In stark contrast to the overall drop in crypto prices, the market for non-fungible tokens (NFTs) launched off 2022 with brisk purchases in January, situation insiders say can be summed up in one word: decoupling.

According to the numbers, LooksRare and OpenSea, two of the most popular NFT marketplaces, recorded record sales in the month of January, totaling US$12 billion. At the same time, the crypto market’s total capitalization fell by nearly 25% in the same month, to around US$1.6 trillion.

Although it may appear contradictory that an asset purchased and valued in cryptocurrency becomes detached from cryptocurrency values, one industry official explained that it represents different consumer profiles and wants. The potential of blockchain was recognised by Wall Street, which ventured into crypto markets, but the normal NFT trader is not part of that environment. This split also points to NFTs being a speculative hedge against the broader crypto markets.

According to CryptoSlam data, there were 770,000 unique NFTs buyers in January 2022, up about 2,500% from the 30,000 reported in January 2021.

Is the NFT scenario still the same?

To put it bluntly, no. The NFT space seems to be going through a slight hiccup.

Following a phishing assault that resulted in dealers losing as much as $3 million, activity on OpenSea, the world’s largest marketplace for digital collectibles, plummeted.

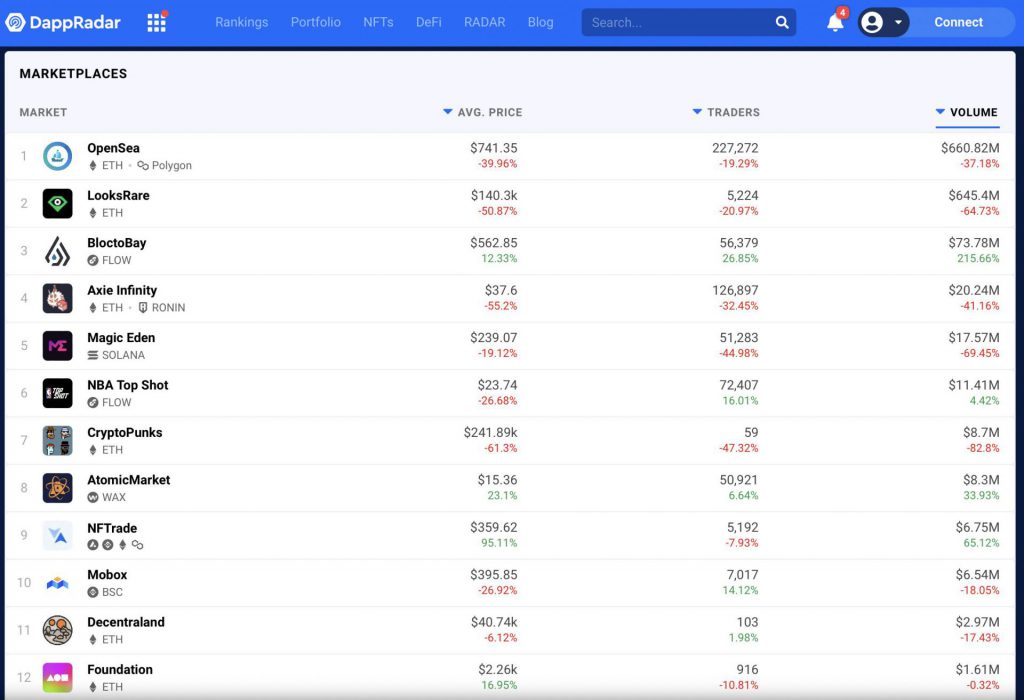

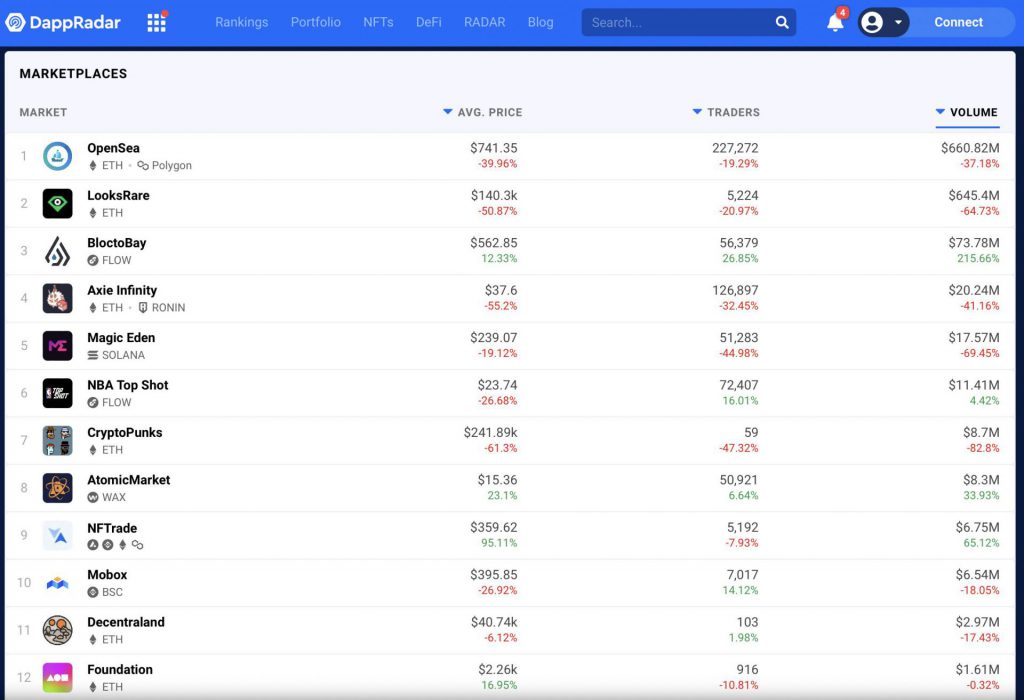

According to analytics source DappRadar, trading in nonfungible tokens has decreased in recent days. According to the site, OpenSea’s seven-day trading volume was down 37% as of Tuesday.

The crisis on the Ukraine-Russia border, has created a lot of panic among investors, as well as collectors. This development has not only affected the crypto space, but also the stock markets, which too, is on a down trend.

According to data from Dappradar, NFT’s aren’t booming as much as they were in the beginning of the year.