Every being is entitled to have his/her personal opinion on any subject. Consequentially, whenever opinions clash, controversies arise.

Well, people from the crypto space are known to have extremely wild takes on any and every matter. While a few prefer to veil their identity before outrightly opining on subjects, the rest, do it without any filter.

One such controversial opinion was brought to light during the late hours of Sunday when the founder of the digital asset exchange FTX—Sam Bankman-Fried—said that Bitcoin has no future as a payments network. He attributed the same to its inefficiency and high environmental costs.

The FTX exec went on to add that Bitcoin’s Proof of Work [PoW] consensus mechanism of validating blockchain transactions was not capable of scaling up to cope with the millions of transactions that would be needed to make the crypto token an effective means of payment.

He said,

“The Bitcoin network is not a payments network and it is not a scaling network.”

The crypto billionaire, further opined that other less energy-intensive alternatives like the PoS mechanism would be required to create a functional crypto payments network. He said,

“Things that you’re doing millions of transactions a second with have to be extremely efficient and lightweight and lower energy cost. Proof of stake networks are.”

Numbers speak for Bitcoin

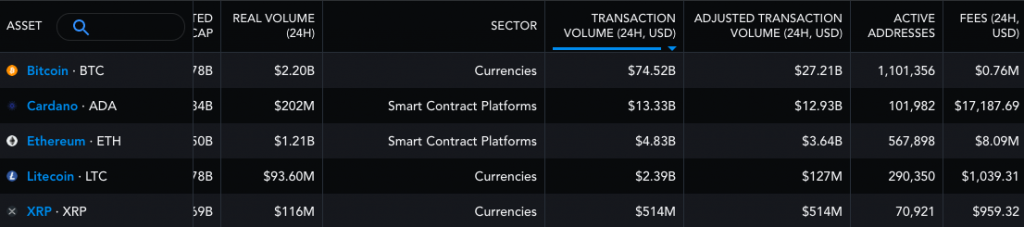

At the moment, however, the number of transactions carried out on the Bitcoin network remains to be unmatched by any other protocol. Over the past 24-hours, for instance, the transactional volume on Bitcoin accounted for $74.52 billion. While the same Ethereum—the to be soon PoS network—merely stood at $4.8 billion. In fact, none of other Bitcoin’s counterparts have been able to cope with its on-chain transactional activity of late.

Additionally, the lightning network has started regaining its relevance, allowing Bitcoin to hold fast to its utility token tag. Alongside, the network’s adoption has also seen a macro-rise, indicating that the network’s future ain’t dark after all.

Well, despite his harsh views, the FTX exec ended up asserting that he still believed the world’s biggest digital asset had a place in the crypto market.

“I don’t think that means Bitcoin has to go,” he said, adding that the token may still have a future as “an asset, a commodity and a store of value” akin to gold.