In a world where the US dollar is under threat internally and from BRICS countries, analysts are suggesting that a major economic crisis could hit the US in the coming years. One research firm, in particular, believes that bullish investors are ignoring the signs that this economic crisis could be a dangerous moment for the US Dollar.

Los Angeles-based independent economic research firm Beacon Economics believes a crisis is brewing around the US Dollar. The firm says that the huge Federal deficit and overvalued asset markets are driving excessively hot consumer spending. That might be good for the current growth of the US economy but is setting up problems later on.

“These issues began long before the pandemic struck, but actions by the Fed in response to the crisis have made the nation’s long-run economic situation significantly worse,” said Christopher Thornberg, founding partner of Beacon Economics. “Their decision to firehose an extreme amount of new money into the economy expanded U.S. money supply by 40% in an 18-month period – show me a nation that wouldn’t see a surge in spending and prices after such an aggressive increase.”

Also Read: Binance Gets Court Approval to Invest Customer Funds in US Treasury Bills

BRICS Pushes US Dollar On The Brink Of An Economic Crisis

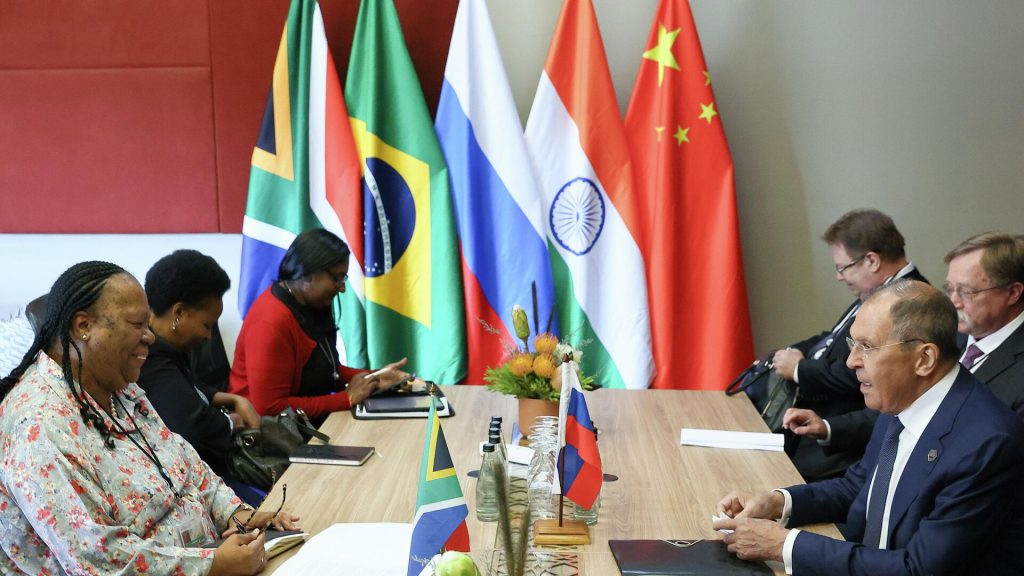

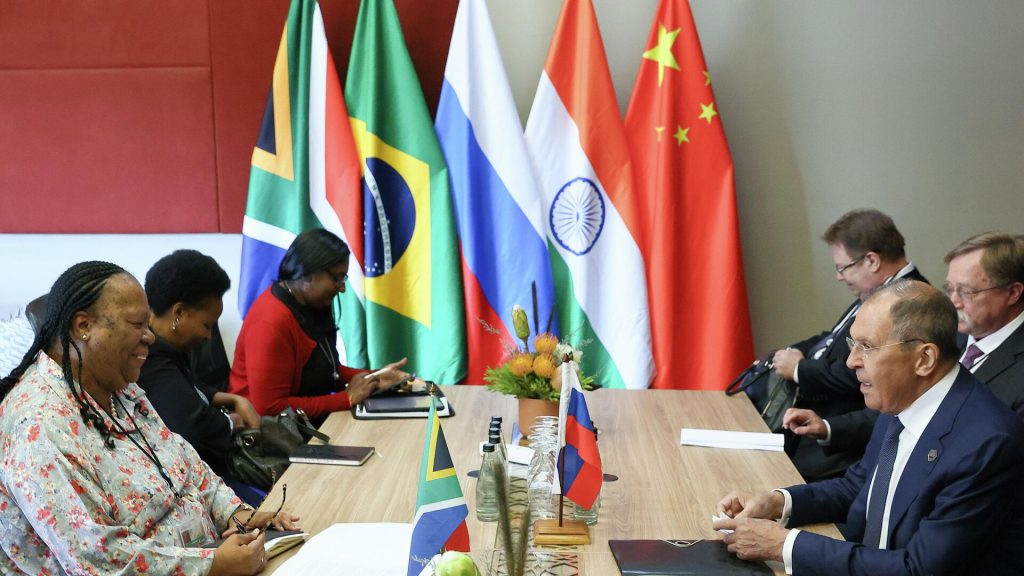

The struggle with inflation has been a driving reason behind the greenback’s recent struggles. This battle is a contribution to this worrisome outlook for 2030. However, the growth of the BRICS alliance also causes some worry for the US Dollar. The BRICS bloc is clearly challenging the US currency, and Russia’s Sergey Lavrov recently said that de-dollarization is a process that cannot be stopped. On the heels of those meetings and agreements, the grouping appears fortified in its resolve.

Also Read: BRICS Reveal How the U.S. Dollar Will End

This year, news surfaced of a BRICS payment system in development. Iran recently affirmed its desire for that payment system to connect all of the collective’s central banks. These kinds of initiatives open the door for the bloc to continue decreasing US dollar activity. Which could have massive effects on the currency.