JP Morgan’s alert highlights a significant surge in gold and Bitcoin prices. This rise is fueled by the intensifying debasement of trade. This shows the level of growing concerns about economic instability and currency devaluation.

Let’s explore this topic further!

Also Read: Dogecoin New Addresses Surge 72%: What it Means for DOGE in October

Gold & Bitcoin Surge: Navigating the Debasement Trade with JP Morgan’s Insights

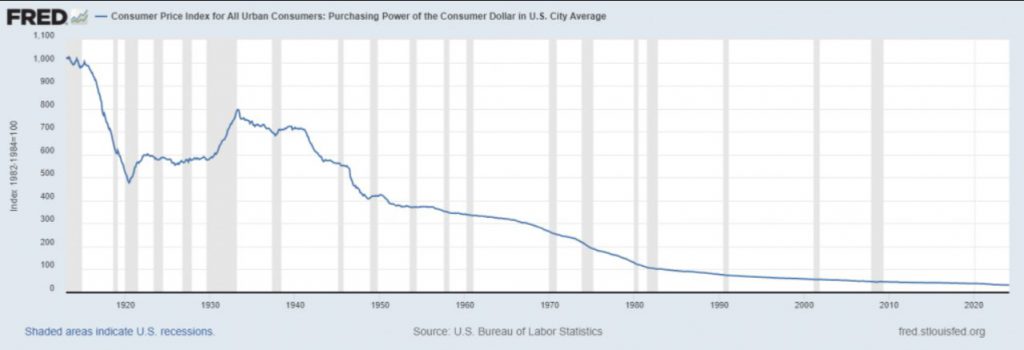

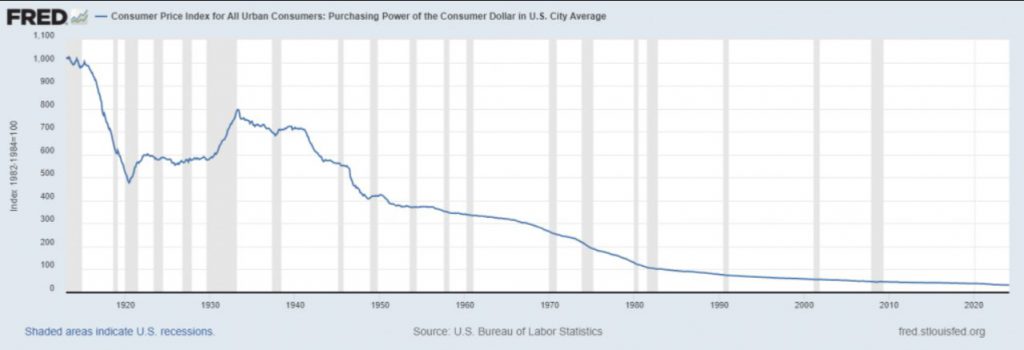

Understanding the Debasement Trade

JPMorgan analysts, led by Nikolaos Panigirtzoglou, explain the debasement trade:

“The ‘debasement trade’ is a term that reflects a combination of gold demand factors which in our client conversations range from structurally higher geopolitical uncertainty since 2022, to persistent high uncertainty about the longer-term inflation backdrop, to concerns about ‘debt debasement’ due to persistently high government deficits across major economies, to waning confidence in fiat currencies in certain emerging markets, and to a broader diversification away from the dollar.”

Gold’s Stellar Performance

Gold prices have surged to around $2,700 per ounce. JPMorgan states, “There is little doubt that the pace of central bank purchases is key to gauging the future trajectory for gold prices.”

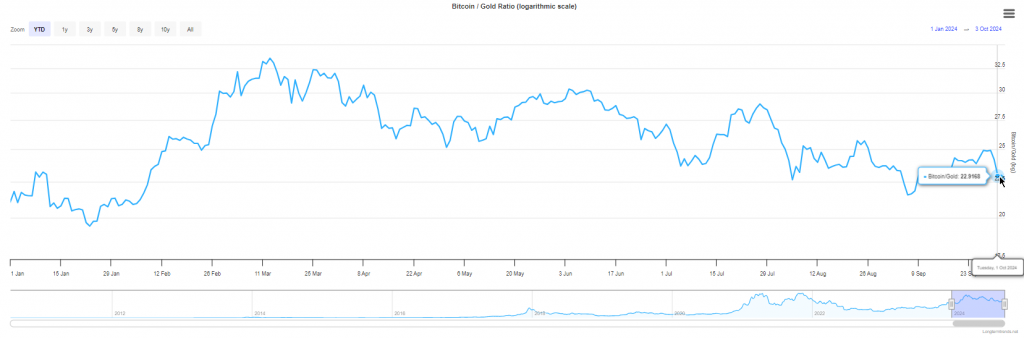

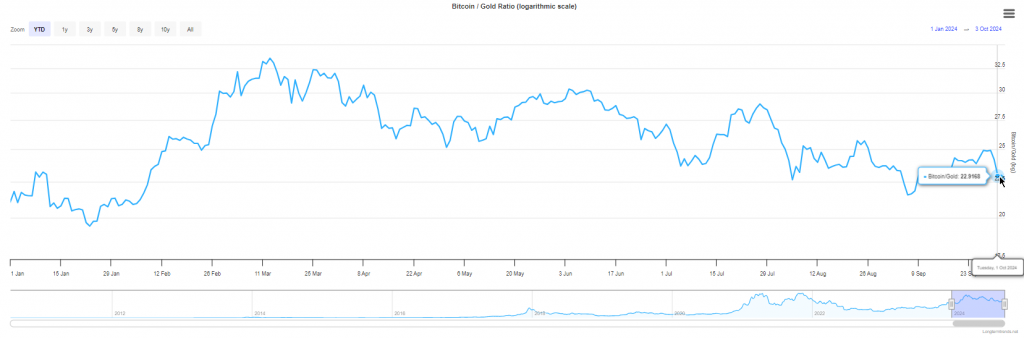

Bitcoin’s Rise Alongside Gold

Bitcoin, trading near $60,000, has also benefited from the debasement trade. JPMorgan notes, “To us, this suggests that speculative institutional investors such as hedge funds might see gold and bitcoin as similar assets, i.e. both as beneficiaries of the so-called ‘debasement trade’, but not Ethereum.”

Also Read: US Lawmakers Push Bipartisan Support For Bitcoin Reserve Bill

Factors Influencing the Debasement Trade

Several elements contribute to the ongoing strength of the debasement trade:

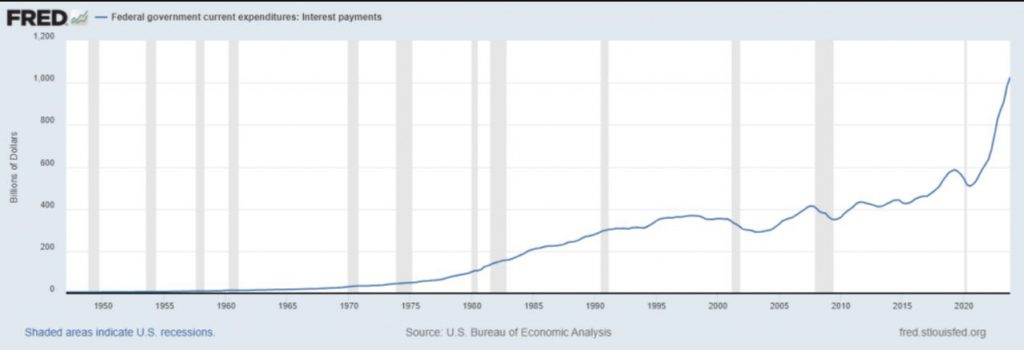

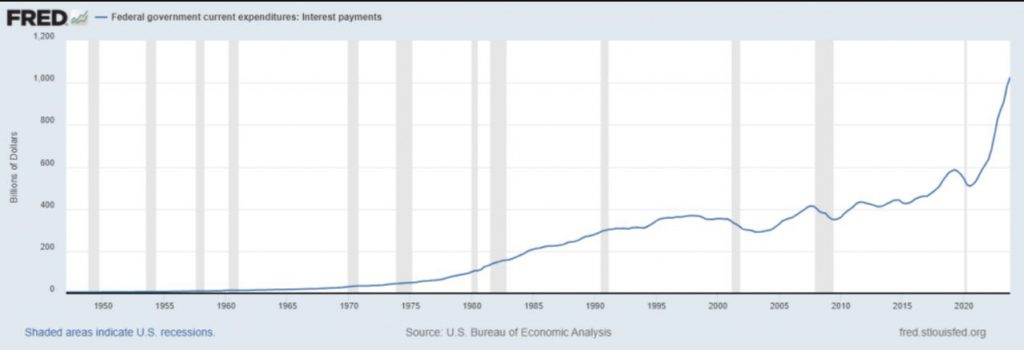

- The U.S. dollar’s declining share in global currency reserves, now at 57%

- Potential geopolitical tensions and expansionary fiscal policies

- Investors’ shifting focus from recession fears to debasement concerns

JPMorgan analysts observe, “This is because investors have been rather occupied in recent months with the recession trade.”

Implications for Investors

As the debasement trade gains momentum, investors increasingly view gold and Bitcoin as hedges against economic uncertainty. JPMorgan reports that gold’s price move has “gone well beyond the moves implied by dollar and real bond yield shift,” suggesting other factors are at play.

Also Read: BRICS: Expert Says US Dollar is Nearing The ‘End of the Line’

The JP Morgan alert on surging gold and Bitcoin prices shows how important this type of trade is at the time of writing this guide. As investors navigate these uncertain waters, the dance between traditional and digital safe-haven assets remains a key focus. We’re curious to see how this will pan out.