Over the past day, Bitcoin managed to climb up from the $38k bracket to the $39k bracket. As a result, most alts—that seemed to have derailed from their recovery track—started trading in green. At press time, the global crypto market cap stood at $1.8 trillion, up by 1.79% in the last 24-hours.

The sentiment in the Ethereum market too had flipped. Until a couple of days back, a few key metrics had painted a bearish outlook for the alt-pack leader. But now, seems like the tables have turned already.

Time to greet Ethereum bulls

From 3 April until yesterday, ETH had roughly shed about 22% of its value. However, around the same period, the number of Ethereum daily active addresses significantly improved. Outlining the “positive” implication of the same, Santiment tweeted,

“This has created an upward trend and a bullish divergence. Utility growing while prices drop is a strong case for prices turning positive.”

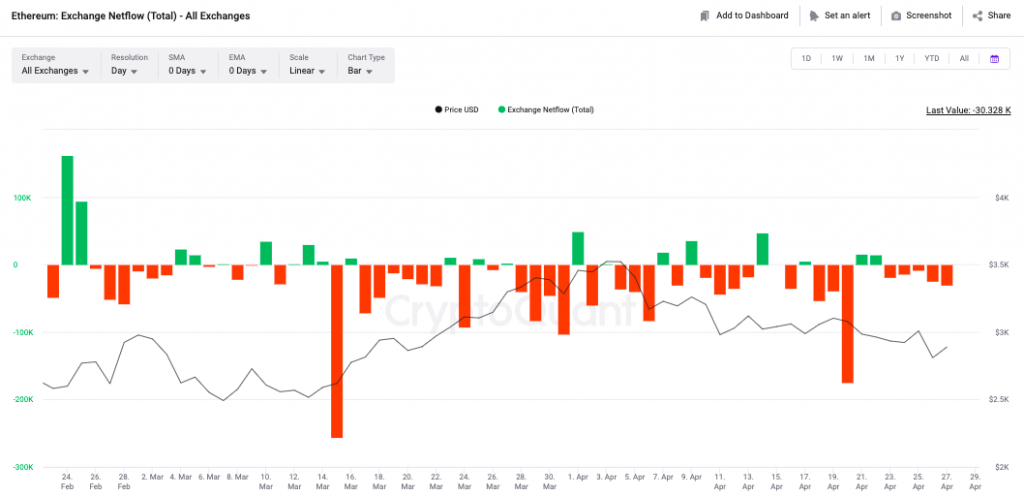

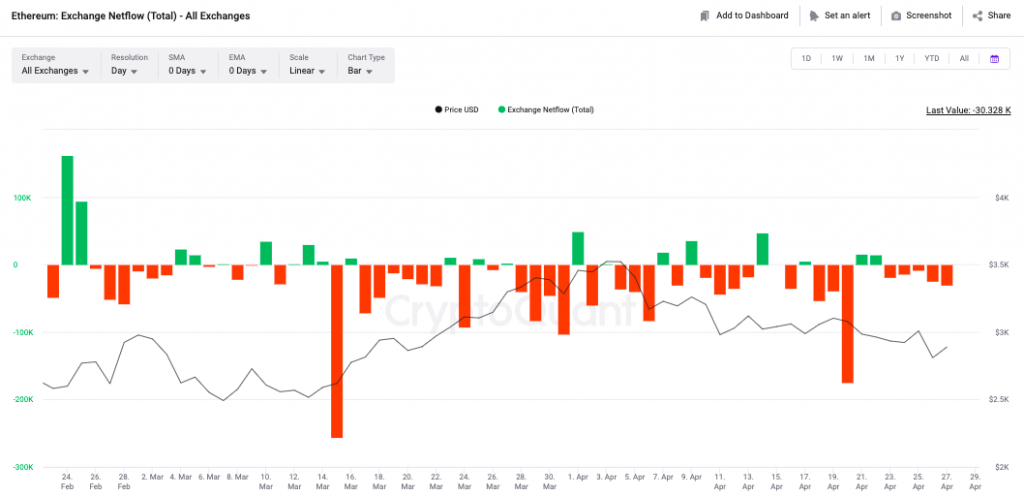

At this stage, the state of other metrics has also started flashing optimistic signs. Take the case of the exchange net flows itself. At the beginning of the week, green bars were registered on the chart, indicating the presence of a selling bias in the market.

Now, however, with red bars being registered and their lengths gradually inclining, it can be deduced that buyers have started making their presence felt again.

Alongside, it is interesting to note that Ethereum’s Estimated Leverage Ratio [ELR] has declined from 1.87 to 1.79 over the past three days, indicating that the over-heated derivatives market has now started cooling down, making the environment favorable to foster a leg up.

Despite the said positives, the needle of Ethereum’s F&G index continues to point towards fear. So, even though an uptrend seems to be likely for Ethereum, traders need to exercise some caution until a concrete trend is established.

At press time, Ethereum was trading at $2.88k, up by 2% in the day’s trade.