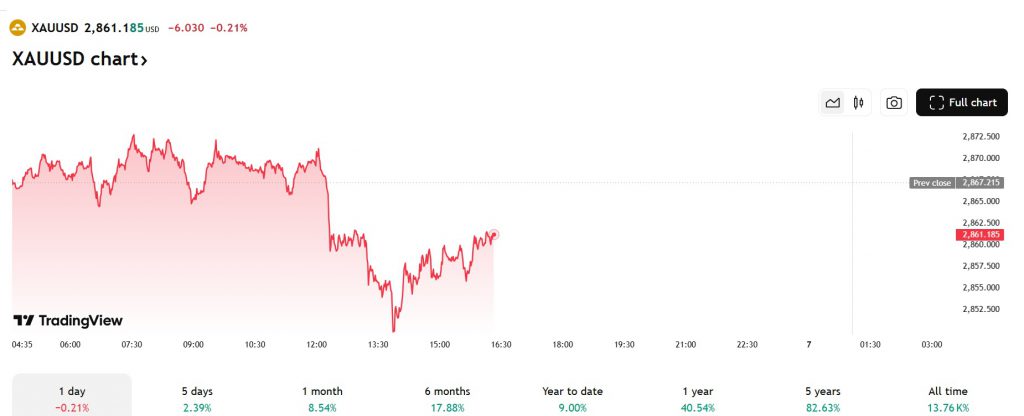

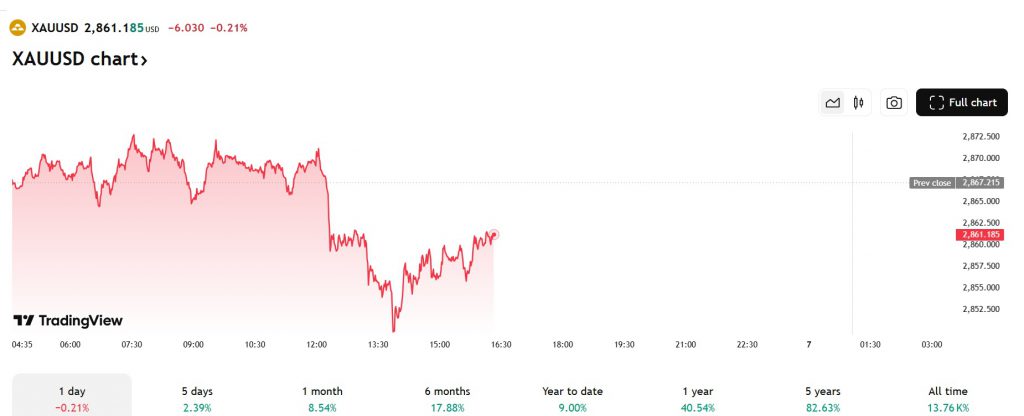

Gold prices have reached the $2,861 mark on Thursday and are hovering close to their all-time high of $2,882. The XAU/USD chart is already up 9% year-to-date and is attracting bullish sentiments. The precious metal had a record surge of 27% in 2024 after nearly 14 years, where it pumped similar gains in 2010. It continued the run well into 2025 despite the US dollar gaining strength in the indices after Trump’s victory.

Also Read: Countries That Receive Highest Foreign Aid From the U.S.

If gold prices continue the upward trajectory, it could reach the $3,000 mark much sooner than expected. Goldman Sachs had predicted that the precious metal could reach $3,000 during the second half of 2025. However, if the glittery metal maintains its current positive momentum, it could breach $3,000 in the first half of the year.

Also Read: Standard Chartered Provides 5-Year Bitcoin Forecast: See the Target

Gold Prices Explode: $3,000 Target Firmly in Sight

Gold is receiving heavy demand from institutional funds, retail investors, and central banks of developing countries which is driving prices up. The latest data shows that central banks around the world have purchased more than 1,000 tonnes of gold in 2024. The accumulation remains steady for the third year in a row indicating that prices could surge further in 2025.

Also Read: Most Used Currencies in the World: SWIFT Data

The World Gold Council published a report that demand for physical gold from retailers touched a high of 4,974 tonnes in 2024. The record high demand comes after gold prices are steadily scaling up in the charts. Retail investors fear missing out would lead them to shell higher prices to accumulate the same amount of the yellow metal.

“The combination of record gold prices and volumes produced a Q4 value of $111 billion. This took 2024 over the line to reach the highest-ever annual value of $382 billion,” the latest report said. 2025 could also be a game-changer for the precious metal and reward investors with stellar profits.