Index funds are changing the investment game. Billionaires are now focused on a Bitcoin-based fund. This fund promises huge returns. Meanwhile, these investors are selling their Nvidia stocks. They’re eyeing potential gains of up to 83,000%.

Also Read: Fed Rate Cut: 25 or 50 Basis Points Amid Rising Unemployment?

Why Billionaires Are Betting Big on This Index Fund: A Comprehensive Guide

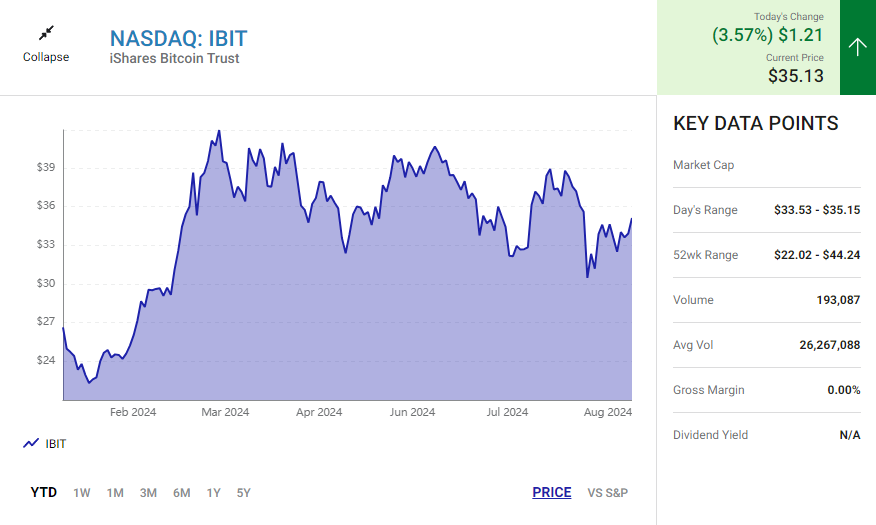

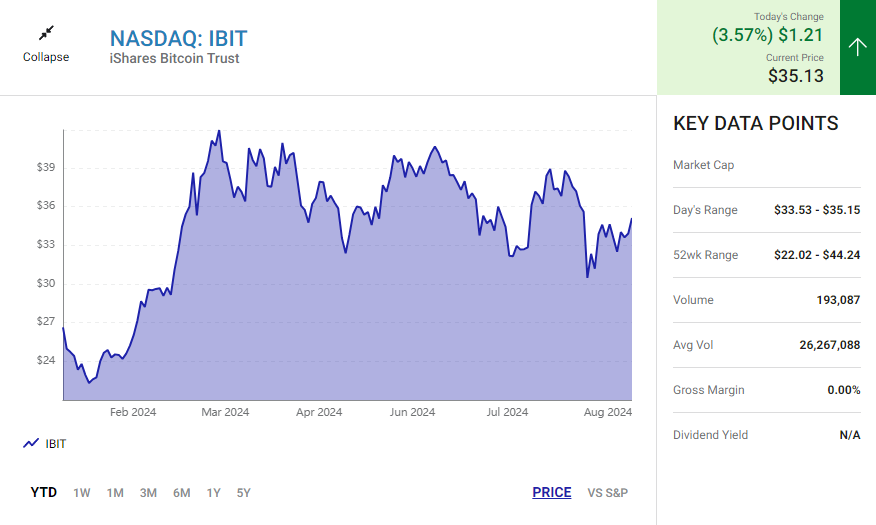

iShares Bitcoin Trust Shakes Up the Market

The iShares Bitcoin Trust (NASDAQ: IBIT) is in the spotlight. This fund tracks Bitcoin’s performance. It offers a new way to invest in cryptocurrency, making it more accessible like an index fund.

Index Fund Changes: Billionaires Move from Nvidia to Bitcoin

SEC filings show a big change in strategy. Top hedge fund managers are making moves. David Shaw and Steven Cohen are selling Nvidia stocks. They’re buying more of the iShares Bitcoin Trust, aligning their strategy more with an index fund approach.

Experts Predict Massive Growth

Bitcoin trades at $59,000 now. But some Wall Street experts see much higher prices ahead. Bernstein analysts think it could hit $1 million by 2033. Ark Invest’s CEO is even more optimistic. She predicts $3.8 million per coin by 2030, making index fund returns seem smaller in comparison.

Also Read: ASEAN Dollar Domino Effect: What Will Happen If Thailand Ditches USD?

Ups and Downs of the Crypto Market

The crypto market is known for big swings. Bitcoin has dropped by 50% several times before. New regulations could also change things quickly, affecting even index fund returns tied to crypto.

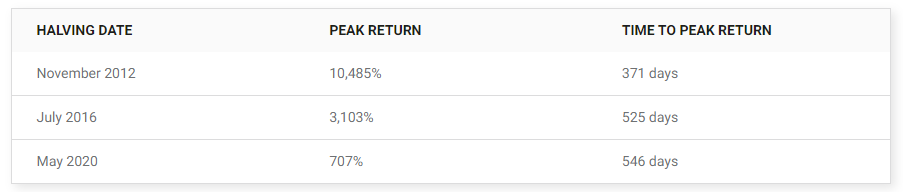

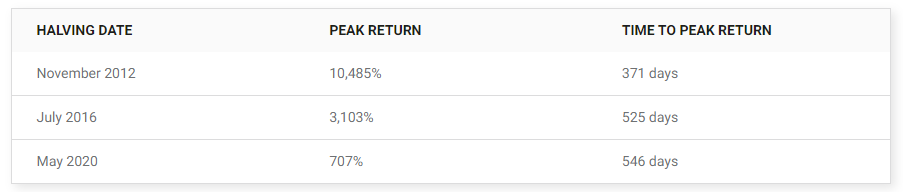

Halving Events Drive Prices Up

Bitcoin has a limited supply. Every four years, the new coin production is cut in half. This event often leads to price jumps, which can also influence the performance of a crypto-focused funds.

Also Read: Cardano: When Will ADA Reclaim Its All-Time High of $3.09?

Bitcoin ETFs are changing how people invest in crypto. Billionaires are leading this change. It could reshape finance for years to come, similar to how the index fund transformed stock investment.