After dwindling near the $45,000-$46,000 range between 17th-20th December, Bitcoin ripped a bullish day on the 21st, with a 4.27% recovery. It reached $49,576 today but missed the mark at $50,000.

While the bullish sentiment has seemingly returned for the king coin now, on-chain indicators suggested a shift in narrative between July and December 2021. In this article, we will be analyzing the trend change and whether it can cause an effect going forward.

Bitcoin STH remain profitable but the range is higher?

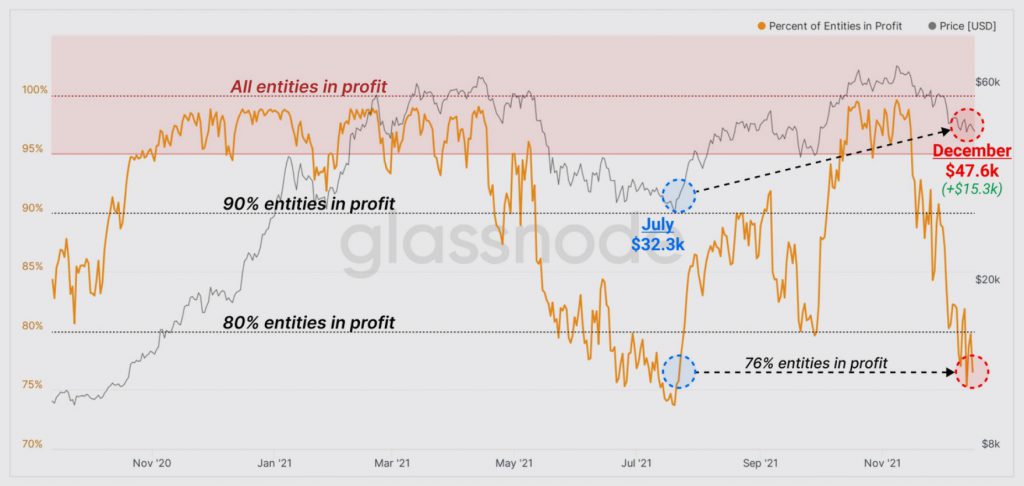

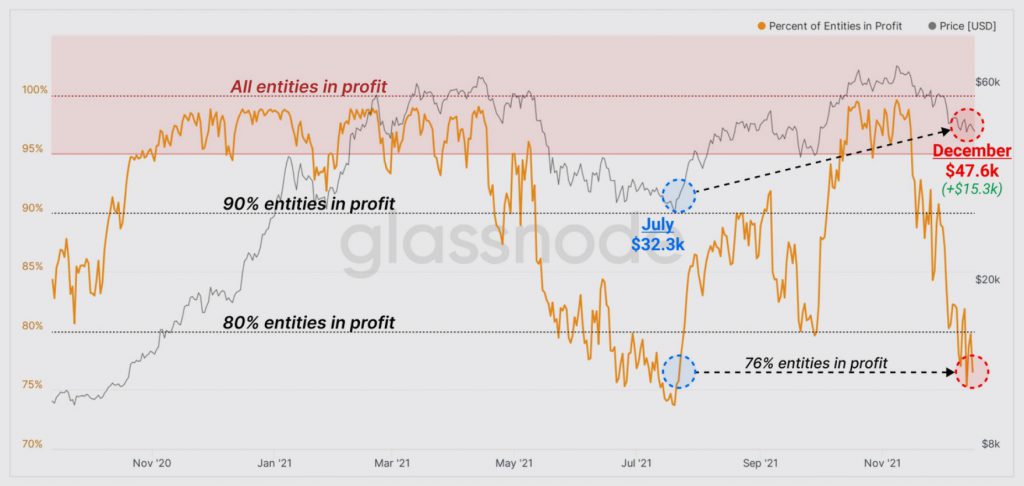

The bullish rally for Bitcoin can be divided between two halves in 2021. One occurred in Q2 and the other arrived in Q4. Now, according to glassnode, the coin rotation among short-term holders is displaying an intriguing development.

Back in July, 76% of all bitcoin on-chain addresses were in profit at $32,300 with respect to BTC‘s peak value in May. In October-November, new highs were established and at one point 100% of the entities reached a state of profit. Now, Bitcoin is down 30% from its ATH, and all entities in profit have again reached 76%. However, the major difference is that the price point is now $47,600.

In an ideal situation, the entities in profit should have been higher at his price range. Now, inference can be drawn that between July and December, more coins were bought hence the profit entity reached a higher state. The current market is top-heavy, which means that more short-term holders are underwater with BTC‘s current valuation.

Will this weakness seep into bearish sentiment?

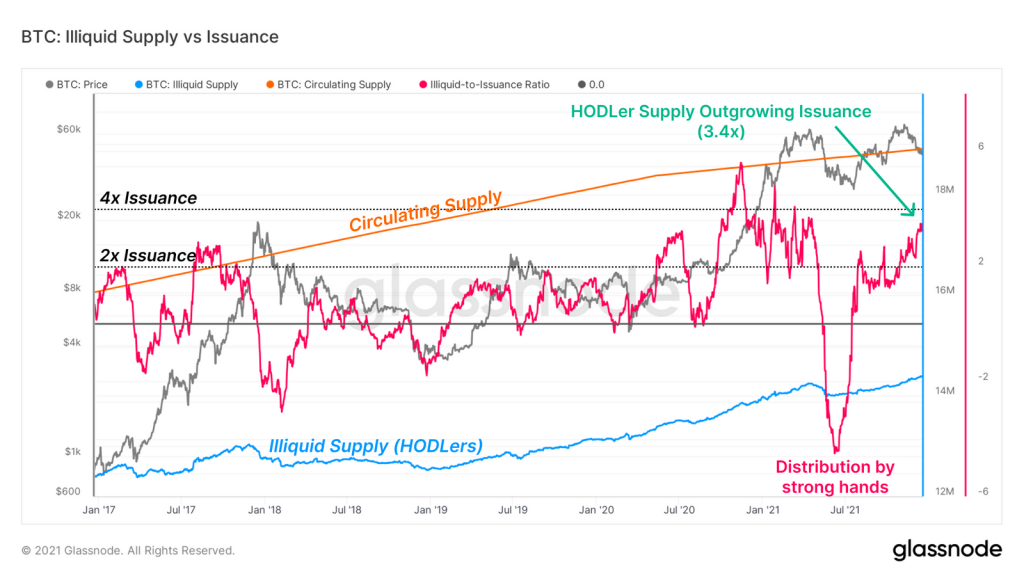

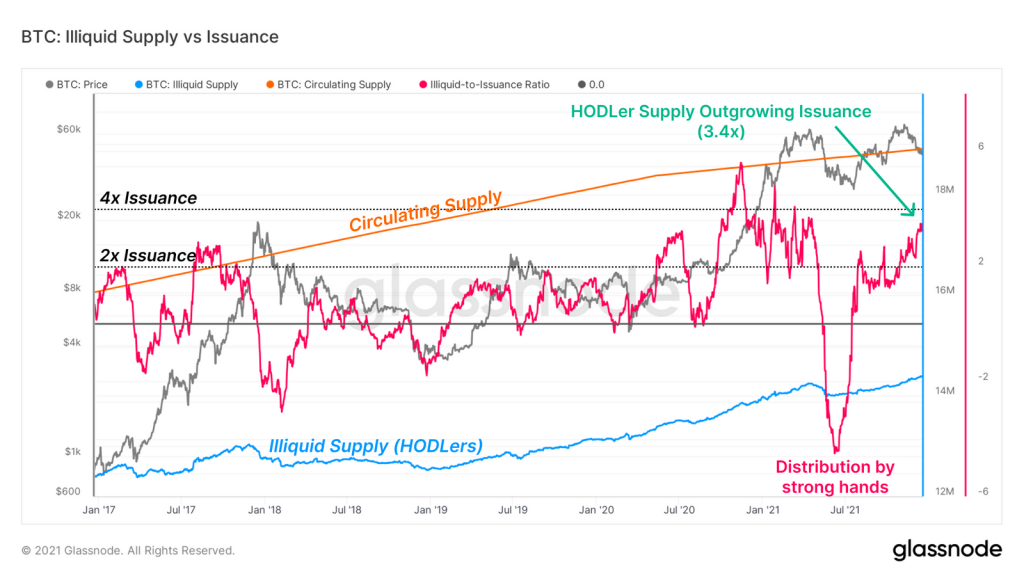

Not yet. While short-term holders might be indicating a state of panic, long-term holders have continued accumulation. The Illiquid supply in possession has consistently increased. Illiquid supply is the BTC tokens that are not on centralized exchanges, and are unavailable for selling. The higher the illiquid supply, the more strong is the long-term narrative.

Hence, at this moment, there is still hope that Bitcoin can recover and orchestrate another bullish leg. At press time, investors should look out for BTC to recover above $50,000 before contemplating an investment.