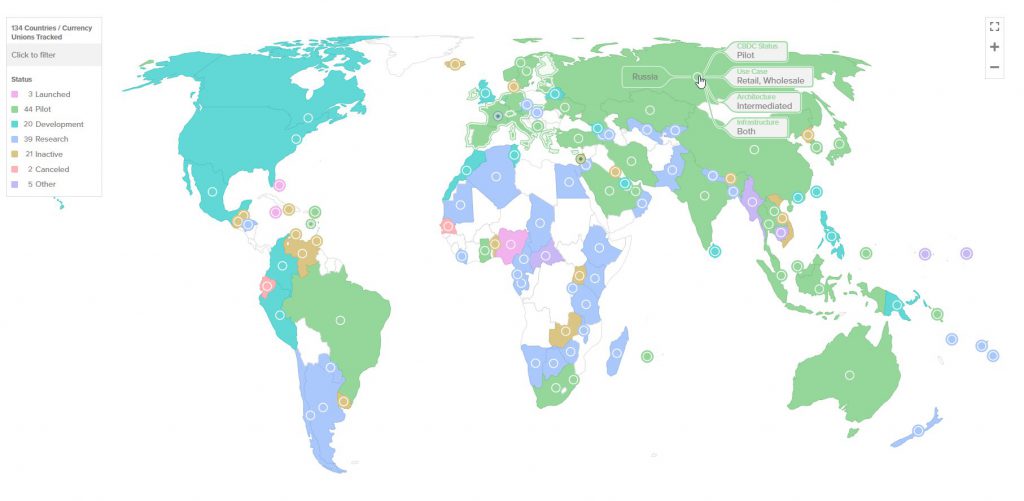

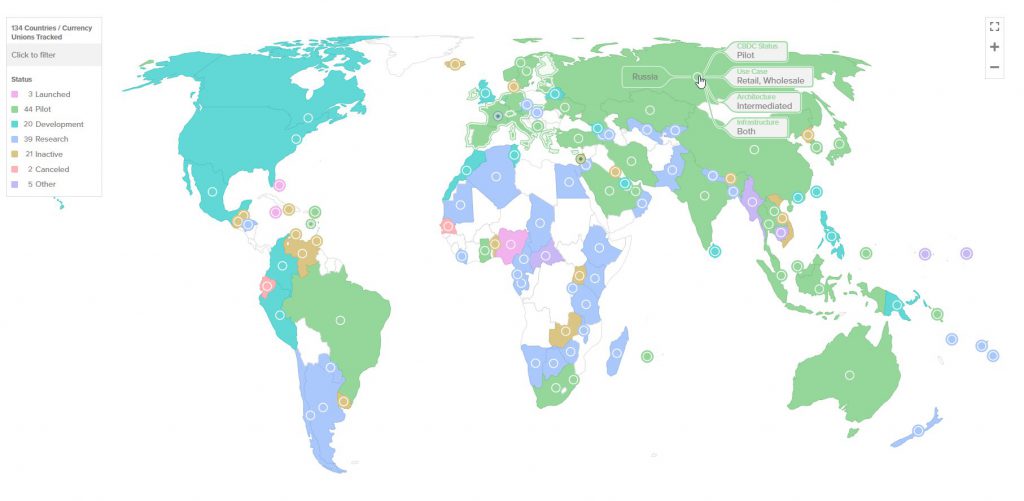

CBDC initiatives are, well, showing quite varied progress across major economies right now, with the digital euro gaining some real momentum while Russia, on the other hand, delays its digital ruble and the U.S. is, you know, actively opposing such initiatives. These contrasting approaches to CBDC development, at the time of writing, definitely highlight different priorities and concerns regarding digital currency security and implementation across the globe.

Also Read: Nvidia (NVDA) Stock March 2025 Price Prediction

Unpacking CBDC Growth, Adoption, and Risks Amid Regulatory Challenges

ECB Advances Digital Euro Initiative

The European Central Bank has, just recently, announced an expansion of its CBDC efforts, and is particularly focusing on a wholesale settlement system and all of the implications. This development, which is happening right now as we speak, marks significant progress in the digital euro journey that actually began back in November 2023, if you can believe it.

ECB Executive Board member Piero Cipollone, who also oversees the initiative and its implementation, stated:

“This is an important contribution to enhancing European financial market efficiency through innovation. Our approach will pay due attention to the Eurosystem’s goal of achieving a more harmonized and integrated European financial ecosystem.”

The ECB emphasizes that it is “embracing innovation without compromising on safety and stability” as CBDC development continues to progress in Europe and across the eurozone, which is pretty important to note.

Russia Postpones Digital Ruble Rollout

Russia has just announced a delay in its digital ruble implementation, which was kind of unexpected. This CBDC was originally scheduled for launch sometime after July 2025 but now faces an indefinite postponement and uncertain timeline, and no one really knows when it might actually happen.

Bank of Russia Governor Elvira Nabiullina explained the situation during a recent meeting:

“We will shift to mass introduction of the digital ruble a bit later than initially planned, specifically – after all pilot phases are worked out and all consultations with banks on the economic model that is most beneficial for their clients are completed.”

Despite this unexpected delay, the CBDC pilot program continues with about 1,700 citizens, around 30 businesses, and approximately 15 banks participating in various trials and tests and whatnot.

Also Read: GTA 6 Leak: John Cena’s Heel Turn + Will Villains & Sea Monsters Rule?

U.S. Takes Strong Anti-CBDC Stance

The United States has definitely adopted a rather firm position against CBDC adoption, with an executive order signed on January 23 that actually prohibits any digital dollar development, which is pretty significant if you think about it.

Prior to re-election, the president declared during a speech in Portsmouth, New Hampshire:

“As your president, I will never allow the creation of a central bank digital currency. Such a currency would give the federal government, our government, the absolute control over your money. They could take your money, and you wouldn’t even know it was gone. This would be a dangerous threat to freedom, and I will stop it from coming to America.”

This executive opposition really highlights concerns about digital currency security that have resonated with many American policymakers and legislators, and it’s something that seems unlikely to change anytime soon.

Global CBDC Security Challenges

The rather divergent approaches to CBDC adoption reflect significant differences in how major economies currently view implementation risks and all that. While the ECB pushes ahead with the digital euro, Russian authorities are demonstrating, you know, some caution with their digital ruble plans, which is understandable given the circumstances.

Governor Nabiullina emphasized during a recent meeting with banking officials:

“We handle them with great care because our task is to ensure that the digital ruble is popular so that it gains the trust of citizens and businesses.”

Implementation costs remain a big concern for CBDC development in many regions, with Russia’s banking association estimating expenses of up to 100 million rubles (which is about $1.1 million or so) per bank, and that’s no small amount.

Also Read: Pi Coin Hits New Heights Before Dropping 55%—Is Recovery Possible?

The contrast between the European enthusiasm for the digital euro, Russian caution with the digital ruble, and the American opposition reflects some broader debates about the role of central banks in digital currency innovation. These different CBDC approaches will likely shape how digital currencies are implemented and regulated across major economies in the coming years, and it’ll be interesting to see how it all plays out.