Jefferies Group, a global financial services company, trades gold for Bitcoin. Gold seems to be losing its shine as a long-term investment and safe-haven asset, with crypto taking that spotlight.

Jefferies Wood Buys More Gold

After trading gold for Bitcoin in December 2020, the global head of equity strategy at Jefferies, Christopher Wood, has increased Bitcoin’s weight on his portfolio. The exposure to gold is currently down by five percentage points (ppt) in favor of Bitcoin.

This recent Bitcoin purchase comes after Wood shared in April that he is ‘extremely bullish’ on BTC since it enables a global monetary system. He also added that the top coin had become ‘investable’ for institutions.

The first Bitcoin futures ETF launch in October may have pushed Jefferies Wood toward acquiring more BTC. Over the last year, Bitcoin’s value has gone up by 114%, while that of gold has reduced by 6.43% over the same period.

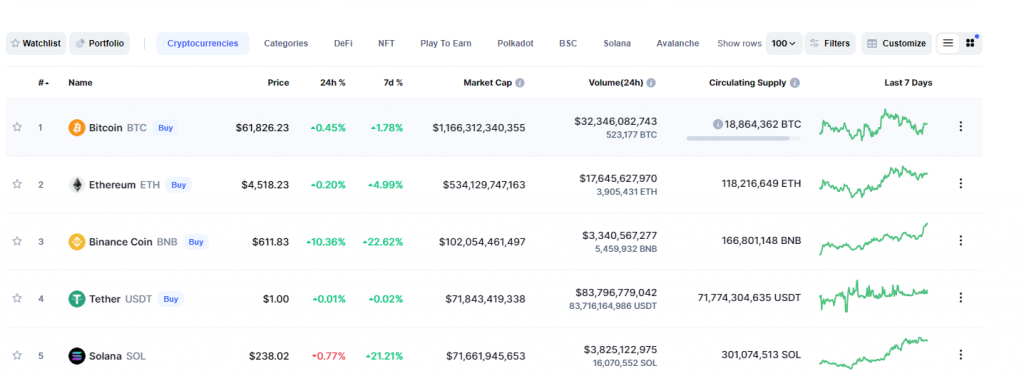

Bitcoin is currently worth over $61,000 as it aims to reclaim its recent all-time high value of $66,000.

Cutting Its Losses on Gold with Bitcoin

This latest BTC purchase by the New York-based investment giant comes after its first purchase back in December 2020. The December purchase was the first time the firm was dipping its toes in the cryptocurrency waters.

This purchase saw the firm make a 5% BTC allocation on its long-only global portfolio for US-denominated pension funds. At the time, BTC traded at $22,000. The first BTC purchase by Woods came after JPMorgan strategists had predicted more BTC acquisitions by firms, which would cause gold to suffer.

The US-denominated funds, created by Jefferies in 2002, currently has 40% in physical gold. Additionally, other allocations to this particular fund are 20% in unhedged gold mining stocks and 30% in Asia ex-Japan equities, weighted according to the long-only thematic portfolio.

While writing his weekly note to investors, Wood shared that he is still bullish on gold. He, however, shared that it is risky for gold bugs to ignore that BTC is currently gold’s competitor as a store of value.

Wood also wrote that the firm would not add Ethereum to the portfolio since it is not a store of value asset. He also said that he thinks Ethereum is likely to outperform the top crypto in the coming months. According to market capitalization, Ethereum comes second to Bitcoin, which many refer to as ‘digital gold.’

Also, in his note titled, ‘Greed and Fear.’ Wood noted that blockchain technology has the potential to “trigger the end of the current dollar paper,” just like it brought to “an end the need for intermediaries.”

More on Jefferies

Founded in 1962, Jefferies Group currently has around 2,885 employees. Some of its subsidiaries include Jefferies Finance LLC, Jefferies LLC, Jefferies Hong Kong Limited, and Jefferies Hoare Govett.

CEO Richard B. Handler leads the multinational independent investment and financial service provider. Jefferies Group currently has assets worth $440 billion under management.