During the early hours of Friday, the market witnessed quite a brutal crash. The global crypto market cap was down on its knees to $1.83 trillion, after shrinking by 7.34% in merely a day’s time.

After shedding around 10% each, BNB and Cardano remained the top large-cap losers. Other coins didn’t trail much behind. The top-2, i.e. Bitcoin and Ethereum, lost 7% and 9% of their value over the past day. Similarly, coins like LUNA, XRP, and DOGE reflected depreciated figures falling in the 4%-7% bracket.

Solana’s riches to rags tale

Solana, the market’s current 7th largest coin, dipped by 8% in the same timeframe. However, in terms of liquidations, this coin stood third – right behind Bitcoin and Ethereum.

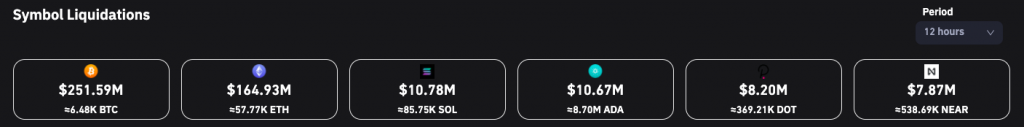

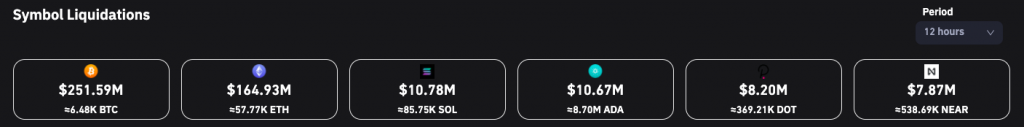

As per data from CoinGlass, the total liquidations over the past 12-hours had amounted to $624.91 million, with BTC and ETH representing $251.59 million and $164.93 million respectively. Solana remained the flag bearer of the alts, for contracts worth $10.78 million had been liquidated over the past half-a-day.

When zoomed in, things did look a lot clumsier on their own chart. Reflecting a 12-hour value of a little under $10 million, the long liquidations had, by and large, overshadowed the under $1 million short liquidations.

The wipe-offs were, notably, very high during the initial 8-hours. However, over the past 4-hours, things seem to have cooled down, indicating that the market that was strongly supportive of short traders is now, not that stern.

The same was reflected in the funding rate numbers. Except on Okex, the rate was either positive or neutral on all other exchanges at the time of writing.

Now even though longs have started re-asserting their dominance and are currently funding the shorts, traders need to exercise caution at this point because the market has not yet zeroed down on a concrete trend yet.

Making sense of Solana’s indecisiveness

On the 4-hour chart, things did look disheartening for Solana, for it had dunked below a crucial support level.

During the year transition phase, Solana did form a triple bottom around $167, but couldn’t hold back and kickstart an uptrend. It dropped below to the $130s and re-created a similar set-up there. However, this time, SOL used the level as a support and stayed above it. In fact, even on 19 Jan, the coin was re-tested at the same level and it successfully managed to bounce back.

Nevertheless, today’s crash pushed Solana to a price level that was previously observed only in September last year. At that time notably, $124-$125 had acted like strong support. So given the fact that Solana is currently hovering around those exact same levels, it would be interesting to see if the old support comes into play.

If yes, then we might be able to see Solana re-claim $132 and start inching upwards. However, if the downtrend remains persistent, then the coin could fall down to a level as low as $108 within the next few trading sessions.