Nvidia is all set to announce its earnings reports on November 20. The firm’s aforementioned report is a great topic of discussion among investors, as Nvidia is currently battling an intense issue of overheating of its AI chips. In light of this, Jim Cramer, a notable former hedge fund manager, has weighed in his thoughts, adding how NVDA may perform in the wake of recent events.

Also Read: Billionaire Investor Laments Selling Billions Of Bitcoin (BTC) Early

Cramer’s View On Nvidia

Nvidia is all set to announce its Q3 earnings report on November 20. The firm is one of the leading companies in the world and has established a consistent price pace when it comes to its stock price and trajectory.

However, the firm has hit a roadblock with its AI chips at present. The company’s AI chips have battling overheating issues when connected to servers. This development is forcing investors to think otherwise, compelling them to speculate whether the development will negatively impact NVDA stocks.

Jim Cramer has come up with a different analysis of NVDA, adding that such developments will not hamper the firm’s progress. Cramer shared that such developments might present themselves as buying opportunities for investors that they shouldn’t let go of.

“I am more inclined to think you’re getting a buying opportunity in Nvidia thanks to The Information publishing a story that may, or may simply not be that.”

Cramer was earlier documented talking about Nvidia’s long-term rise under the leadership of President-elect Donald Trump. Cramer signed on stocks that may note significant spikes under Trump’s rule, naming Nvidia as one of the stocks to explore at the moment.

The former hedge fund manager touted Nvidia as a winner, adding how Trump likes winners, and the firm’s successful spree of winnings may prove lucrative in the long term.

“Trump likes winners; he likes success stories, which means he’ll like NVIDIA. Trump is all in with Elon Musk, and you know Elon Musk respects NVIDIA.”

Also Read: Pepe: Here’s How To Be A Millionaire When It Hits $0.0005

The Firm’s Price Target: Can If Claim $200?

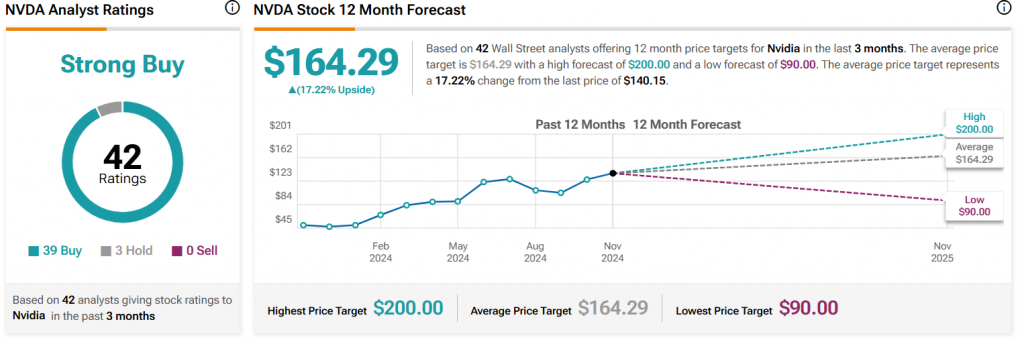

NVDA is currently sitting at $140, with an immediate price target of $164. However, TipRanks shared that the firm is also eyeing the $200 price high if all developments go well within the next 12 months.

“The average price target for Nvidia is $164.29. This is based on 42 Wall Street Analysts’ 12-month price targets issued in the past 3 months. The highest analyst price target is $200.00; the lowest forecast is $90.00. The average price target represents a 17.22% increase from the current price of $140.15.”

Also Read: Poll: 85% Investors Believe Bitcoin Will Reach $100,000 in 2024