Ethereum’s price was at the helm of its daily 20 and 50 Simple Moving Averages, having regained the $3,000-mark on Tuesday. However, low institutional and retail interest continued to plague Ethereum, suggesting that rejection is more likely a bullish breakout. At the time of writing, ETH traded at $2,998, up by 4.3% over the last 24 hours.

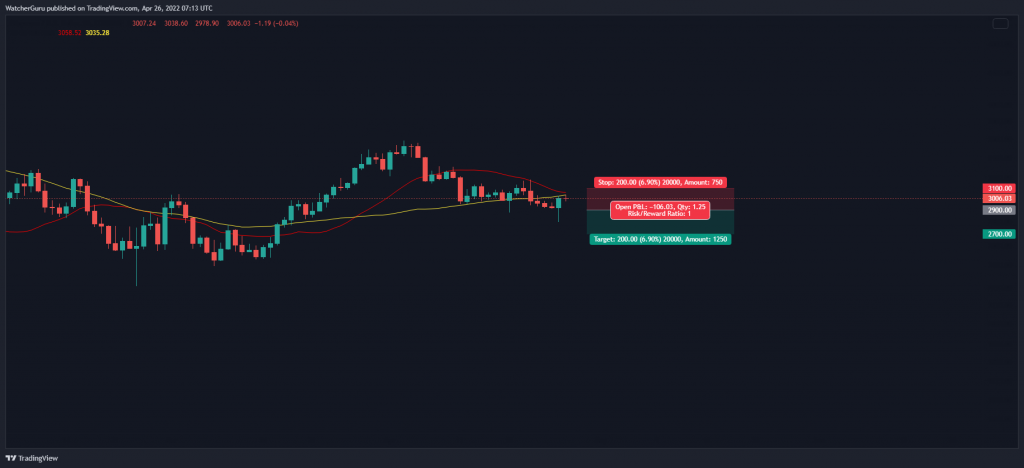

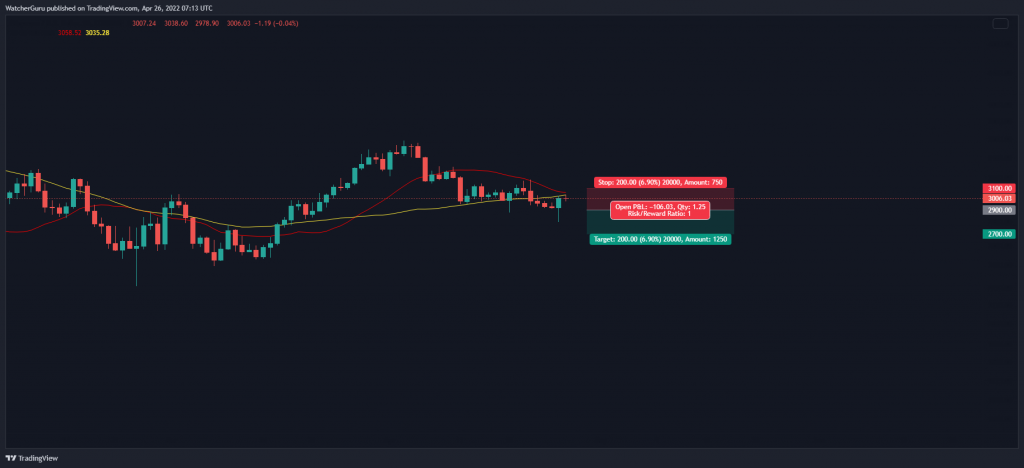

Ethereum touched an important level on Tuesday after a risk-on broader market pushed its price to the 20 (red) and 50 (yellow) SMA’s around $3,000. While $3,300 and $3,400 were the next important areas on the chart, exchange data and a rise in institutional outflows hinted that ETH could struggle to advance any higher in its current cycle.

According to a Coinshares report, institutions have been pulling their funds away from Ethereum throughout April, with institutional outflows touching nearly $17 Million last week. Interestingly, Ethereum was the only coin to witness such high outflows among its top 10 competitors. In comparison, Bitcoin, Solana, Polkadot, and Cardano saw minor institutional inflows ranging from $0.3-$2.6 Million.

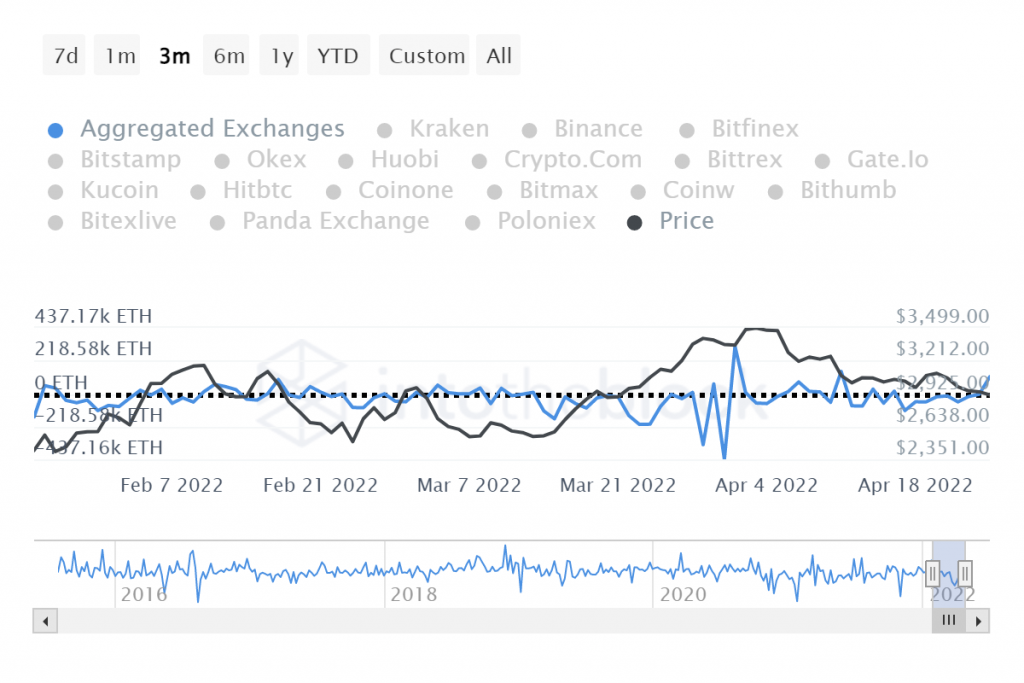

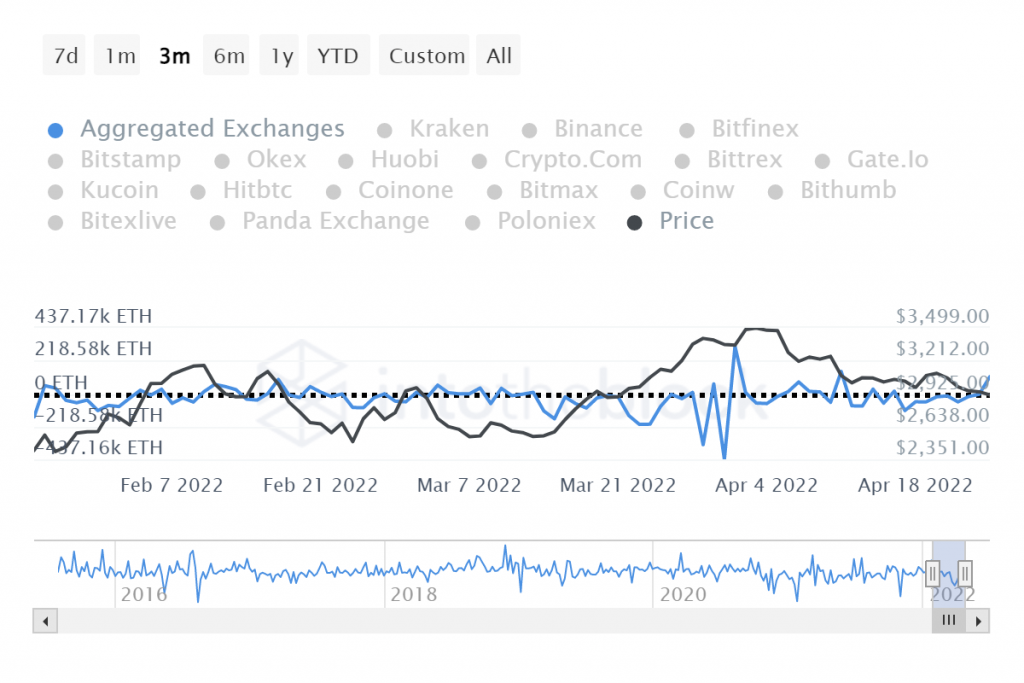

Meanwhile, even though ETH’s daily price increase coincided with an uptick in exchange inflows, the sentiment was changing quickly as the price approached a critical level. Total NetFlow on exchanges spiked on the day, suggesting that more Ether tokens were now leaving personal wallets and flowing into crypto exchanges than vice-versa. Crypto entering exchanges is usually a sign of dampening investor apatite as some offload their tokens in anticipation of a price decrease.

Ethereum Daily Chart

With receding institutional backing and retail demand, Ethereum’s daily rise could be limited to its 50 and 20 SMA’s. A rejection at the current $3K level looked more likely and should sell orders follow, $2,800-$2,700 support would be the first area of defense.

Those betting on a bearish outcome can short Ethereum’s price at $2,900 and exit their trades at the lower end of a down-channel at $2,700. Stop-loss can be at $3,100 right above the 50-SMA. The trade setup carried a 1 risk/reward ratio.