Bitcoin’s price is often gauged using different metrics and one such method is assessing how futures traders are placing their bets through funding rates. With BTC making progress towards the $45K ceiling, it’s important to assess whether a high funding rate can alter its near-term trajectory.

Funding rates are periodic payments made by traders to keep their long or short perpetual contract positions open. Extreme readings, generally, are undesirable and a neutral funding rate is more in line with organic growth.

Bitcoin’s average funding rate, which is the mean taken by the funding rates across top exchanges, spiked to a 3-day high on 20 March. Essentially, this meant that traders who were long on Bitcoin had to pay more to cover short positions. Although positive funding rates indicate an upbeat sentiment, extreme readings can trigger a downturn in price. Take BTC’s November downtrend for instance. The funding rates rose to a 6-month high in October on Binance prior to BTC’s retracement for an ATH in November.

Bitcoin Prolonged Correction?

Bitcoin is targeting two major price levels over the short term – $45K and $37K. So the ultimate question is whether a high funding rate can trigger a deeper correction back to $37K and if such an outcome will be detrimental to Bitcoin’s attempted jab at $45K.

Firstly, it’s worth pointing out that BTC’s average funding rate has already begun stabilizing towards a more neutral reading. The above-mentioned chart showed that the funding rate is now back to equilibrium on 21 March.

Secondly, the Bitcoin fear and index has recovered by 7 index points over the past week, suggesting that investor confidence in Bitcoin was getting back on track following ‘extreme fear’.

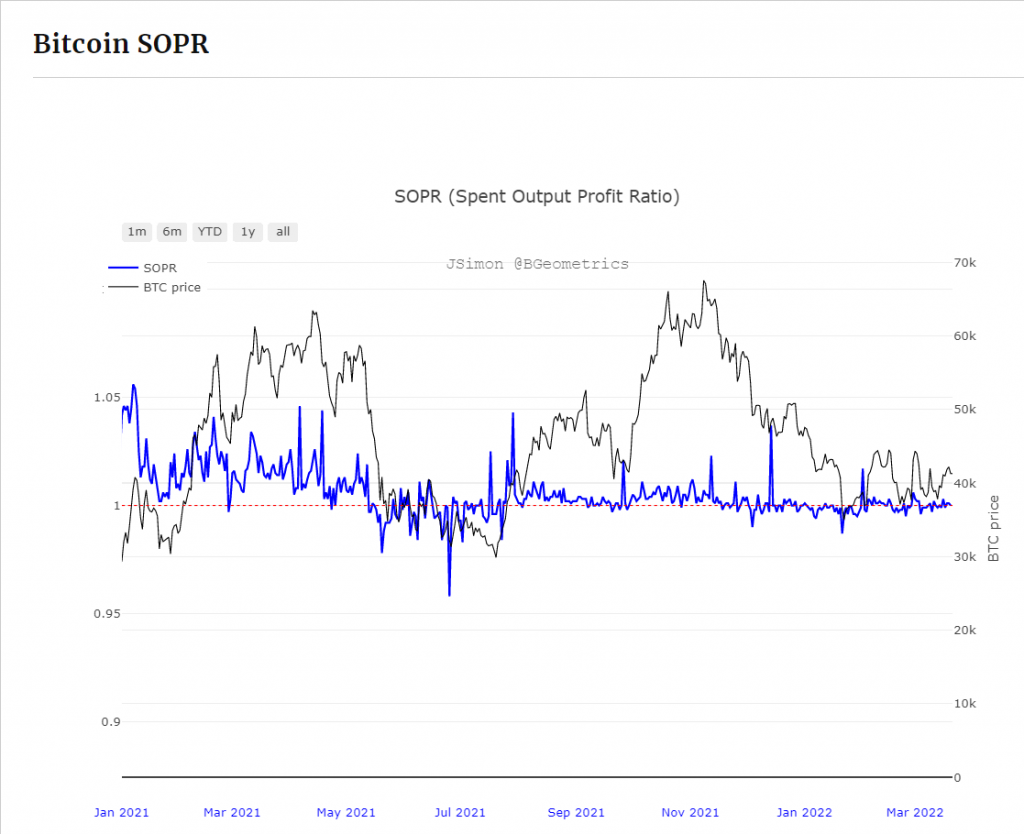

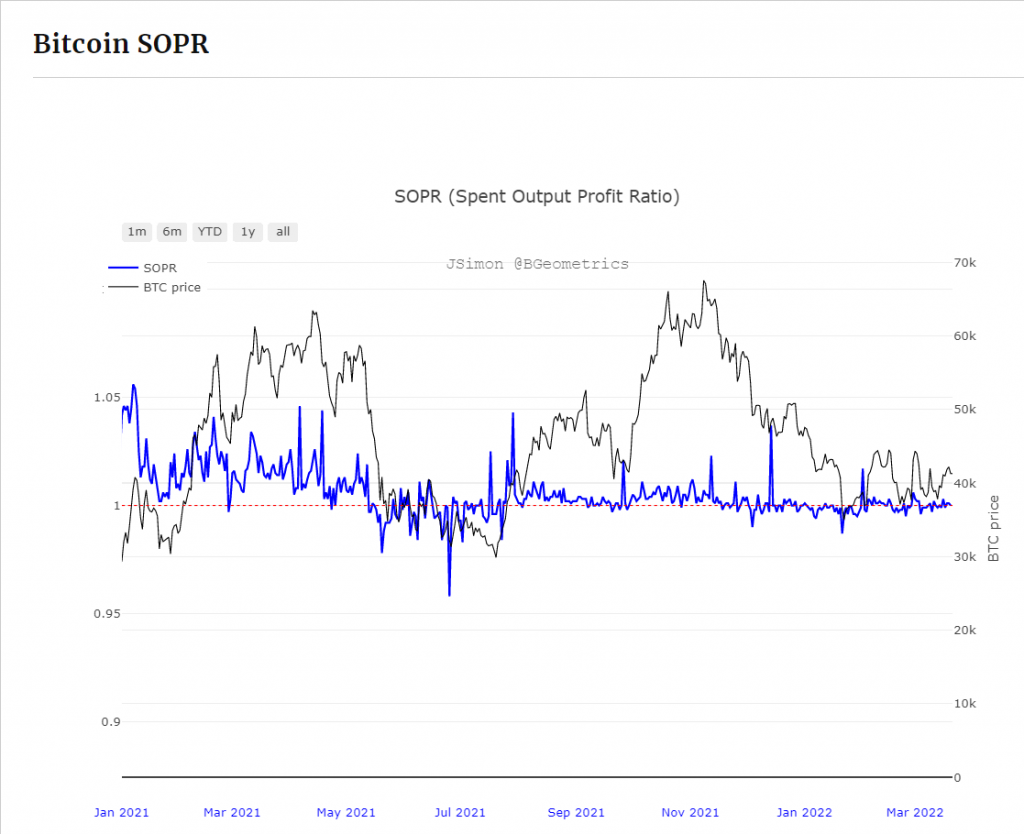

Thirdly, Bitcoin’s Spent Output Profit Raito has generally improved since 7 March, with traders selling BTC at a profit. The SOPR indicator helps gauge the macro sentiment, reflecting the degree of realized profit for all coins moved on-chain. As more coins are spent back into liquid circulation, the probability of a local top improves.

Bottom Line

The bottom line – exuberantly high funding rates are dangerous for Bitcoin but the current reading posed fewer risks than BTC’s November 2021 correction. Additionally, other macro readings show that sentiment is generally favorable despite the present correction. With that in mind, is $45K off the table? Certainly not, should bulls hold BTC above $40K over the coming days, the market would still be in a prime position to tackle its overhead ceiling and make way towards the coveted $50K mark.