The crypto tumble on Thursday was led by the market’s king coin. After opening above $37k, Bitcoin was already back to the $35k range at the time of press. Owing to the price swings, coins worth $75 million were liquidated in merely a 4-hour window during the early hours of the day.

Outlining Bitcoin’s ‘lower-lows’ phase

Leaving aside today’s dip, BTC’s price has been creating lower lows since 16 February. On a couple of days in between, it tried to non-conform to the said trend but wasn’t successful in doing so. More or less since the same time, BTC has also been trading below its 50 days moving average.

At this stage, Bitcoin does have a couple of supports in-and-around its current price range. The $32.7k to $32.9k range managed to aid the coin’s price climb up the ladder earlier in January this year and back in July last year. The said levels could provide some respite to BTC this time around too. Further below, Bitcoin can also rely upon the $29k level, that assisted it in the same July-August phase.

Beware of the upcoming options expiry

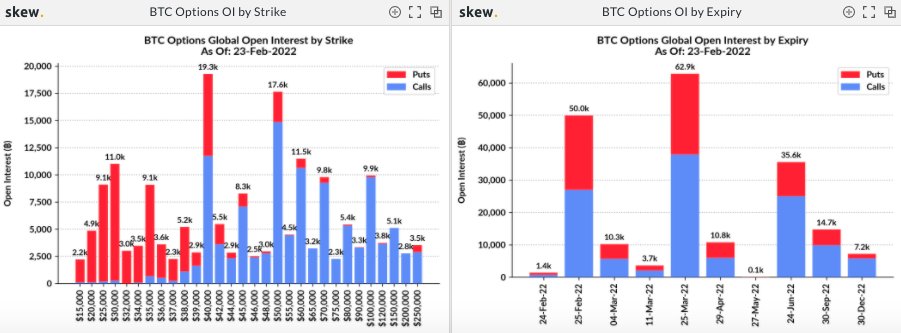

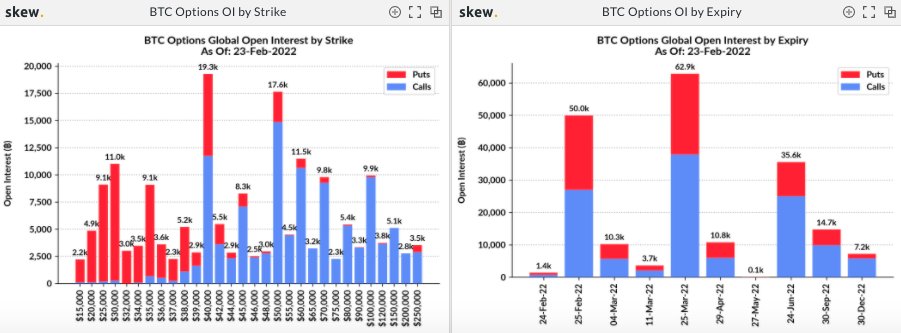

The Bitcoin market is set to undergo a notable options expiry involving 50k coins tomorrow. The snapshot attached below [right] shows that the number of calls and put contracts are more or less equal.

Now as expected, puts have been dominating lower prices upto $39k, while post that rage, call contracts have an upper hand [left part of the snapshot].

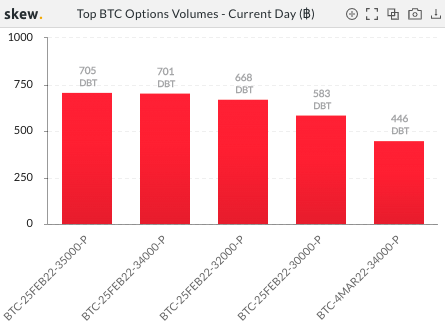

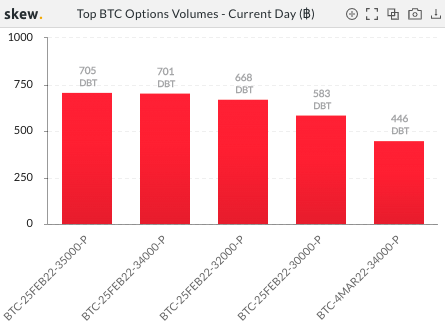

However, as the bearish sentiment gained further steam today, the new traders entering into the market have mostly only procured puts. As can be seen from Skew’s chart below, 705, 701, 668 and 583 DBT put contracts have been obtained at strike prices of $35k, $34k, $32k, and $30k respectively on Thursday.

Even in the $36k to $38k price range, the contracts of the same sell nature only have the whip hand.

So, as long as Bitcoin’s price continues to revolve around its current range, it would be quite difficult for put traders to resist themselves from exercising their option of selling their respective coins during the expiry period tomorrow. If the sell-pressure mounts up, then not much would be able to stop Bitcoin’s price from free-falling.