Bitcoin is attracting bullish sentiments since January and is up nearly 38% since the start of the year. The leading cryptocurrency jumped from $16,500 in January to $23,400 on Monday before briefly retracing in price. Despite enjoying a successful start in 2023, investors believe that a downturn could be on the cards. The recent rally does not confirm a bullish market as the global economy is yet to stabilize amid rising inflation and job cuts.

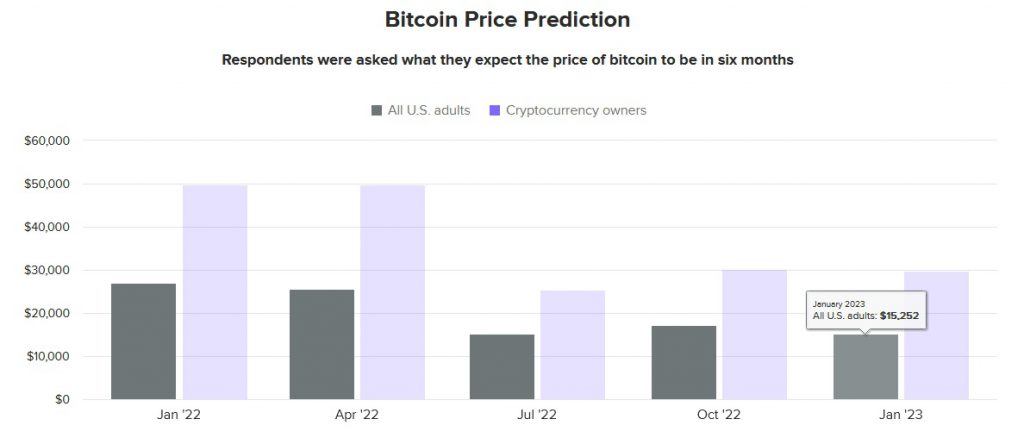

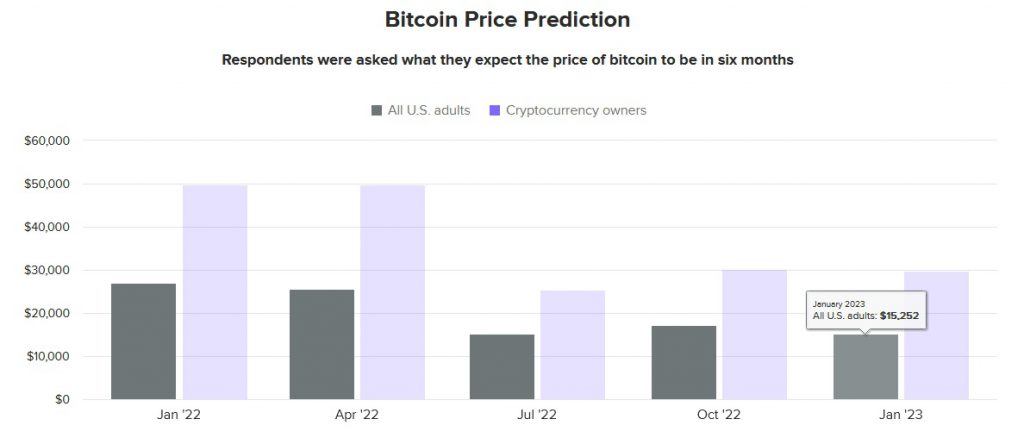

According to research conducted by Morning Consult, investors are skeptical about Bitcoin’s sudden price rise to $24,000. The survey shows that holders believe the king crypto could head south in the next six months due to the weak global economy.

Also Read: Bitcoin Could Reach $1 Million By 2030: Prediction

Investors Predict Bitcoin Price For the Next 6 Months

Morning Consult held a survey for 4,000 BTC investors and 40% of the respondents polled believe that Bitcoin is headed for a crash. The survey sheds light that investors believe the cryptocurrency market’s rise in 2023 could be a fake pump or a bull trap.

Among the 4,000 respondents, 40% of investors predict that Bitcoin could reach $15,252 in the next six months. That represents a drop of nearly 40% from its current price of $22,900.

Also Read: Whales Move $126M Worth of XRP: Here Is the Transfer Breakdown

The survey is clear that investors are skeptical about BTC and are hesitant to take an entry position fearing a crash. Though BTC’s short-term growth looks promising, the long-term prospects remain shaky.

BTC’s overall health depends on the economy which is staring at a possible recession. If a recession hits the economy this year, both the stock and the cryptocurrency markets could experience a bloodbath.

JP Morgan CEO Jamie Dimon and the World Bank have raised signs of a recession before Q3 of 2023. Therefore, the next six months remain to be a crucial period for the financial markets.

Also Read: Google Acquires $300 Million Stake in AI Start-Up Anthropic

At press time, Bitcoin was trading at $22,866 and is down 2.3% in the 24-hour day trade. It is also down 67% from its all-time high of $69,044, which it reached in November 2021.