Many individuals have steered clear of cryptocurrency for one specific reason: its volatility. The entire market is undeniably prone to fluctuations, mostly because it is still in its early stages. Bitcoin [BTC] has experienced its own dose of volatility, even though the asset has achieved a relatively stable position when compared to other cryptocurrencies.

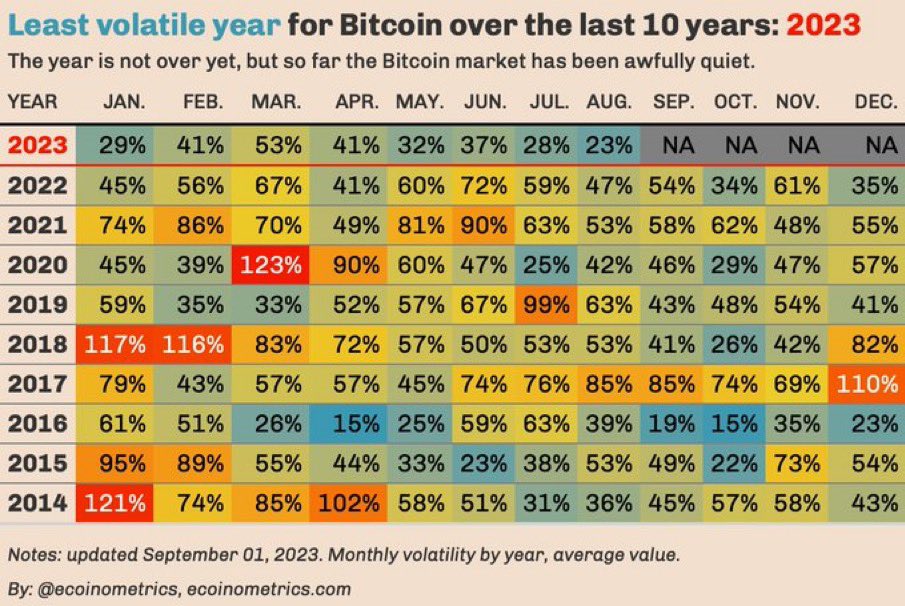

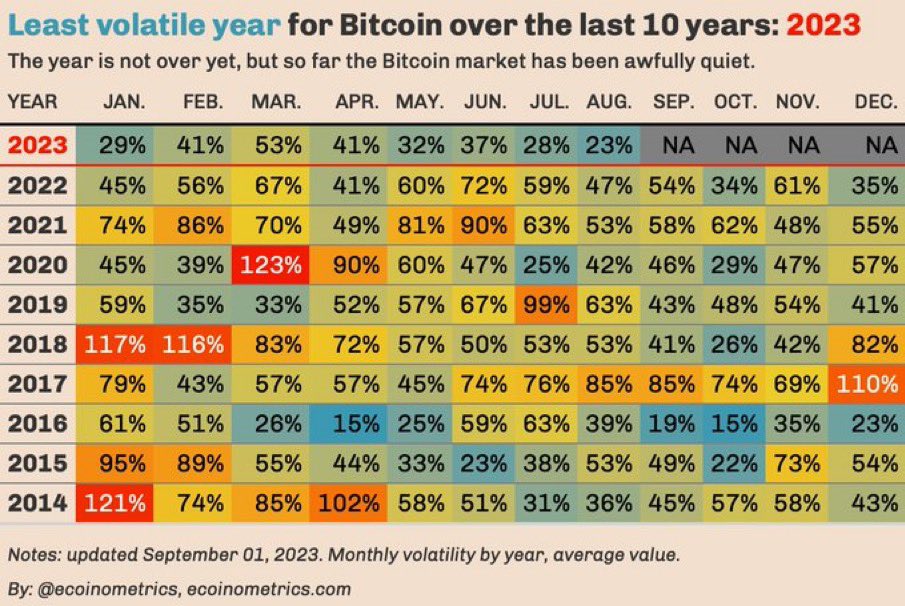

Following a turbulent 2022, the present year has demonstrated a notable level of stability for the leading cryptocurrency. It appears that 2023 is shaping up to be more than just that. According to a recent report, 2023 stands out as the least volatile year for Bitcoin in the past decade. Although the year is not yet over, its performance has been relatively subdued thus far.

As depicted in the chart, Bitcoin has witnessed a rise in instances of volatility throughout the years. Several monthly average volatility readings for BTC exceeded the 100% mark. The most recent occurrence was in 2020. The peak level of volatility for this year was observed in March. Conversely, August saw the lowest level of price fluctuations.

As of the current moment, the volatility of BTC stands at 35.43%. Throughout the year, BTC reached its peak at $31,446 in July, while its lowest point was in January when it was valued at about $16,500. At press time, BTC was trading at $25,699.68, reflecting a 1% dip in its daily value.

Also Read: U.S.’s First Futures Bitcoin ETF Reacts Ironically: Nullifies 7% Spike

What are the factors affecting Bitcoin’s volatility?

Numerous factors contribute to the price fluctuations of Bitcoin. These encompass investor sentiment, governmental regulations, media attention, and the dynamics of supply and demand. The market value of Bitcoin is fundamentally influenced, by the quantity of coins in circulation and the extent to which individuals are willing to invest in it.

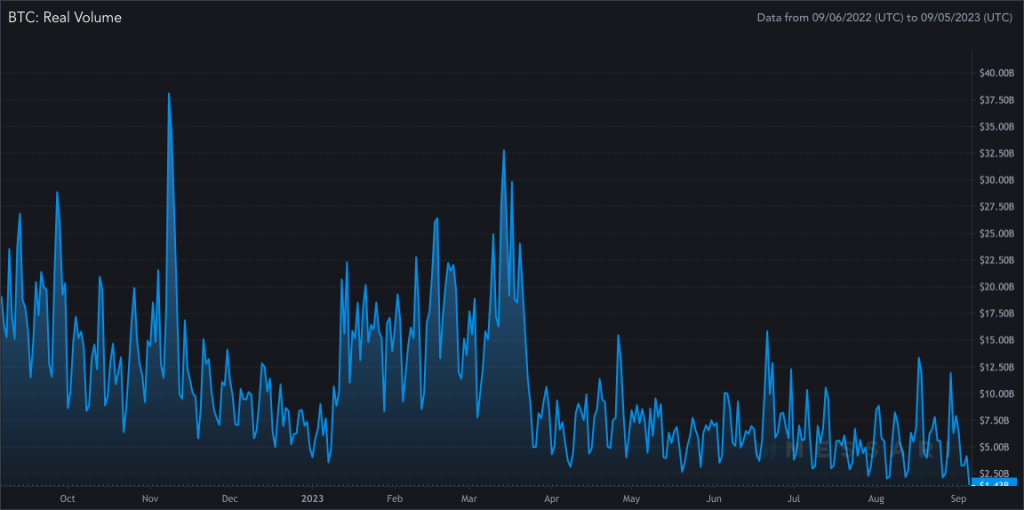

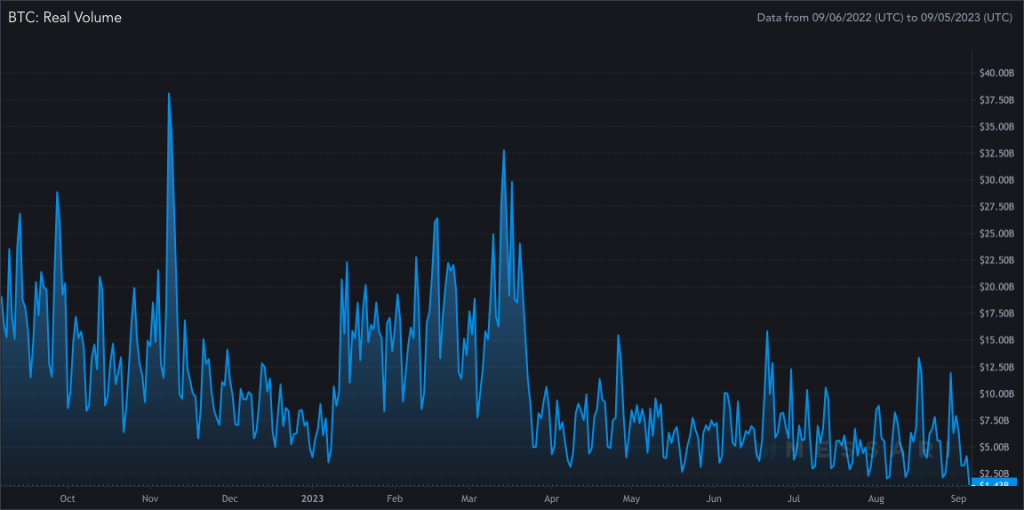

Furthermore, Bitcoin has experienced a decline in its network activity. The actual trading volume, which represents the total volume on exchanges devoid of wash trading activities, has seen a significant decrease in the current year. Presently, the genuine trading volume of BTC stands at $1.43 billion, marking an 88.39% drop over the past year.

Likewise, there has been a notable decline in the count of active addresses this year when compared to the figures from the previous couple of years. The recent decrease can be viewed from both bullish and bearish perspectives. On the bullish side, it suggested that Bitcoin may be moving away from its nascency, as it is no longer as prone to extreme price swings. However, on the bearish side, a sustained period of low volatility could mean that significant upward movements are less likely to occur.

Also Read: Mining One Bitcoin is Less Expensive Than Drying Clothes