Bitcoin dropping below $40k on 10 January managed to instill a novel wave of fear in the minds of market participants. While a few from the space started advocating a much deeper dip, the rest, began rooting for the support regions in-and-around $40k to come into play and rescue Bitcoin.

The rooting did help. Post the dip, Bitcoin quite quickly started inching upwards over the next few trading sessions. By Thursday, the king-coin breached $44k and was seen trading around the same number at press time too.

As highlighted in yesterday’s article, strong fundamentals alongside the support received from the HOLDer community aided BTC’s recovery.

Litecoin: Treading on Bitcoin’s pre-carved path

Litecoin, the silver to Bitcoin’s gold, also flashed similar movements on its price chart. On the 10th, it dunked down to a level as low as $120, but gradually recovered over the next 48 hours. At the time of press, it was seen trading around $140.

Litecoin has always shared a very high correlation with Bitcoin and has historically mirrored its price movements. With the correlation hovering around 0.97, the same has been observed this time too.

The tale of two

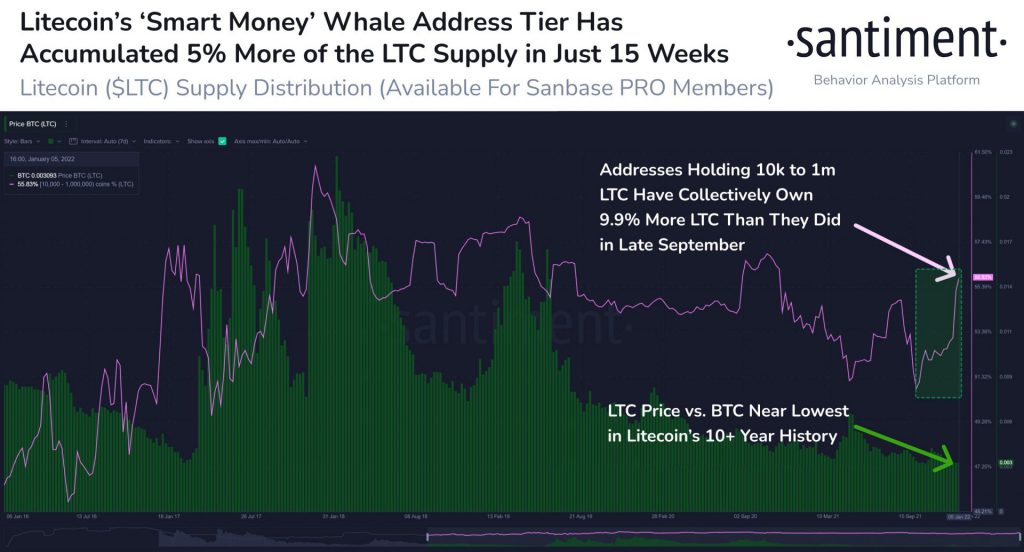

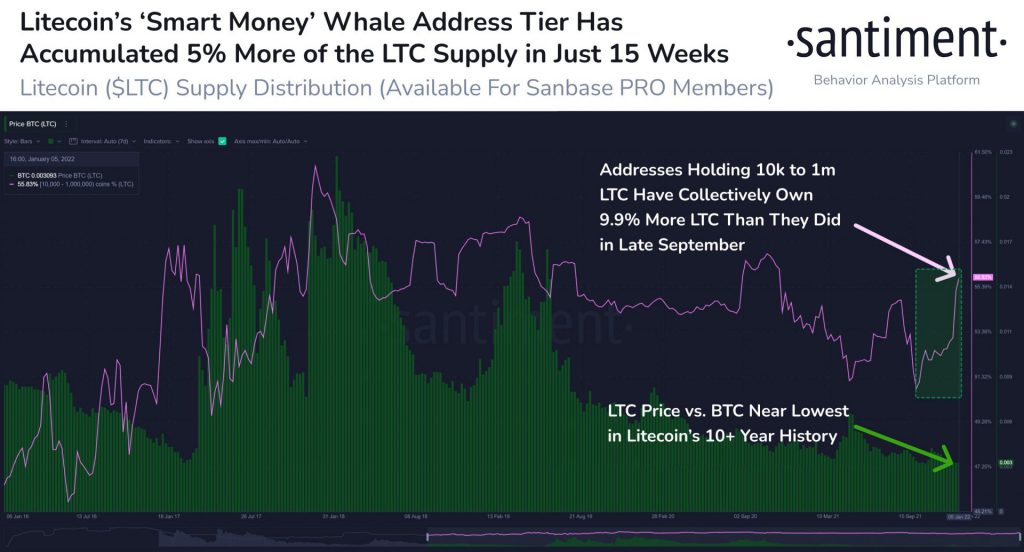

Even Litecoin’s metrics have started treading in the same direction as Bitcoin’s. One of Santiment’s latest tweets highlighted that the whale addresses HODLing 10k to 1m LTC are currently in a 15-week accumulation pattern. The same is, notably, their longest since 2017. What’s more, these participants have added 5% of LTC’s supply in just 15 weeks.

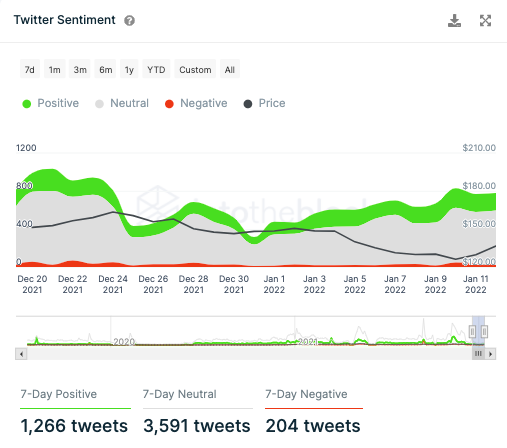

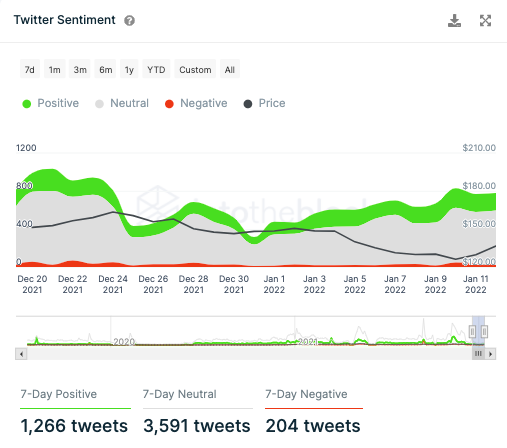

Despite the broader accumulation trend going on, the sentiment on Twitter has been pretty sober of late. Over the past 7 days, for instance, 3.5k ‘neutral’ tweets associated with Litecoin have been made.

Nevertheless, when the positively/negatively inclined tweet numbers were noted, the former largely overshadowed the latter by 1062, stirring in optimism.

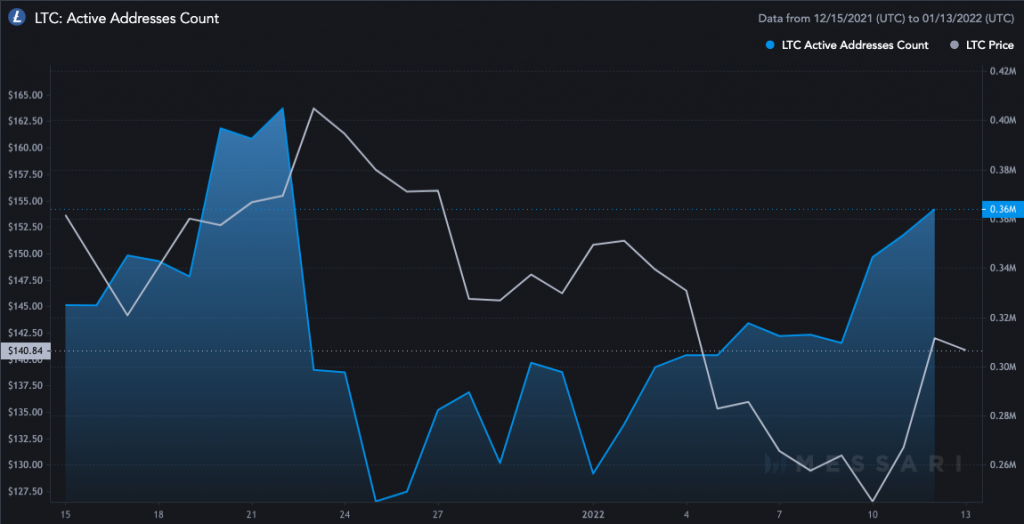

What’s more, the active address count that had shriveled down by a notable extent during the year transition phase has now started getting back in shape.

The upward inclination of the curve in the chart attached below is indicative of the return of Litecoin transfer activity. It also means that the LTC blockchain has started getting even more active with every passing day.

So now, with the positive broader sentiment, healthy address activity, and the accumulation trend in play, Litecoin is in a good position to continue performing well. However, it remains quite crucial for Bitcoin to continue performing well to aid Litecoin.