During 2020 and 2021, it was largely observed that Altcoins had the tendency to perform during a Bitcoin slump or lackluster period. That hasn’t been the case in 2022, as the market has continued to collectively shed valuation in the charts.

At press time, major assets were dropping again this week after a mild recovery between 11th-16th January. However, at the moment, the Altcoin market cap is testing a key range and these assets have been the top losers over the past 24-hours.

Altcoins Market-Cap stumbles to Sept 2021 bottom

The Altcoin market cap reached an all-time high of $1.70 trillion on 10th November. Since then, it has declined by 36% at press time, and it is presently testing a support range, which was established in September 2021. From the above chart, it can be observed that the Altcoins market has lost a whopping $70 billion over the past 3 months, and it is currently at $1.083 trillion.

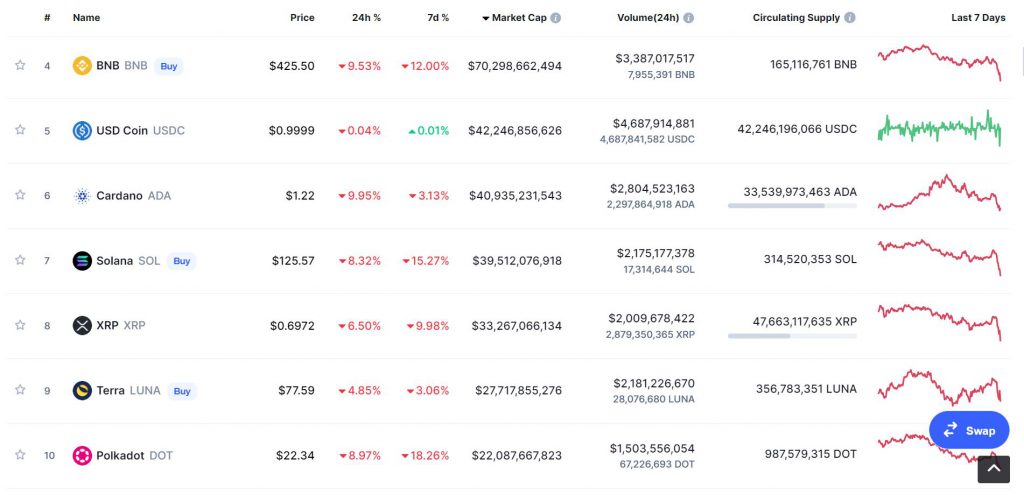

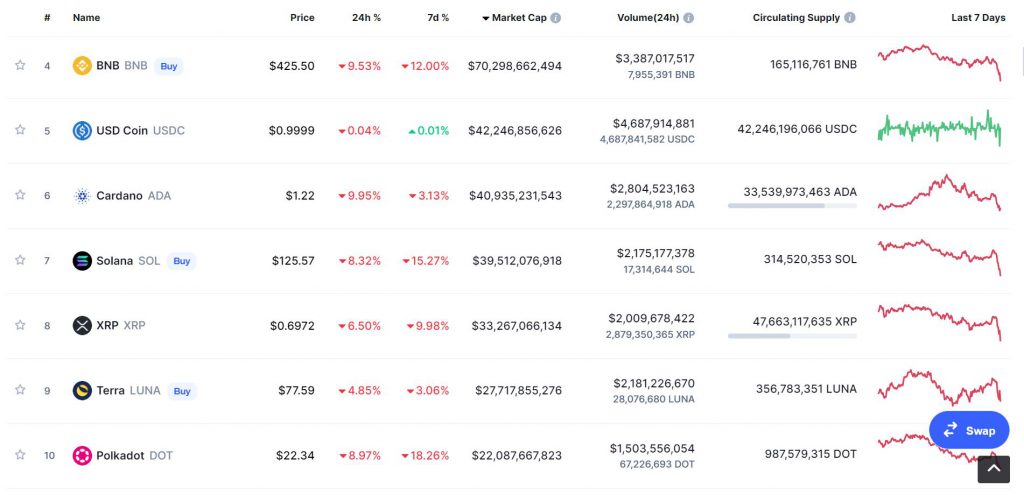

In line with such depreciation, these Altcoins have been the biggest sufferers over the past day.

Binance Coin

Binance Coin solidified its position amongst the top 5 digital assets in 2021, but over the past few weeks, its valuation hasn’t been pretty. BNB has dropped by 9.53% over the past 24-hours, while its weekly decline is close to 12%.

Unlike the Altcoins’ market cap, BNB is yet to test its September 2021 lows, which is currently at a range of $330-$340 in the chart.

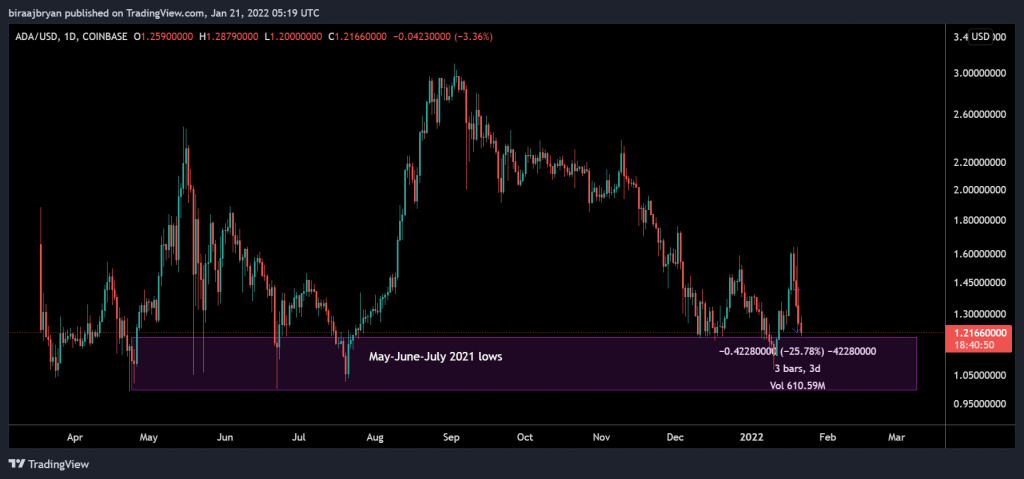

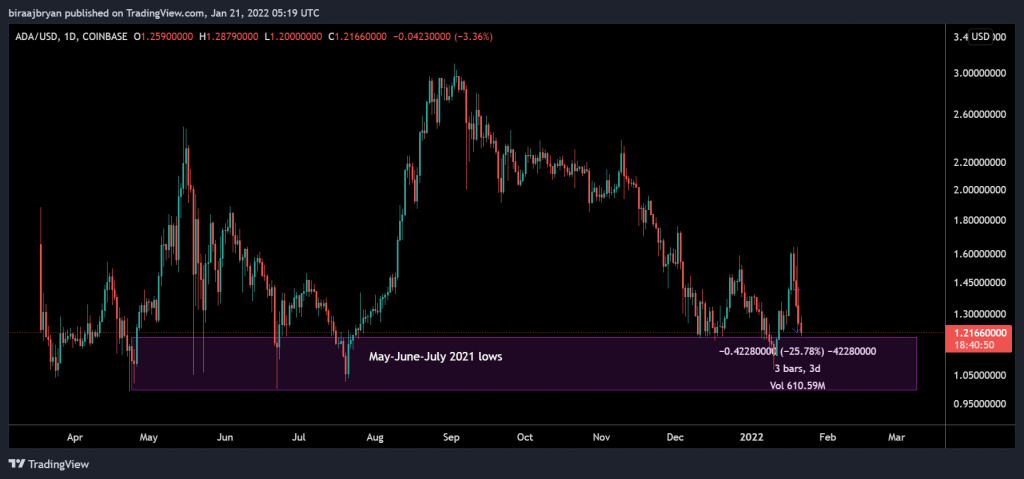

Cardano

The plot with Cardano‘s price has been a lost cause since it reached a new all-time high of $3.06 on September 2nd. While its 24-hour drop was about 10%, since 18th January, the asset has declined by a massive 26%. For Cardano, the situation was a little bit worse as it is currently testing a low range that was established during the bearish run between May-June-July 2021. As observed in the chart, the inability to attain consolidation at this range may lead to Cardano dropping below $1 for the 1st time in a year.

Honorable Misfits?

Lastly, the collective group of Solana, Polkadot, Avalanche, and Dogecoin all depreciated between 8-10% over the past day, as their market cap took a significant hit in the charts. Solana is close to testing its Sept 2021 low of $115, While Dogecoin is just above its recent December low of $0.12, consolidating near the $0.15 mark.

While some traders could be looking at this from a potential buying opportunity, it is important to note that the long-term purview is currently bearish. Hence, it is better to witness a strong bullish recovery first before taking any step in the buying direction.