The crypto realm is abuzz with predictions. A prominent figure in the crypto trading community, Josh Olszewicz, has recently provided insights into the potential price trajectory of Bitcoin (BTC). Olszewicz’s analysis suggests that Bitcoin may be on the brink of surging to the $38,000 threshold. He further amplified the prevailing wave of optimistic sentiment. Presently, the crypto is steadily edging closer to the $35,000 mark.

Olszewicz’s prognosis hinges on the recognition of a specific technical pattern referred to as the “high n’ tight flag.” This pattern is commonly considered a bullish indicator within the realm of market analysis. The “high n’ tight flag” typically manifests following a substantial upward price movement. It derives its name from its distinctive appearance. The “high” element alludes to the rapid and nearly vertical price surge. However, the “tight” phase characterizes the subsequent period of consolidation, forming a flag-like pattern on the price chart. After an abrupt ascent, prices tend to stabilize or move horizontally, creating a platform for a potential breakout. If Bitcoin adheres to this pattern, Olszewicz envisions the possibility of a breakout that could propel the crypto to the annual pivot point of $38,000.

Furthermore, Olszewicz has drawn attention to the existence of two additional bullish technical patterns. This includes the “Adam & Eve” (A&E) and the inverted head and shoulders (iH&S) formations. These patterns signify a certain hesitancy within the market to shift toward bearish territory. They are typically viewed as indicators of a bullish reversal. Nonetheless, Olszewicz underscores a crucial caveat: the emergence of a substantial downturn could disrupt this optimistic pattern. It could potentially redirect Bitcoin’s value towards the $31,000 level.

Also Read: $15 Trillion Could Enter the Markets for Bitcoin Upon Spot-Based ETF

Bitcoin futures record major spike

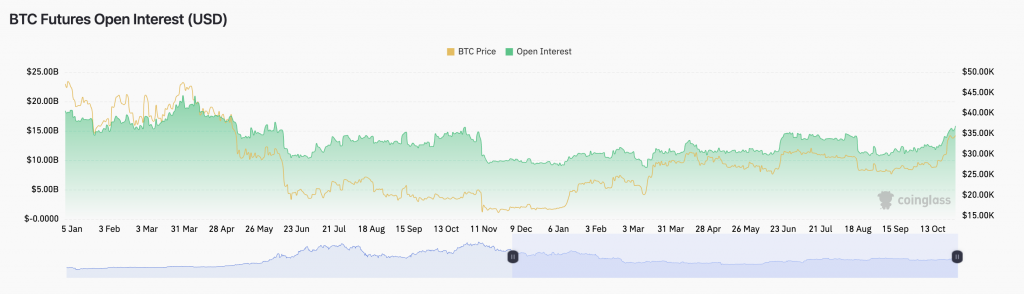

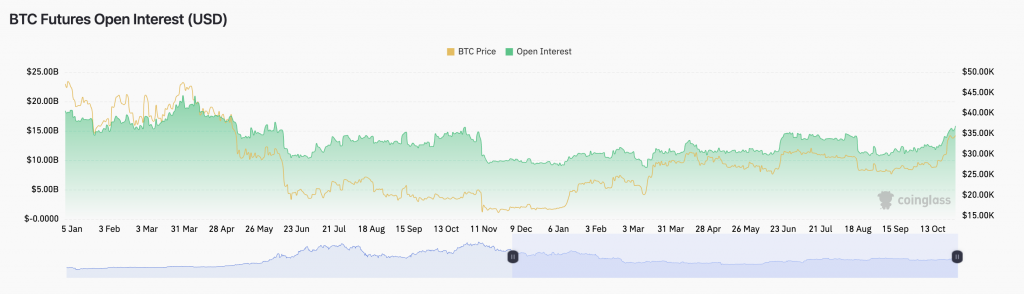

At press time, Bitcoin was trading at $34,272.02, marking a modest 0.69% increase. The asset’s price movements are being closely monitored as it endeavors to ascend to higher levels. Additionally, Bitcoin futures contracts have experienced a surge in open interest, reaching $15.83 billion, the highest level since early June 2022. Open interest in Bitcoin futures has seen a significant 33.5% increase since October, signaling a growing interest in BTC. Bitcoin options holdings are also substantial, currently totaling around $15 billion, having reached a historic peak of $17.73 billion on Oct. 27.

The crypto market is inherently dynamic, and the fluctuations in Bitcoin’s price are under close scrutiny by both traders and enthusiasts. With bullish technical patterns and growing interest, all eyes are on the possibility of Bitcoin attaining the coveted $38,000 threshold in the near future.

Also Read: Bitcoin Forecasted To Hit $87,000 by 2025, Says Panel of Experts