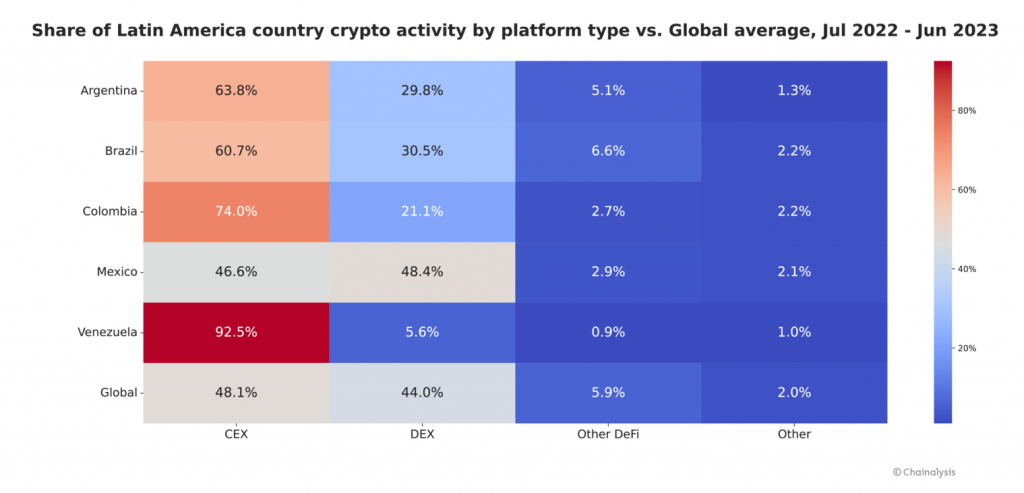

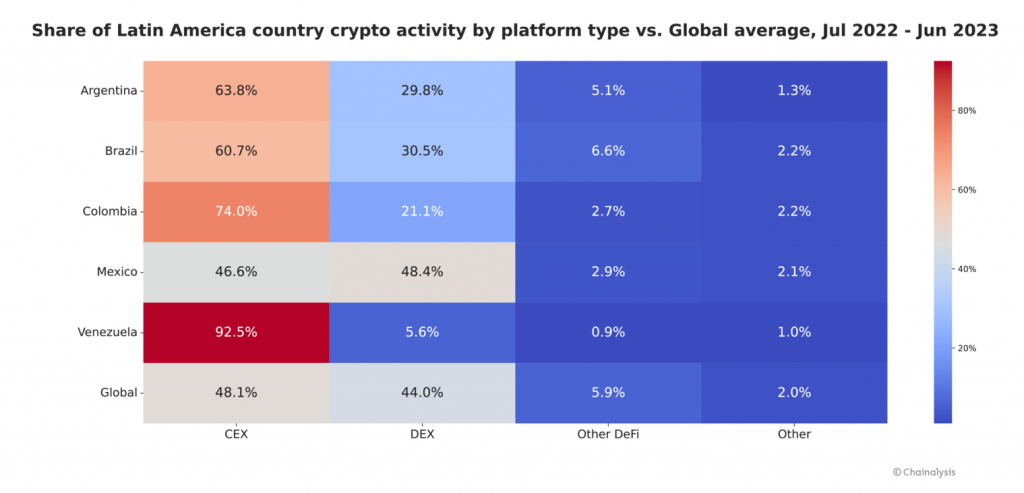

A new report from blockchain analytics firm Chainalysis found that crypto users in Latin America strongly prefer centralized exchanges (CEXs) over decentralized platforms.

The region registered the highest ratio of CEX activity compared to DeFi and decentralized exchanges (DEXs) globally. Certain countries skew heavily toward CEXs.

For example, Venezuela sees 92.5% of crypto volume on centralized exchanges versus just 5.6% on DEXs. Chainalysis cited Venezuela’s humanitarian crisis and use of crypto for aid as driving adoption.

Also read: Cardano Investors Feel the Pain With 93% of Addresses at a Loss

Colombia also leans toward CEXs at a 74% clip versus 21.1% for DEXs. But Argentina leads the region with over $85 billion in estimated crypto transaction volume from July 2022 to June 2023.

Latin American data shows divergence from global trends

The data reveals a divergence from global trends, where DEXs comprise 44% of activity versus 48.1% for CEXs. Latin America appears to favor centralized crypto gateways.

Experts attribute this to lower crypto literacy and a current lack of access to DeFi tools in the region. CEXs offer a more familiar onboarding experience.

But the report notes that crypto use in Latin America is often driven by real economic needs rather than speculation. Adoption is likely to steadily rise, given high inflation and unstable currencies.

As the market infrastructure matures, DeFi and DEX could see increasing traction in Latin America. For now, the unbanked especially depend on centralized crypto access ramps.