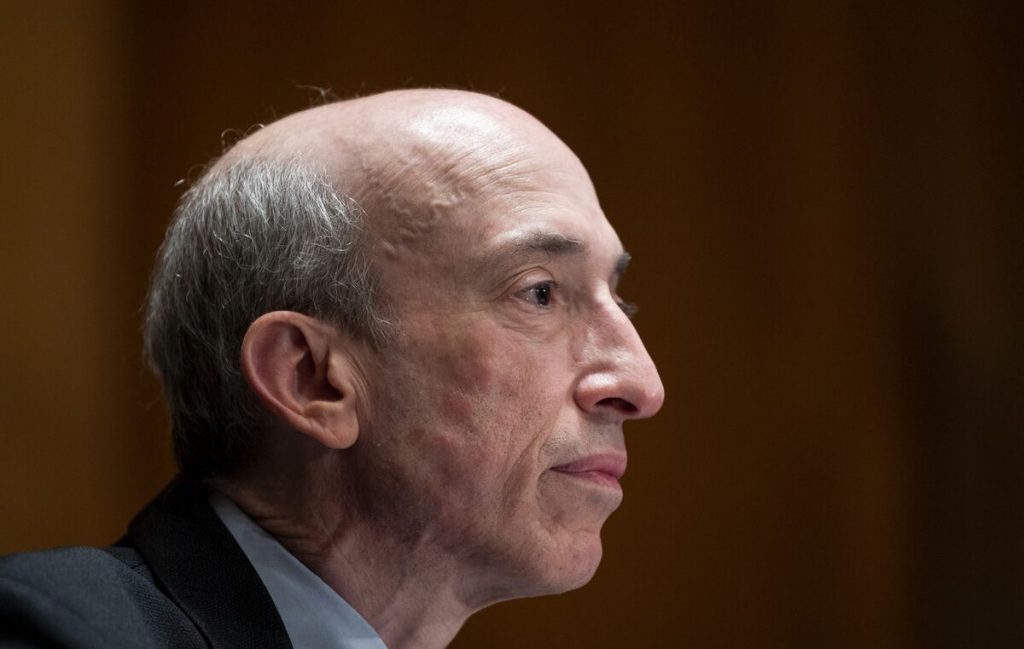

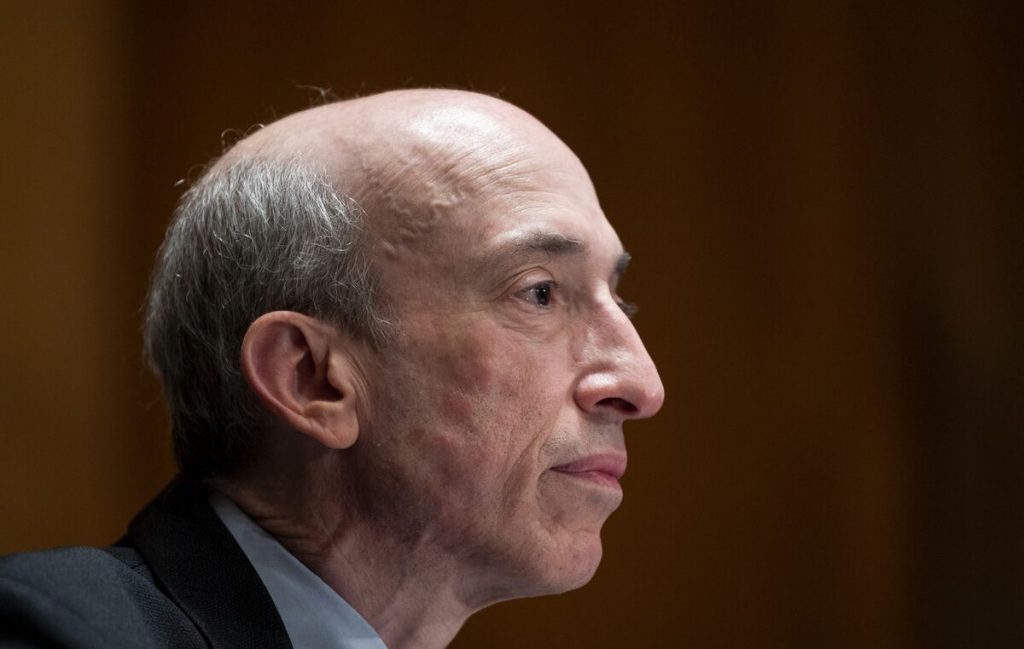

The US Securities and Exchange Commission (SEC) has been under the microscope over allegations that they may have staged a Spot Bitcoin ETF opposition letter. Specifically, due to the connection that SEC chair, Gary Gensler may have to the company that issued the letter.

An independent organization called Better Markets, Inc. published a letter opposing the approval of a Spot Bitcoin ETF by the agency. However, Caselt Island Venterus General Partner Matt Walsh observed questionable stances on the development. Noting the false claims in the letter, the plot thickened when Gensler’s connection to the company was uncovered.

Also Read: SEC Chair Gary Gensler Says Crypto is “Rife With Fraud”

Spot Bitcoin ETF Opposition Letter Traced Back to the SEC?

The digital asset sector has continuously fought for the approval of the very first Spot Bitcoin ETF in the United States. Although the industry is preparing for what its arrival could mean for the industry as a whole, the regulator has been consistent in its unwillingness to approve the creation.

Some have questioned whether the SEC has staged a Spot Bitcoin ETF opposition letter. Specifically due to the connection between the company behind the letter and the SEC’s chair. Alternatively, within the letter itself, Better Markets claims “spot Bitcoin markets have. history of artificially inflated trading volumes due to rampant manipulation and wash trading.”

Also Read: SEC Will Not Approve Spot Bitcoin ETF Says Former SEC Chief

Moreover, the company states that the “CME Bitcoin futures market is not a regulated market of significant size, and the surveillance-sharing agreements with Coinbase add little to no value.” Yet, Walsh states that the letter not only sounds like it could come from Gensler but that the SEC chair is a supporter of Better Markets.

Indeed, Walsh stated that Gensler has met with Better Markets nine times since he first took the position of SEC chair in 2021. Specifically, Walsh notes that this access is unprecedented for the digital asset sector.

Additionally, Justin Slaughter reports that Gensler had actually selected the head of Better Markets to be placed on the “Biden Transition Team for finreg agencies.” The connections certainly call the motive of the letter into question. Considering Gensler’s stance on the digital asset sector, its presence would undoubtedly benefit his case.