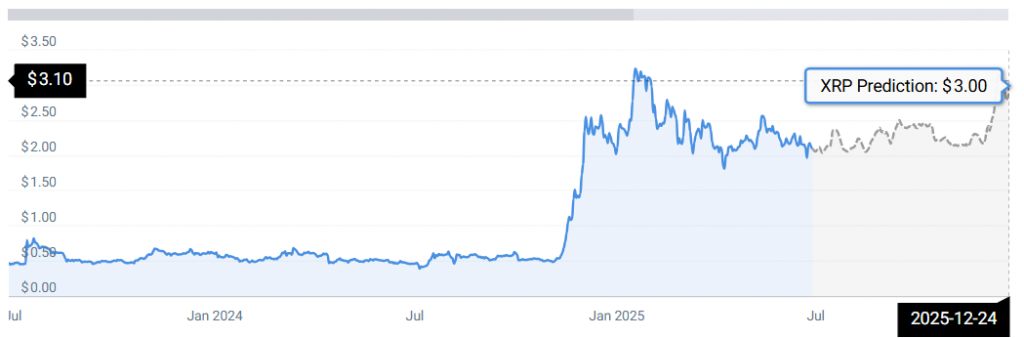

By December, the token may touch the $3 price mark; hence, it’s lucrative to hold Ripple for now. However, these price levels are subject to market change; hence, investor discretion is necessary.

“According to our current XRP price prediction, the price of XRP is predicted to rise by 42.50% and reach $ 3.00 by December 24, 2025. Per our technical indicators, the current sentiment is bearish, while the Fear & Greed Index is showing 65 (greed). Ripple recorded 13/30 (43%) green days with 3.02% price volatility over the last 30 days. “

Also Read: Will The US Govt. Start Buying Ripple (XRP) For Its Reserve?