Price manipulation via wash trading is a common strategy that entities use to earn profits. Usually, entities buy and sell the same asset simultaneously to create a false impression of market activity. Nevertheless, the trade reflected no change in actual ownership. Liquidity is fragmented in crypto, and as a result, smaller markets are easier to manipulate via large orders. Solidus Labs recently revealed that the price of billions of dollars worth of crypto has been manipulated over the past three years. As far as specific numbers are concerned, the report revealed,

“Since September 2020, liquidity providers (LPs) on Ethereum-based decentralized exchanges (DEXs) have wash-traded at least $2 billion worth of cryptocurrency, manipulating the prices and volumes of more than 20,000 tokens.”

Also Read: Banana Gun’s Crypto Crashes by 99.7%: ChatGPT Finds Contract Bug

Wash Trading Must be Prevented for Markets to Thrive

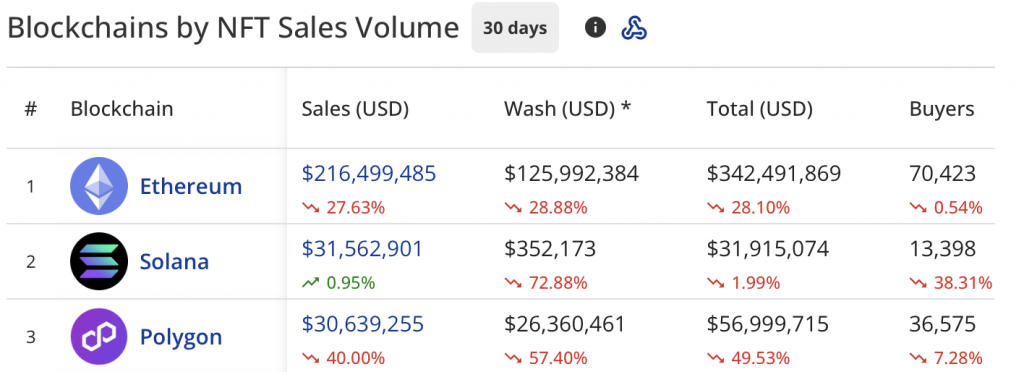

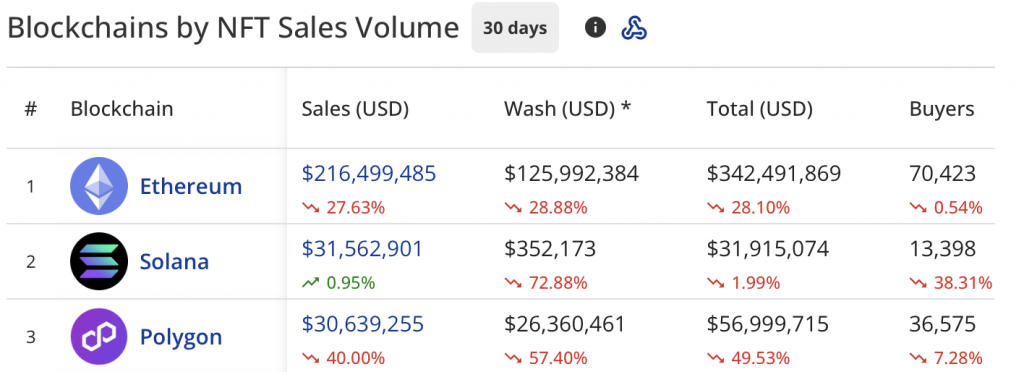

A report by the National Bureau of Economic Research [NBER] in 2022 revealed that 70% of unregulated exchange transactions are wash trading. In fact, even in the NFT market, wash trading is a common occurrence. Over the past month, the Ethereum blockchain has settled $216 million via NFT sales. However, data from CryptoSlam revealed that $125.9 million was wash traded. On Solana, the proportion was comparatively low, while on Polygon, the wash trading figure was significantly high.

Also Read: This is Bitcoin’s Strongest Recovery Excl. ‘ETF-Rally’ Since July 13

Arguably, fair markets are crucial for sustainable growth. Nevertheless, there seems to be a lack of clarity on certain conditions. The report pointed out that there are still question marks regarding who is responsible for wash trading prevention and detection. Even so, DEX-based wash trading is detectable, and, in many cases even preventable. Solidus’ report asserted,

“Wash trading may be a new problem for DEXs, but, much like insider trading, it’s one with a proven solution.“

Also Read: Binance: SEC’s Requests Are ‘Burdensome’