Pitchbook has released its global market snapshot for April. Let’s just say that the markets, both crypto and traditional, were not at their best.

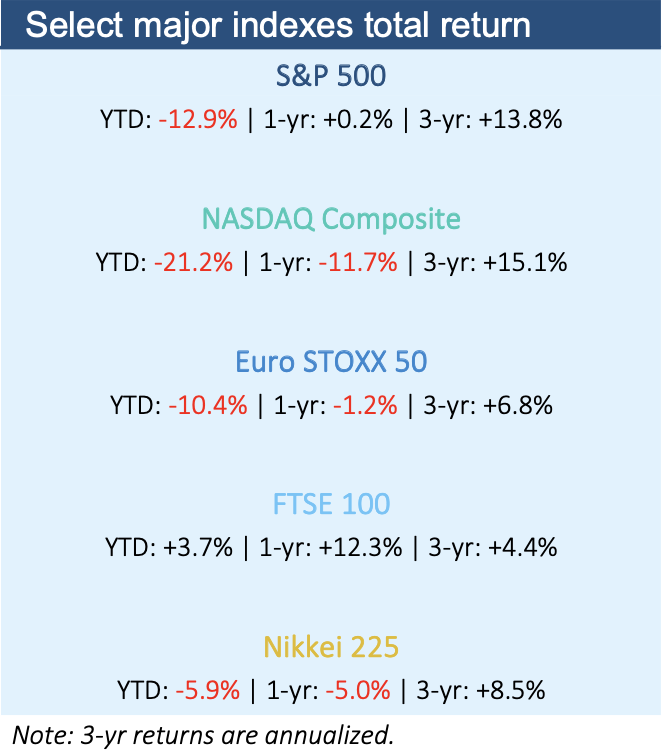

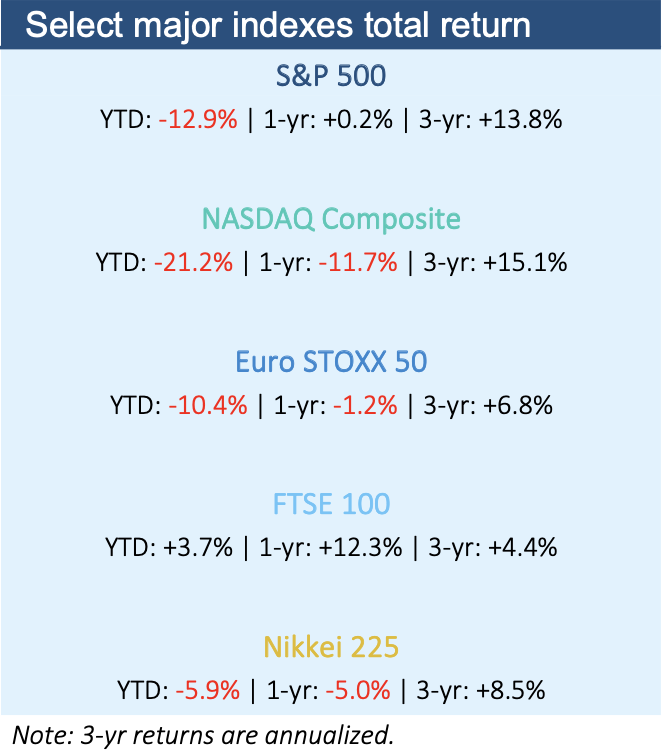

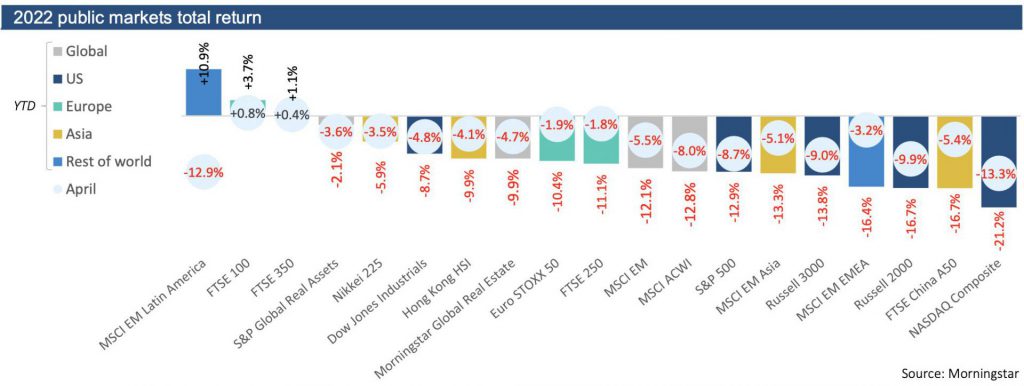

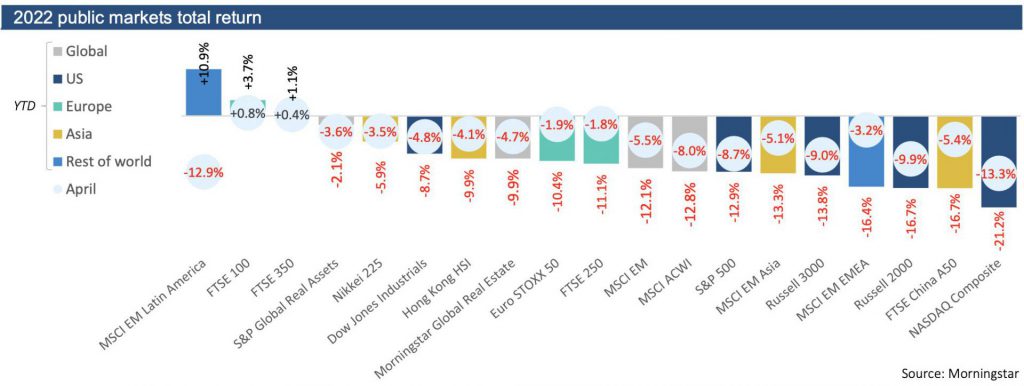

Fearing an interest rate hike from the Federal Reserve, investors were sure in a state of uncertainty. The NASDAQ has reported a sharp sell-off, with a -13.3% decline. This April was the worst performing month by the NASDAQ since Autumn of 2008. The S&P 500, meanwhile, had its worst year since 1939, and that’s the year World War II broke out.

Even Warren Buffett‘s Berkshire Hathaway, which had outperformed other blue chips this year, couldn’t avoid the disaster. Last week, it dropped 3.8%.

In April, the consumer staples sector was the only one to gain ground. It was in the greens with gains upto +2.5%.

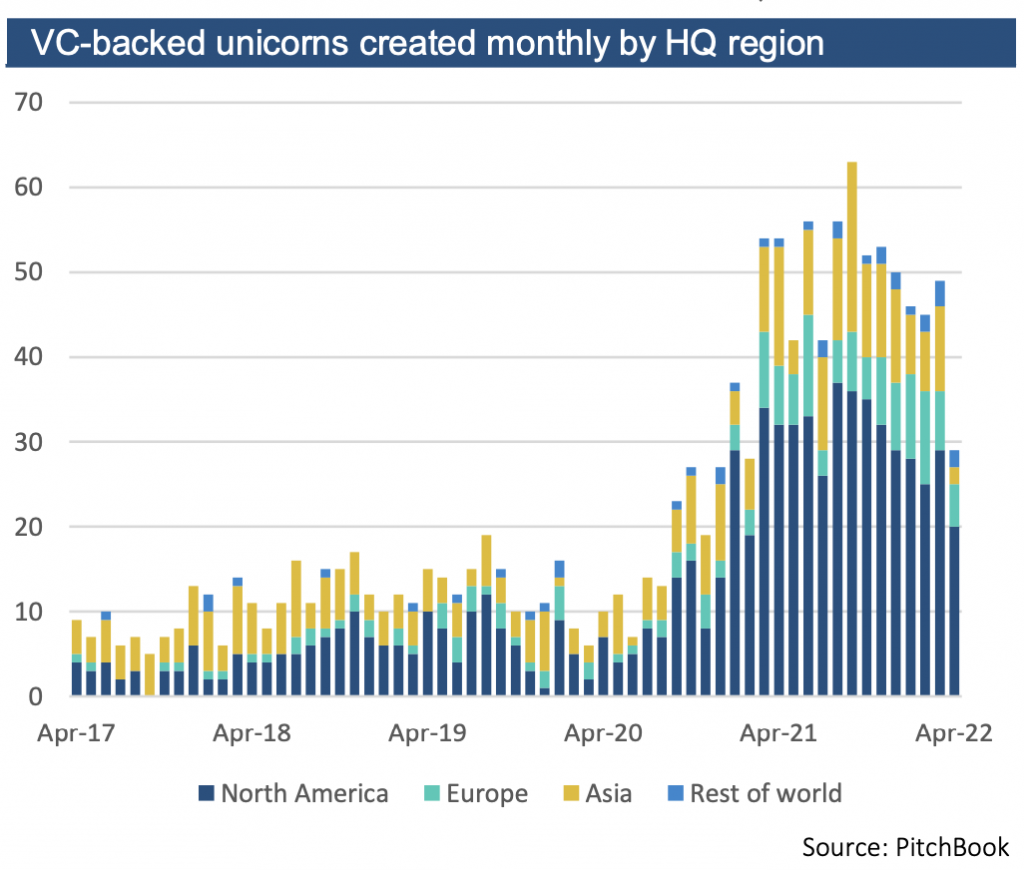

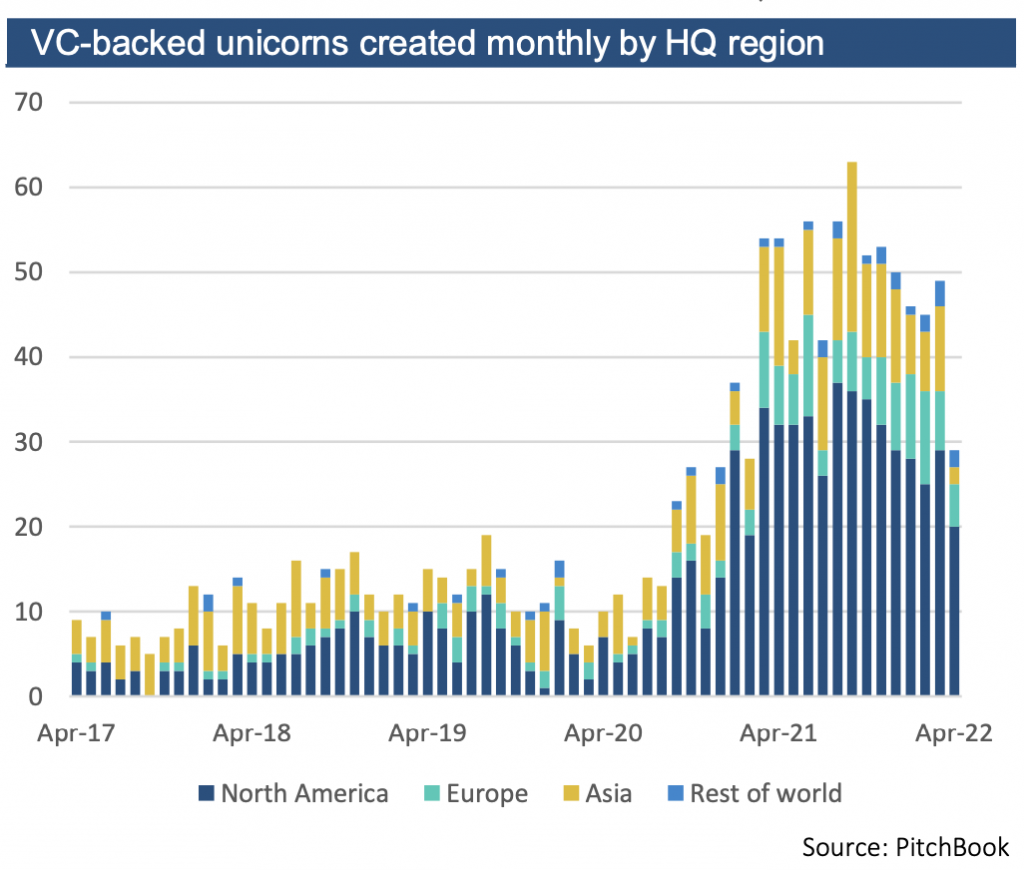

Additionally, companies hitting the billion-dollar unicorn status hit a decline. The same can be said about companies in the crypto realm. Pitchbook says this may be due to equity market valuations cooling down. Some experts say that agreements may still be in the works, but they are yet to be revealed, expecting the trend to reverse in the next quarter.

Over the previous year, IPOs backed by venture capital have lost roughly half of their value (-47.9%).

However, the month ended on a positive note for US real yields, which closed in positive territory for the first time since December 2019.

Even the crypto market took a hit in regards to the Federal Reserve’s interest rate hike fears. Bitcoin was the worst performing asset in April, falling by up to -17.8%.

Bitcoin’s price hovered at $38,000 on Monday, as investors fretted about increasing inflation, geopolitical tensions, and the potential of the US Federal Reserve tightening monetary policy. In recent months, the crypto market has been increasingly linked to the stock market, making it even more dependent on global economic variables.

Armando Aguilar, the head of alternative strategies and research at Ledn, crypto savings and lending platform, says,

“The overall market has noticed the high correlation to Bitcoin and the general equities markets…The S&P 500 and NASDAQ have had the largest correlations to Bitcoin with 0.88% and 0.91%, respectively. A correlation of one means that they move equally one to the other.”

With no end in sight, analysts predict that the conflict, inflation, and shifting monetary policy in the United States will create even greater volatility in both traditional and crypto markets in the coming weeks and months.