Russia cryptocurrency is set to change how the country handles international payments. Starting September 1, 2024, Russia will officially use digital assets for these transactions.

This marks a big shift in Russia’s approach to crypto adoption and cross-border payments. The move comes as Russia looks for ways around economic sanctions.

Also Read: Shiba Inu: You Can Now Become a SHIB Millionaire For Just $14

Navigating Russia’s Crypto Adoption: Cross-Border Payments and Economic Impact

New Russia Crypto Laws and Oversight

On August 8, Russian President Vladimir Putin signed a new law. It allows Russia to test using cryptocurrencies for international payments. The Central Bank of Russia will oversee this process. The National Payment Card System will help with the trial.

Using Stablecoins for Trade

Russia plans to use stablecoins for international transactions. These are digital coins tied to regular currencies. The Central Bank is working on rules for using stablecoins in Russia.

Support from Other Countries

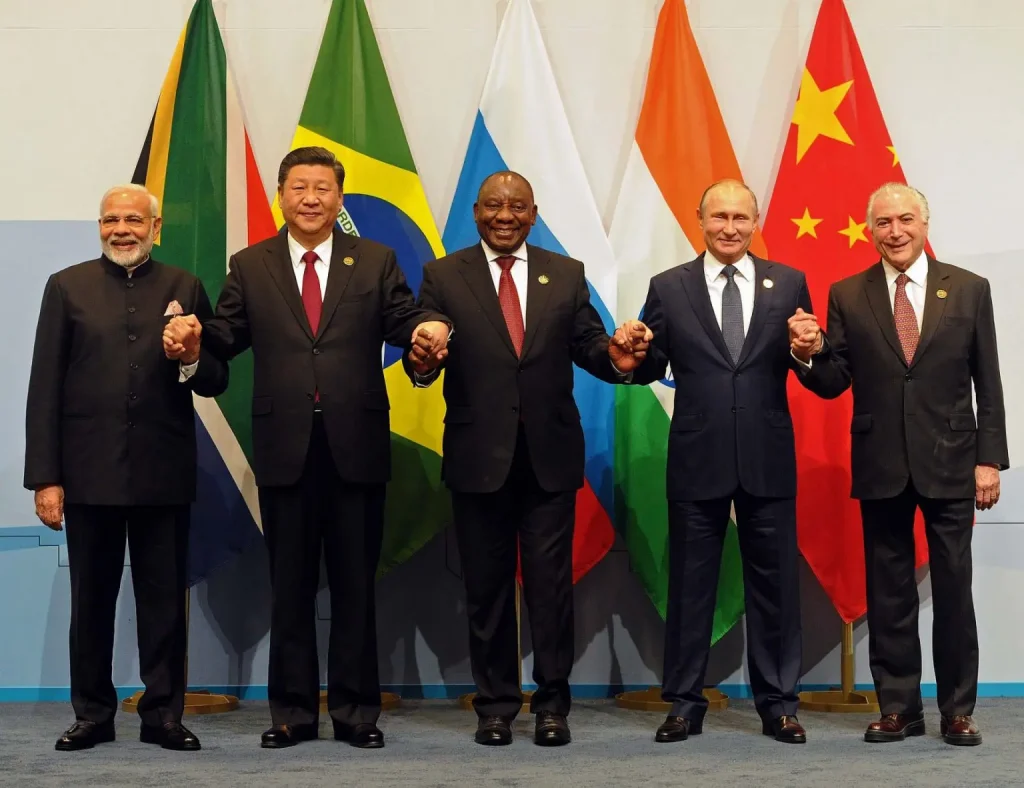

For this plan to work well, Russia needs support from BRICS nations. Some countries have shown interest, but it’s not clear if all will fully commit.

Also Read: FLOKI: Double-Bottom Pattern – Next Big Investment with 20% Surge?

Testing the Digital Ruble

While working on cryptocurrency plans, Russia is also testing its digital ruble. Right now, about 30 companies and 11 cities accept it. This includes Moscow’s metro and some gas stations.

What This Means for the Economy

Russia’s move towards crypto adoption is a way to deal with economic sanctions. By using digital assets, Russia hopes to keep trading globally despite limits on regular payment systems.

Also Read: PEPE and BONK Price Prediction For September 2024

As Russia starts this crypto revolution, many are watching to see how it affects cross-border payments and the global economy. If it works, it could change how countries handle international money transfers.