The crypto market conditions have been gradually improving. Most assets have been trying to make up for investor losses. Pepe Coin is one such one crypto. This fairly novel meme coin was one of the top gainers at press time, and managed to appreciate by around 15% over the past day.

Now, the losses incurred as a result of the broader market crash instigated by the SEC lawsuits have pinched short-term holders. Nevertheless, early investors seem to be in a fairly comfortable position, for being ahead of the curve. The situation, however, is not as glossy as it seems.

A recent research from SingularityDAO revealed that early participants got to relish the biggest piece of the gain pie. The early profit-taking managed to evaporate liquidity from the Pepe Coin market. Thus, the majority of investors are not in a position to make material profits.

Further elaborating on the current state of affairs, Rafe Tariq, Senior Quant at SingularityDAO said,

“The limited amount of net liquidity is creating a high stakes game of music chairs. Everyday investors are being lured in with the hopes of big profits but the reality is that a small percentage of investors will walk away with profit, while everyone else will get burnt.”

According to the research, only up to 50 million of the 1.2 billion of unrealized profits have the potential to be actually be realized, given the current state of liquidity. That said, it should be noted that over 80% of the potential profits were accrued in the first week of Pepe Coin’s issuance.

Also Read: Pepe Coin Rallies 15%, Elon Musk Says Dogecoin ‘For the Win’

Large Scale Whales Hold Upto 25% PEPE: Research

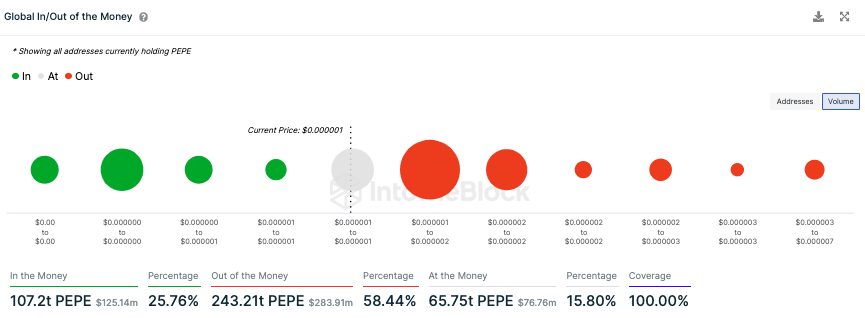

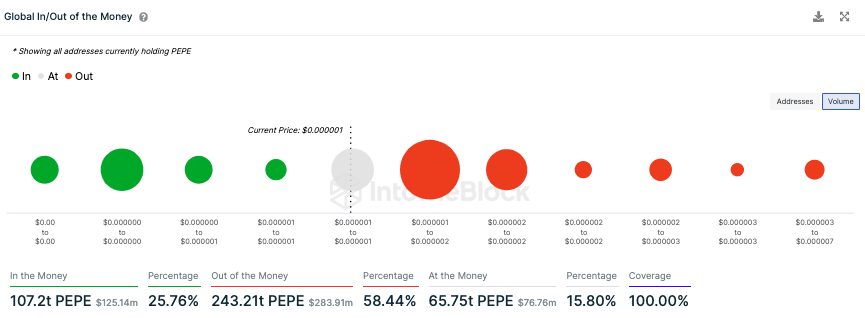

According to on-chain data from ITB, only a quarter of Pepe Coin investors are currently above water, or in profit. Close to 60% of them are underwater, while the remaining are in a break-even position.

Also Read: Dogecoin Renews Bearish Streak: Network Scaling Down?

The research additionally found that a small number of large-scale investors, or “whales”, hold up to ~25% of PEPE. Contrarily, other large investors hold up 46% of the current circulating supply. According to SingularityDAO, this means that a “minority” of investors hold a high degree of influence over the coin’s price, making the investing landscape even more risky.

Commenting on the speculative and risky nature of investing in meme coins like PEPE, Tariq said,

“What appeared to be an exciting opportunity to make a quick buck on the surface was nothing more than false hope for the average individual.”