With the BRICS bloc increasing its opposition to Western hegemony, one expert has noted that the US dollar is likely nearing the ‘End of the line.’ Indeed, the currency has faced a growing de-dollarization movement on a global scale. With an economic crisis burgeoning in the country, it could spell a perfect storm for the greenback struggle.

The BRICS group has firmly embraced a position against the dollar in its policies. That has led the way to increased local currency promotion that carries it ever closer toward a multipolar world. With the 2024 annual summit nearing, there could be even greater de-dollarization developments. That is especially true with the BRICS Pay system nearing an official launch.

Also Read: BRICS: US Dollar Reserves Fall Below 60% For the First Time Since 1995

BRICS Could Capitalize on a Dollar Nearing the ‘End of the Line’

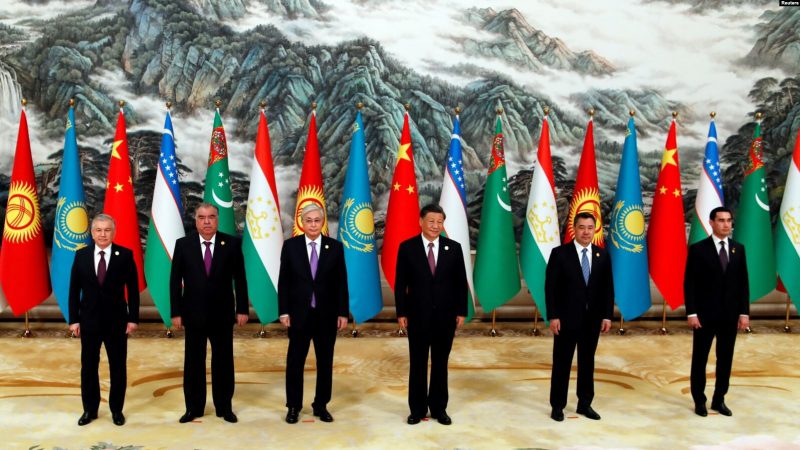

The BRICS bloc has enjoyed unprecedented growth over the last year. Not only has it expanded membership to nine nations, it has seen a host of countries seek increased collaboration with the collective. Its focus on lessening Western reliance on economics has caught on, which could be huge for the group, but worrisome for the West.

Now, amid that BRICS opposition, one expert has warned the US dollar is nearing the ‘end of the line.’ Indeed, finance expert and author of Rich Dad, Poor Dad, Robert Kiyosaki, discussed the state of the US economy. Specifically, he noted that an economic crisis may be present, with the greenback looking to experience a notable descent.

During an episode of his The Rich Dad Channel podcast launched this week, Kiyosaki didn’t mince words. Indeed, he said that the United States is “in the middle of a crash now,” with various facets accelerating it. Additionally, he wanted it as only a matter of time until banks started closing their doors.

Also Read: BRICS Chooses Gold to Power New Payment System, Challenging US Dollar

Speaking of Western leaders like US President Joe Biden, Federal Reserve Chair Jerome Powell, and Treasury Secretary Janet Yellen, Kiyosaki was quite critical. Ultimately, he noted that three “just keep pumping more money into the thing. And I think we’re at the end of the line.”

The remark is likely connected to the traditional US financial empire. That empire is undoubtedly driven by the global reserve status of the dollar. With BRICS and other collectives aiming for that dominance, there is no denying that a shift is approaching.

For many, eyes are on what could be next for global finance. Could a BRICS currency find worldwide adoption? Or could its reliance on gold bring renewed interest in the metal? Although the dollar is still undoubtedly strong, it’s weakening. That is certainly undeniable.